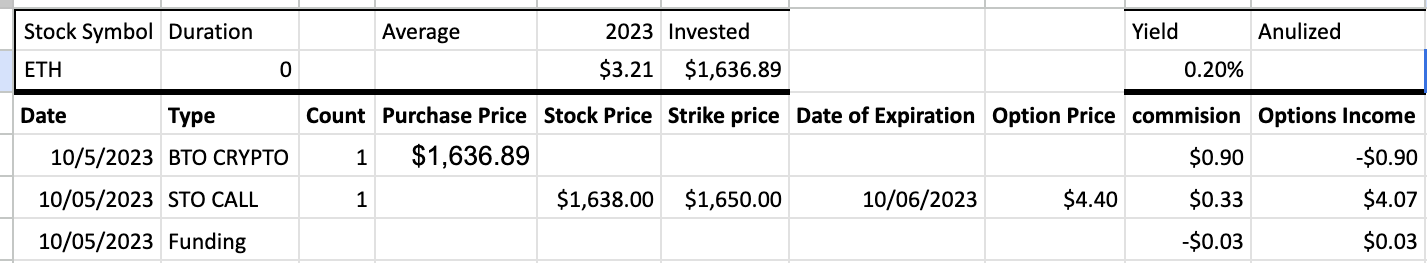

On October 5th, 2023, I sold one covered call option for Terramatris Crypto hedge fund on Ethereum, using perpetual future as collateral.

I bought 1 ETH future at $1,636.89 and simultaneously sold 1 call option with a strike price of $1,650 and an expiry of October 6, 2023, for this trade setup I was rewarded with $4.4 in premium (before commissions).

When trading with perpetual futures we are also paying a funding fee, which for most of the time is 0.01% every 8 hours (about 0.03% daily or about 0.9% monthly). For holding such a position open for 30 days we might be paying about $14.74 funding fees.

To set up this trade it was enough with 17.25 USD + 239 USD margin for 1 call option.

Total investment: 256.25 USD

On the expiry date, October 6, 2023, ETH is trading under $1,650 per coin - options expire worthless and I keep premium - if ETH trades above $1,650 I must pay the difference between spot and strike price.

Say ETH expires at $1,700. I would need to pay a difference of $50

But as I additionally have a perpetual future established at $1,936.89 I will gain from this future contract $63.11

Of course, I should manually close the futures position at the time of expiry.

In case this call position gets assigned at $1,700 I will end up with

1650-1638.89+4.4=$15.51

That’s quite an impressive potential return on investment of 6.05 % in just one day

Break Even: $1,633.68

Now, the biggest drawback from such trading, as always with covered calls itself is a significant price drop, which might be even more painful when trading on margin with leverage. Another potential drawback - funding fees

- Established: October 5, 2023

- Options premium: $3.21