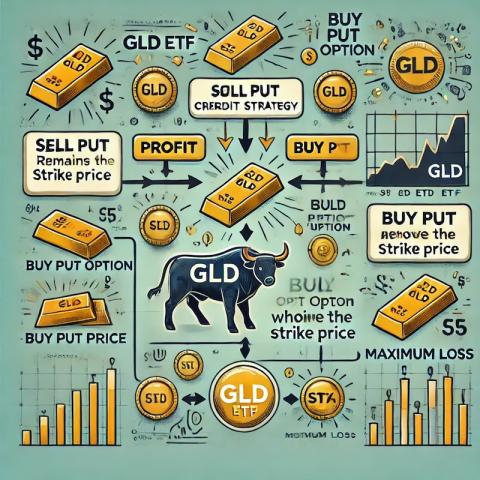

The bull put credit spread is a popular options trading strategy that allows traders to profit from neutral to bullish price movements. This strategy involves selling a put option while simultaneously buying a put option at a lower strike price.

The GLD ETF, which tracks the price of gold, is a common asset for this strategy due to its liquidity and predictable movements.

Here’s a step-by-step guide on how to sell a bull put credit spread on GLD ETF.

Bull Put Credit Spread:

This involves selling a put option at a higher strike price and buying another put option at a lower strike price within the same expiration date.

Objective: To collect a net premium, betting that the price of GLD will stay above the higher strike price until expiration.

Ensure you have an options trading account with a brokerage that supports multi-leg options strategies. Examples include TD Ameritrade, E*TRADE, and Interactive Brokers.

Analyze the GLD ETF:

Conduct technical analysis to determine the price support levels and overall market sentiment towards gold.

Utilize tools like moving averages, RSI, and MACD to identify bullish trends.

Select Expiration Date:

- Shorter expiration dates (e.g., 30 days) allow for quicker premium collection but require more frequent trading.

- Longer expiration dates reduce trading frequency but involve greater exposure to market movements.

Choose Strike Prices:

- Sell Put Option: Choose a strike price just below the current price of GLD where you believe the ETF will stay above until expiration.

- Buy Put Option: Choose a lower strike price to limit potential losses.

Calculate Potential Profit and Loss:

- Maximum Profit: The net premium received from selling the put option minus the cost of buying the put option.

- Maximum Loss: The difference between the strike prices minus the net premium received.

Place the Trade:

- Sell the Higher Strike Put: Enter the details for selling the put option.

- Buy the Lower Strike Put: Enter the details for buying the put option.

- Ensure you select the same expiration date for both options.

Monitor the Trade:

- Regularly check the performance of the GLD ETF and the spread.

- Be prepared to close the trade if GLD approaches the higher strike price to mitigate losses.

Close the Trade:

- If GLD remains above the higher strike price until expiration, both options expire worthless, and you keep the net premium.

- If GLD falls below the higher strike price, consider closing the spread early to avoid maximum loss.

Example

On May 29, 2024 while GLD was trading at $217, I sold following bull put credit spread with expiry on June 07, 2024 (9 days)

- Sell Put Option: $210 strike price, collecting $0.24 premium.

- Buy Put Option: $200 strike price, paying $0.04 premium.

What happens next?

On the expiry date, May 29, 2024, GLD is trading above $210 per share - options expire worthlessly and I keep premium - if GLD trades under $210 on the expiry date, I risk getting assigned 100 shares and will have to buy them paying $21,000

But as I already have collected a premium of $0.2 per share, since May 29, 2024 my break-even price for this trade is $210-$0.2= $209.80

In case of an assignment, I will turn this trade into a wheel strategy and will start selling covered calls

Anyhow, if troubled with the strike price near the expiry, I will try to roll it forward and down, preferably for credit, before actually taking the stock assignment

Selling a bull put credit spread on the GLD ETF is an effective strategy for profiting from a stable or bullish outlook on gold prices. By carefully selecting the strike prices and monitoring the trade, you can maximize profits and manage risks. Always conduct thorough research and consider market conditions before implementing this options strategy.