Investing often carries a deeply personal significance, intertwining our financial aspirations with our cherished memories and family legacies.

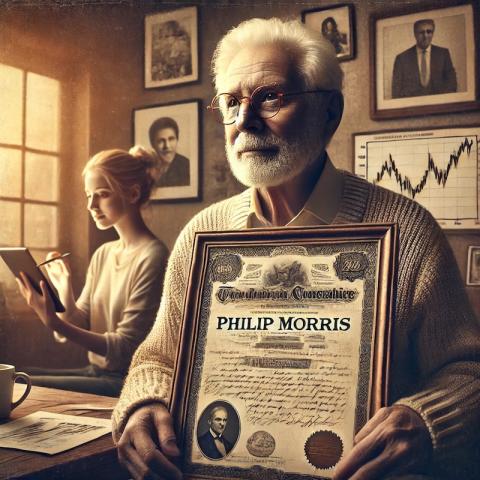

For me, the decision to invest in Philip Morris (PM) stock is not merely a strategic financial move but also a heartfelt tribute to my grandfather. According to family lore, he owned shares in Philip Morris or another tobacco company before World War II. To honor his memory, I've embarked on a journey to acquire shares of Philip Morris through a methodical and thoughtful approach, involving both direct purchases and options strategies.

My grandfather's rumored investment in Philip Morris has always intrigued me. Although I have yet to confirm whether he truly held shares in the company, the idea has inspired me to explore this path. This endeavor is more than just about making money; it’s about connecting with my heritage and keeping my grandfather's memory alive through a shared interest in investing.

Investing in Philip Morris will be a gradual process, reflecting both a careful approach to stock acquisition and a long-term commitment to this project. Here's how I plan to achieve this:

- Direct Stock Purchases: Periodically, I will buy small amounts of Philip Morris stock. This will not only help me build my position over time but also allows me to monitor the company's performance and market conditions closely.

- Options Strategies: To enhance this process, I will employ options strategies, such as writing in-the-money call options. This approach, known as the buy/write strategy, can provide additional income and potentially lower the cost basis of the shares. By selling call options, I can generate premium income which can then be used to purchase more shares or to offset some of the purchase costs.

- Flexible Time Frame: I have not set a strict deadline for accumulating a specific number of shares. My goal is to reach 100 shares by 2030, giving me ample time to navigate market fluctuations and make informed decisions.

One intriguing aspect of this project is my plan to contact Philip Morris to investigate whether my grandfather indeed held shares in the company. This historical exploration adds a layer of personal connection and curiosity to my investment journey. If I uncover any records or confirmations, it would be a fascinating piece of family history to share and cherish.

As I progress with this investment project, I will regularly update you on my experiences, strategies, and findings. This journey is not just about building a portfolio but also about honoring a family legacy and exploring the intertwining of personal history with financial growth.

Investing in Philip Morris as a tribute to my grandfather is a unique blend of financial strategy and personal sentiment. By combining direct stock purchases with options strategies, I aim to build a meaningful position in the company over the next several years. This project is a testament to the enduring influence of family stories and the ways in which they can shape our financial decisions and aspirations. Stay tuned for updates on this exciting journey.

While writing this article I was holding 2 shares of PM:NYSE with an average buy price of $78.96 about 22% less than the market price ($101.78). Such result was achieved in a few weeks from buy/write operations.