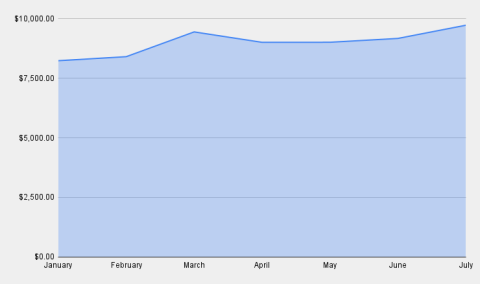

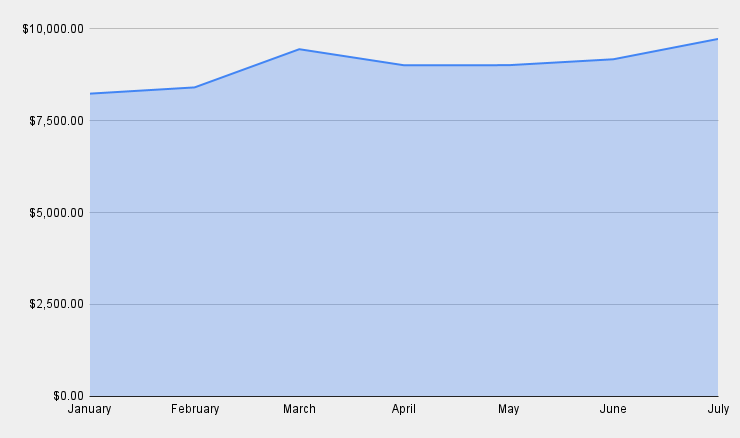

At the end of July 2024, the total value of our stock portfolio was USD 9,726 (€9,006 ). What is about 6% increase or USD 553 gain, if compared to the previous month.

Half of the July we spent in Latvia, working with our frame house and having our kiddos 6th birthday, while the rest of the month we spent in Georgia, enjoying Summer, having few road trips with German friends to Dedoplis Tskaro and Latvian friend to Birtvisi Canyon.

Our Latvian Summer house is coming along nicely, most of the interior works are finished, there are left few windows to be installed and some other interior works.

Now back to the stock portfolio

The increase in the stock portfolio comes from the market appreciation itself and additionally from options trades, while small part of the growth can be attributed to the dividends.

One of my short-term goals is to grow our portfolio to USD 10,000. With USD 274 to go, I believe this target could be crashed already this August, especially if we recover just form a few options trades, but you never know, market can take a steep correction.

The main longer-term goal for our portfolio is to grow our portfolio 100 fully covered Morgan Stanley (MS) shares, supported by an additional 100 British Petroleum (BP) shares. This strategy will enable us to sell covered calls on these shares while also benefiting from dividend payments. At the end of July we had 9.32 MS shares and 13 BP shares.

Last month I experimented with fractional shares buying and I have to say I'm quite satisfied with buying smaller bits of shares, the same way we do in our crypto hedge fund.

Stock Portfolio

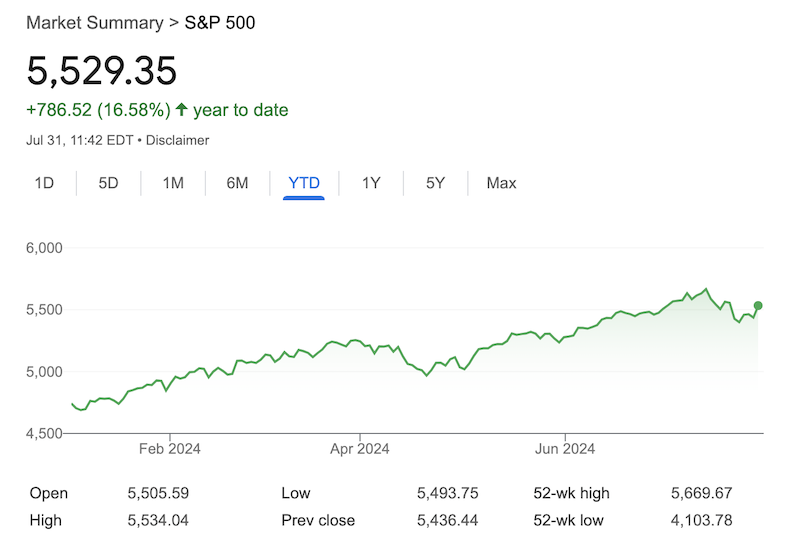

YTD our stock portfolio has gained 18.09%, which beats SP500 by a few basis points (16.59%).

Options trades

We actively sell put options on MS and BP and other stocks, while reinvesting the premiums back into stocks. Besides these two, last month I was selling options on few other tickers, like PM, TEVA, JNJ, NVDA and some more.

NVDA bull put trade went out of the control and I rolled it out to the August 30 expiry with strike price 95.

Because of this adjustments and not willing to take unnecessary risk to the portfolio, I'm not planning to have more options trade in portfolio at least til the middle of August, once I will be sure the NVDA trade is safe enough.

I keep a separate newsletter for my stocks buys and options trades, make sure to check it out at OptionsBrew.com

Dividend income

Last July, in diivdend payments we received $18.01, which is about $0.58 daily. Following tickers paid us dividend in July

| Ticker | Dividend |

| AGNC | $0.51 |

| MPW | $13.77 |

| PM | $3.31 |

| USB | $0.42 |

| $18.01 |

Our current yearly dividend from the portfolio stands at USD 193.46 (+27.96) , yielding 3.44%.

While this is not yet enough to retire comfortably, it is a solid foundation upon which we can build.

I believe by the end of the year we should be able to push our dividend portfolio to $250-300/yearly

Plans for August 2024

For the month of August, we are looking to dollar cost average buying fractional shares on NVDA, BP and maybe some other ticker. Not planning lots of options trades as we are recovering NVDA trade. There is at least USD 600 in options recovery trades to be taken in the month of August.

How was your investments performing in the month of June? Leave a comment!