After reading the recent Hindenburg Research report on Roblox (RBLX), I decided it was time to dive into something I had never done before—short selling a stock. In theory, everything lined up. The report highlighted significant concerns about Roblox, and I believed the stock was set to drop. With confidence, I placed my first-ever short trade, expecting a sharp fall.

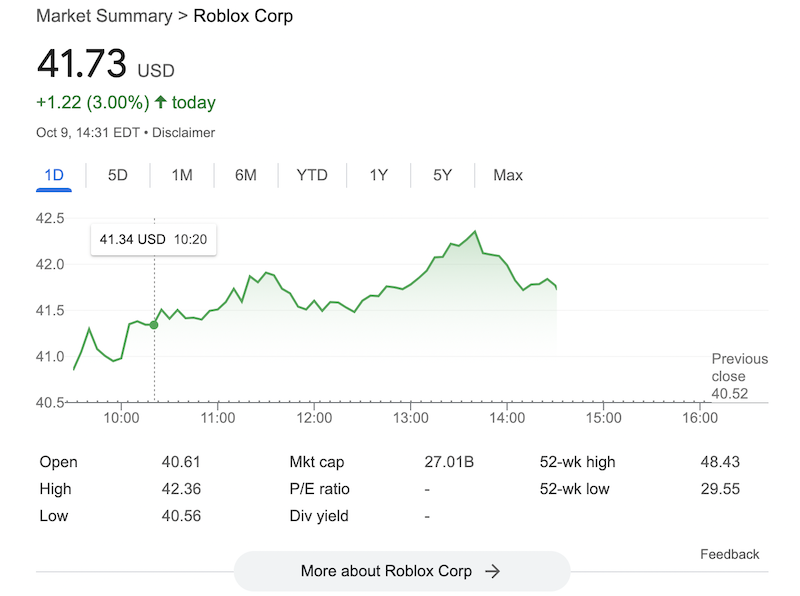

But as markets often do, they surprised me. The moment the opening bell rang, RBLX’s stock price surged. Instead of seeing the drop I had anticipated, the stock shot up, leaving me puzzled and instantly reminded of the Reddit warriors and the infamous GameStop (GME) short squeeze saga.

This unexpected turn of events forced me to rethink my strategy. I had entered the trade with confidence, but instead of gains, I got a front-row seat to how unpredictable the market can be—especially when it involves a high-profile stock and retail investors who might view shorts as the enemy.

I don’t usually engage in short selling. In fact, selling puts is more my wheelhouse, and this experience reminded me of why. Short selling, particularly in the volatile conditions I faced, can quickly lead to unexpected losses. Coupling this experience with my usual strategy of selling puts made me realize just how dangerous it can be to hold both short positions and puts in the same portfolio. Each carries significant risk, and when combined, they can create a portfolio highly vulnerable to sudden price movements.

For me, this trade wasn’t just about the financial outcome; it was about the lesson learned. Short selling is a skill that requires a different mindset, and it’s not one I’ll be rushing to incorporate into my usual strategies. This experience only reaffirmed my preference for strategies like put selling, where risk is more controlled.

In the end, the market will do what it does best—teach us humility. While I might not be shorting stocks again anytime soon, I’m thankful for the lesson learned from my first venture into the world of short selling.