I've been investing in the Mintos.com peer to peer lending marketplace since the beginning of 2017, or it has been already 36 months or three years since I've been exposing my funds to this Latvian fintech platform.

In the past three years, I've made a nice revenue of EUR 1,477.86 (before tax) and in today's article, I decided to share a quick overview for the past three years and also make a quick glimpse for my plans for 2020

Disclosure: This article contains affiliate links to mintos.com peer to peer lending website, by clicking on links on this page and by making investment on mintos.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Background - I first heard about Mintos.com at the start of 2016, one thing that made it attractive to me was an option to lend in Georgia (the country I've been living since 2011). Being familiar with the overall Georgian economy and the fact that so-called fast credits are very popular among the Georgian population, just oblivious I did it find appealing to monetize on it somehow. And Mintos.com seemed like a plan. See: Invest in Georgia - Peer-to-Peer (P2P) lending - Mintos.com

Fast forward - three years later, I still invest with Mintos.com, I find them great, but they are just not interesting for me anymore, as I have found much more attractive and more interesting ways to invest and even generate income, selling options (stock market). I believe Mintos.com is great for set and forget style investors looking to generate relatively stable income.

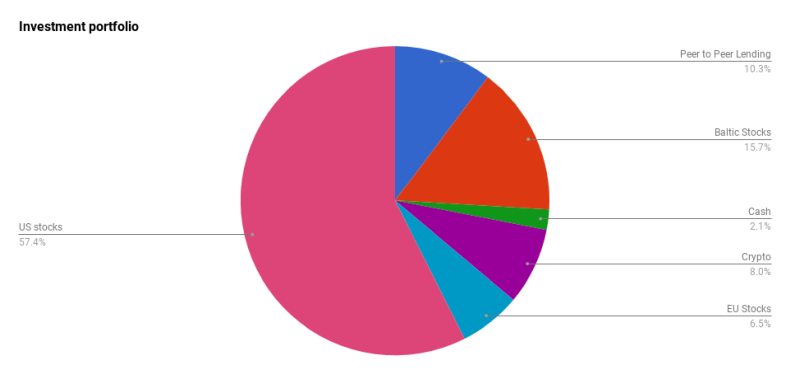

At the start of 2020, mintos.com took the third-largest position (US stocks 57.4% and Baltic stocks 15.7% ) in my portfolio with 10.3% of my funds invested on Mintos.com marketplace.

Investment portfolio structure at the start of 2020

2019 in Review and Financial Goals for 2020

During the past three years, the overall share of Mintos in my investment portfolio has decreased from 27.7% in December 2017 to 10.3 % in January 2020.

The reason is quite simple, during the years I have shifted my focus on the stock market, currently being focused on income generating form option trading.

A diversified portfolio helps. Never put all eggs in one basket, as they say.

10.3% seems to be a kind of save level to be exposed in peer to peer lending

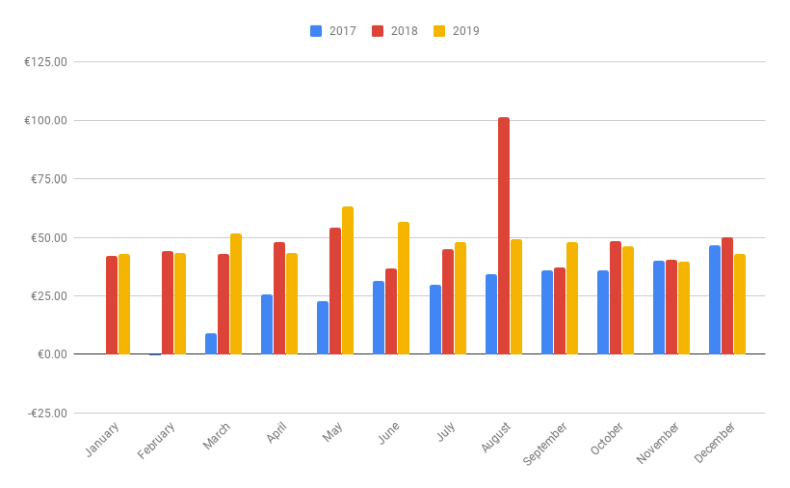

Despite being just third in size Mintos, has been among the second-best earner after US stocks in terms of dividend income (loan repayment) in 2019, in a passive income earning me EUR 575.35 or EUR 1.57 daily. Dividend income from the Baltic stocks earned me €404.49 or EUR 1.10 daily.

Learn more: Dividend Income

About interest earned on mintos.com

During the past three years, the maximum I've invested on the Mintos.com platform is €5,116.51 (June 2019) and has made a profit from interest payments EUR 1,477.86. That would be to about 28% yield over the past three years. In 2017 - 7.94%; 2018 -14.82%; 2019 - 14.78%. This number is higher than average excepted around ~11-12% annual rate because I keep investing about a half of the amount in Georgian Lari loans (they come offer 16%-17% yield, but for a long time in 2018 were at 18%)

Monthly income from Mintos.com 2017-2019

Also, I should note that I constantly add and constantly remove funds on the Mintos.com platform, I only deposit GEL while I withdrew EUR. Now since the second half of 2019 seems GEL deposit has been removed from the platform and there are no plans to renew it (at least that what support has told me several times)

That is a red flag for me - as I don't plan deposit any other currencies than GEL (remember - I joined only because I can deposit GEL) - my further participation with Mintos I can see as I will be there while funds will run out (I will withdraw). On the other hand, there is no rush for me and I will keep investing existing funds + converting existing GEL to EUR, to fund EUR loans (lately there is a shortage of GEL loans on the platform)

Unfortunately, because of I keep investing both in EUR and GEL currencies and because of currency exchange rates, the total value for my investment if converted back to EUR currency at the start of 2020 is a negative -7.34% value growth. Be cautious when investing in international currencies.

Mintos.com contributes regularly to my dividend income with about EUR 40/mo, for 2020 I'm looking this will decrease to about EUR 30/mo, because of the withdrawals

Withdrawing money and paying taxes

In 2019 I have withdrawn money from Mintos.com peer to peer marketplace several times, to finance new purchases on NYSE In most times money arrived at the bank account in one-two working days.

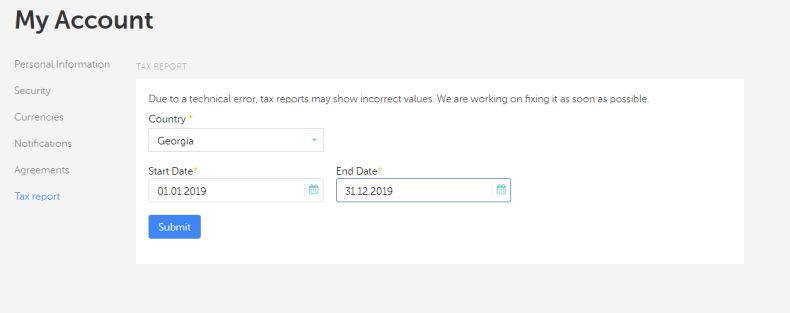

Now, from money earned on the Mintos.com platform, I should pay taxes, luckily the platform offers simple tax guidance for the citizens of most countries.

Mintos Tax report

According to the Latvian Tax system, I have to pay 20% income tax. For me, that would mean to pay in tax ~ EUR 115.07 for 2019. I'm paying income tax once in a year when filling yearly tax income forms with Revenue service.

As I'm not a tax advisor, I cannot comment much on here, for further questions and your situation please consult your tax advisor

About Auto Invest

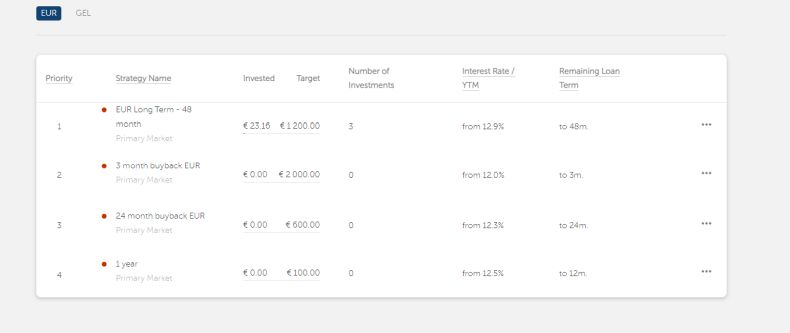

Despite Auto Invest worked like a charm in the past, I have disabled it already in 2018 as I like doing all investments manually because I like to keep a hand on the pulse.

Auto investing in Mintos.com platform

Auto Invest automatically implements your chosen investment strategy. After you have entered your investment criteria, Auto Invest will automatically invest in suitable loans. You can access Auto Invest at any time and follow your portfolio activity in real time to make sure it is working according to your investment goals. Auto Invest is a very efficient tool for saving time spent on investing activities. It also allows you to access newly placed loans in the system before manually-made investments.

You can pause or cancel Auto Invest at any time.

Once you have confirmed your investment criteria, Auto Invest will review loan listings and invest funds in loans that meet your preferences. Auto Invest will continue to automatically analyze and invest in suitable new loans as soon as they are listed. If you change any Auto Invest setting, all available loan listings will be rechecked to make sure they meet your investment criteria.

Invest & Access

There have been some several new features introduced during 2019, most visible probably being Invest & Access feature, which I haven't tried out, but what might be appealing to new investors is a feature to withdraw funds anytime:

- 9.79 % average interest rate

- Access your money anytime

- Best diversification to manage risk

- First to buy high demand loans

Invest & Access fully diversifies your investment across current loans from all applicable lending companies on the marketplace. Your exact portfolio mix automatically adjusts to the market. To give you the best diversification for additional protection and stable returns, Invest & Access rebalances your portfolio daily.

Invest & Access only invests in loans with a rating of A+ to C- and buyback guarantee. In addition, it only buys loans from lending companies that have been on the marketplace for at least 6 months.