This is a quick follow-up post to my original idea of experimenting with writing crypto covered calls on Ethereum and Bitcoin, I started at the end of November 2020

This is not the first time I'm selling options on crypto, in fact, I've been doing so for the last two years. This is the first time I'm applying one trading strategy only. About 3 years ago I was very enthusiastic about crypto mining and I was building my Ethereum mining rig, which at it's high was earning about $5.5 per day. See: Mining Ethereum @ ~53 MH/s and Siacoin @ ~310 MH/s Earns me $5.53 Daily - And It's Time to Take a Pause

Today I sold 3 out of the money covered call options on Ethereum, with 1DTE, for what I got, 0.003938 ETH, or about 1.31% daily income yield, and also I sold 0.1 out of the money 1DTE call options on Bitcoin, for what I got 0.00004375 BTC or about 0.43% daily income yield.

With todays exchange rates (1 ETH = $600, 1BTC = $19.062), that gives us $2.36 and $0.83. Total $3.19. All numbers are after platform taker commissions

My total investment so far, during this 30-day experiment is $436.91. The daily income of $3.19 would mean about 0.7% daily income. Which is AWESOME.

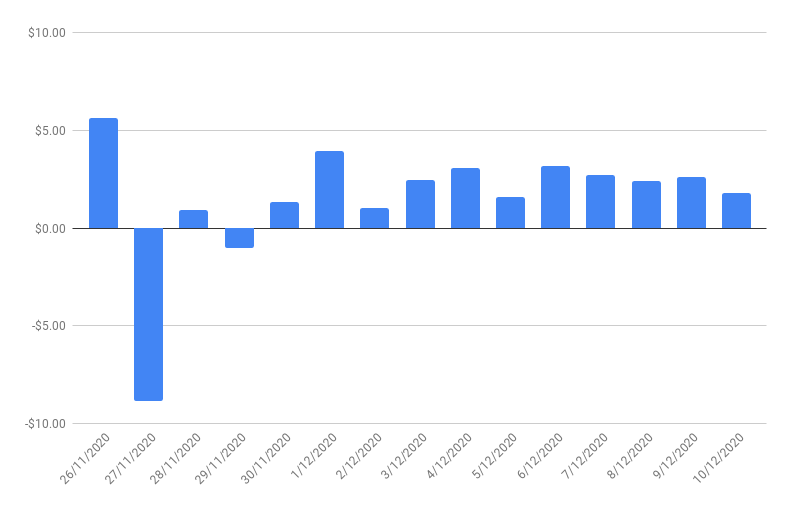

Now, not every day is the same, and there have been days when I've actually lost my coins, but that's already another story

daily Income from trading crypto options

While the experiment is still on-going, I've already decided that I want to make at least $10/daily by trading crypto options in the next 2-3 months. In short, that would mean I need to invest some additional $800, but rather than doing that, I will dollar cost average + reinvest all coins.

The plan is on a weekly basis to match up the income of the Deribit platform and invest the same amount via Coinbase.

In the last 7 days, I have made a total of $11.85, so the plan is to invest then the same amount by buying new coins.

Let's see will I be able to get this daily income up to $5/day by the end of December