The inspiration for this post came from a Dividend Empire article titled My 33-Year-Old Dividend Growth Portfolio.

Also, I would like to mention that a couple of weeks ago I met a fellow Italian investor here in Tbilisi (Massimo, if you are reading this - hi to you), we spent about 90 minutes enjoying a cappuccino and discussing investments in Tbilisi, Georgia, investments in oil, gas, and of course dividend investing. Massimo told me he has been investing for about 17 years and that lead me to realize that in fact, me too - I have been investing since 2001/2002.

I apologize for the somewhat misleading title. Unfortunately, I do not actually have such a portfolio. But I sure can model one.

Now, about 17 years ago I was 16/17 years old, and in fact, bought my first stock using privatization certificates. I bought Latvijas Kugnieciba stock. Which latter in 2005 I sold for about 500 or 600 Latvian lats and bought a Canon camcorder which didn't last long (my mom drowned camcorder somewhere in the Red Sea). Later on, around 2007 I bought some Lietuvos Dujos stock (which again I sold soon). I returned to investing in Baltic stocks once more back in 2017.

Since 2017 I've invested in 16 Baltic stocks, made a dividend income EUR 706.10 ( EUR 265 in 2017, EUR 386 in 2018, and looking an about EUR 500 in 2019)

This time I decided to invest only in dividend-paying Nasdaq Baltic stocks, see Dividend Paying Stocks In Nasdaq Baltic Market By Yield

Returning to 2002, I doubt I was able to buy Latvijas Gāze stock back in 2002 with privatization certificates, and that's why I will use hard cash calculations for the further

I had 22 privatization certificates back, in 2002. The price for one privatization certificate (when used in stock purchases was LVL 28), I had a buying power of LVL 616 back in 2002. Now, since 2014, the EURO is used instead of Lats in Latvia (1 EUR=0.702804 LVL) EUR 876.48 - was the capital I invested in Latvijas Kugnieciba.

Latvijas Gāze is one of the safest stocks from the Nasdaq Baltic list, in fact, Latvijas gāze is the only company which has paid a dividend since 1999, I decided to model, what if instead of buying Latvijas Kugnieciba instead I would have bought Latvijas Gāze back in 2002?

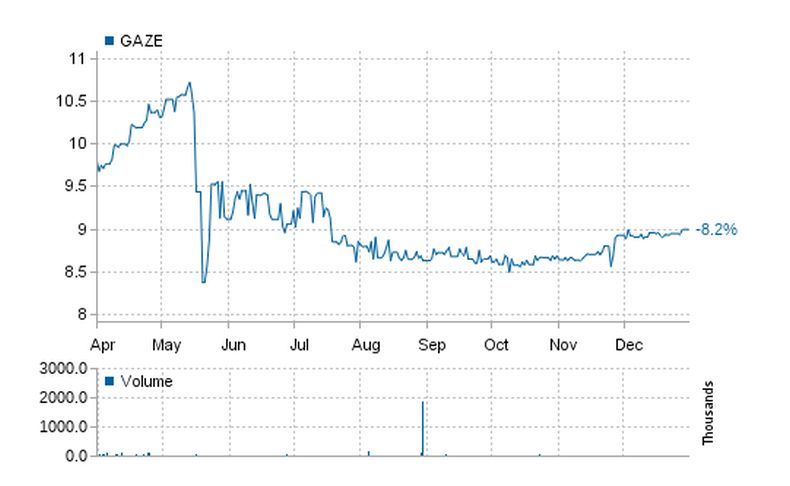

The stock price for Latvijas Gāze April - December 2002

I don't remember correctly on which date precisely I bought my stocks, but I remember it happened somewhere around April / May, that's why I will use for this example extreme values (the lowest and the highest)

- The lowest EUR 9.7 per share (April 2002)

- The highest EUR 10.7 per share (May 2002)

Let's do simple maths:

- lowest price:EUR 876.48 / EUR 9.7 = 90 shares (no fractional shares here)

- highest price: EUR 876.48/10.7 = 81 shares

Latvijas Gāze has paid annual, sometimes bi-annual and sometimes special dividend ever since 1999.

With current trading price in 2019 at around EUR 10.2-EUR 10.5 per share, I would say I would have neither value growth nor value drop, the price in 2019 surprisingly is the same it was back in 2002.

Dividends

Now the real magic happens with dividends - I would have earned ~ EUR 955 - EUR 1,062 in dividends in the past 17 years. Nothing much, just EUR 56 - EUR 62 annually. On the other hand that's just from one investment back in 2002.

Dividends Reinvested

To make it more interesting I decided to see how much I would earn in case of DRIP (dividend reinvestment plan), which unfortunately isn't available for Latvijas Gāze nor is offered from any stockbroker (at least I'm not familiar with).

With dividends reinvested I would have earned ~ EUR 1,590 - EUR 1,844 in dividends in the past 17 years. Better for about 30-50% if compared to not reinvesting dividends) EUR 93 - EUR 108 annually. The total value for the portfolio would grow from about EUR 876 in 2002 to EUR 2,274 - EUR 2,662.

Dollar cost averaging

Last, but bot not least, let's do a simple maths example on buying more shares once in a year, paying a fixed price. For the ease of this example, I will use the average price of EUR 9.5 per share

My total investment in Latvijas Gāze after 17 years would be EUR 876.48 * 17 = EUR 14,900.16, which would give me about 1568 shares in the company. In 2018 it would give a dividend income of about EUR 909. Now that's some serious growth compared to just EUR 56 - EUR 108 annually.