It feels like I'm losing ground under my feet when looking on the future dividend income for the month of May 2018.

At the start, Olympic Entertainment group announced it's intentions to leave Nasdaq Baltics (here I hopped for lucrative dividends) - I decided to sell my humble holdings of Olympic Entertainment Group and bought instead Kaunas Energijos and some other stock for the upcoming month of June.

Today Zemaitijos Pienas announced dividend cut (even worse no dividends for 2018), but proposed minimum buyback price per share. My first thought was - if there is no dividend - I don't need such share in my portfolio. Though I spent my time, did some analytics - and I have been thinking a lot on if shares don't bring money, I must sell such share and put money into shares generating money.

Zematijos Pienas stock price for the past 5 years (Data source: Nasdaq Baltics)

During the last 5 years, the stock price for Zemaitijos Pienas has risen by more than 130%. After an announcement come about dividend cut for 2018, the stock price dropped by -7.26%. On Friday evening Zemaitijos Pienas stock was changing hands at EUR 1.66 (second lowest day in 2018). Since the begging of the year Zemaitijos Pienas stock has lost about -4.6%.

I'm not obsessed with these charts, but what I'm learned from crypto trading, it looks EUR 1.66 is the lower support resistance level, and it's too early to speak about the bear market. On the other hand, here is what I don't like - the massive growth has happened throughout 2017 (+62% value growth in 2017). As I have made some good profits already with Zemaitijos Pienas (first bought back in 2017 for EUR 1.49) it would be probably smart to sell now when I have made some profits. That's in fact a good idea, let me make a probably very silly move - I will wait until price will bounce back to EUR 1.82-1.85. Dude, I already hear - it will never happen :)

Now, as they say - never lose money!

I haven't yet decided what I will do with this stock - either I will keep it for one more year, or I will still sell it at profit.

Nevertheless, of my decision, I did some more technical analytics and found shares of Klaipedos Nafta good enough. They have dividends in the month of May. Without Olympic Entertainment Group and Zemaitijos Pienas I will not take in dividends some EUR 40 in May. With the help of Klaipedos Nafta I'm looking to take back at least EUR 20.

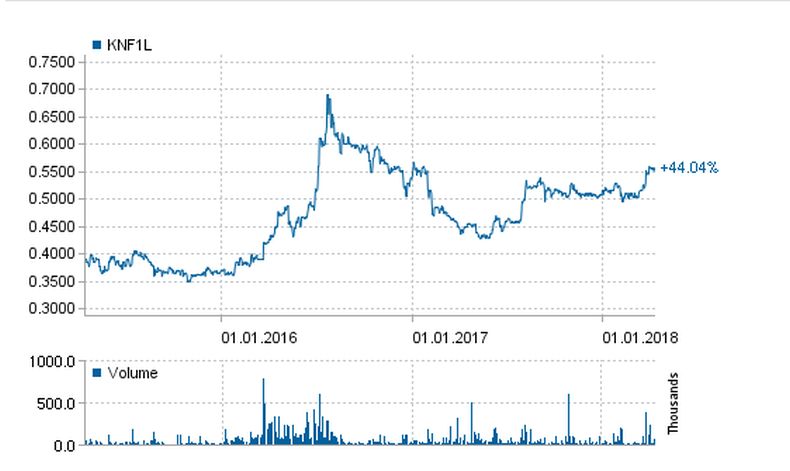

Klaipedos Nafta stock price for the past 5 years (Data source: Nasdaq Baltics)

I truly believe dividend income should add up every year. In last May I took around USD 65 in dividends, when I last time, at the start of the year, calculated future dividends for this May I was looking on about USD 150 (USD 85 gain). After selling Olympic Entertainment Group stock, the future dividend fell to about USD 120. If Zemaitijos Pienas cut the dividend, total dividend income fells to about USD 80. In a year I've managed to increase dividend income just by USD 15. It doesn't look good. With such speed after 10 years, I will make just USD 200. It sucks.

With the help of Klaipedos Nafta stock, I'm looking to take back some dollar, so I can make at least USD 100 in dividend income in May (Still humble). When looking on 2019 I should try hard to reach at least USD 200. Hard but doable.

Pretty strange Spring in the Nasdaq Baltics (at least for me). Hard to imagine what will happen next.

If Zemaitijos Pienas will renew dividend payment next year in May, I could make around USD 250 then. If there is no dividend even next year - bella ciao - Baltic Stocks isn't interesting for me just for hold. Stocks should generate dividend income. Currently, Zemaitijos Pienas takas about 6% from my Baltic stock portfolio. Decent. On the other hand, if I would sell now and put this money, let's say into peer to peer lending - I could make additional + EUR 50.

Speaking about Baltic stock technical analytics (which takes data for the last 4 years) - there are just 7 companies (from 72) I find good enough. With good history, yearly dividend increase. Klaipedas Nafta, unfortunately, doesn't pass all my criteria to be an ideal stock, but at least this stock puts a plaster on my May dividend income. Not to speak oil and liquid gas terminals in Lithuania - IMHO, which is a good business.

My Baltic stock portfolio slowly is moving into energy sector - I wouldn't say this is a good idea, but it looks like that energy companies in the Baltics are more stable and more predictable than, let's say dairy stocks.

I'm looking to add Klaipedos Nafta to my portfolio soon, as I've spent a lot already this month, there are not much funds I could allocate for this stock purchase.

In theory, I could get rid of the Zemaitiojas Pienas stock, but I'm still thinking to keep or not to keep for the long-term. For a long-term investor, it's not interesting to sell just a year after I bought. For me, it's interesting to keep the stock for at least 10 years, and preferably with regular dividends.