I've been investing in Mintos.com peer to peer lending marketplace since the beginning of 2017, or it has been already 12 months or one year since I've been exposing my funds to this Latvian fintech platform.

In the past 12 months I've made a nice revenue of EUR 311.42 (before tax) and in today's article, I decided to share a quick overview for the past 2017 and also make a quick glimpse for my plans for 2018.

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos. At the moment, US citizens or taxpayers cannot register as investors at Mintos.

Affiliate link here: Sign up to Mintos.com here. By using this affiliate link for registration both you and I will receive — 1% of your average daily balance which should be paid in 3 installments for the first 90 days.

Remember - investments are risky, never invest more you can afford to lose.

Background - I first heard about this Latvian fintech at the start of 2016, one thing that made it attractive to me was an option to lend in Georgia (the country I've been living since 2011). As been familiar with overall Georgian economy and the fact that so-called fast credits are very popular among Georgian population, just oblivious I did it find appealing to monetize on it somehow. And Mintos seemed like a plan. See: Invest in Georgia - Peer-to-Peer (P2P) lending - Mintos.com

Now, it took me some 8 months more, before I actually started to invest via Mintos.com platform, and just in the January of 20, 7 I deposited the first amount to Mintos. See: My Start at Investing on Mintos Peer to Peer Lending Platform: Depositing Funds

Make sure to check out my previous monthly and quarter reviews about Mintos.com

- Review of Mintos Peer to Peer Lending After One Month of Investing

- Mintos.com Review after 3 month investing in Peer to Peer loans

- Review of Mintos.com Peer To Peer Lending Platform After 6 Month of Investing

- Mintos.com Peer To Peer Lending Review After 9 Month of Investing

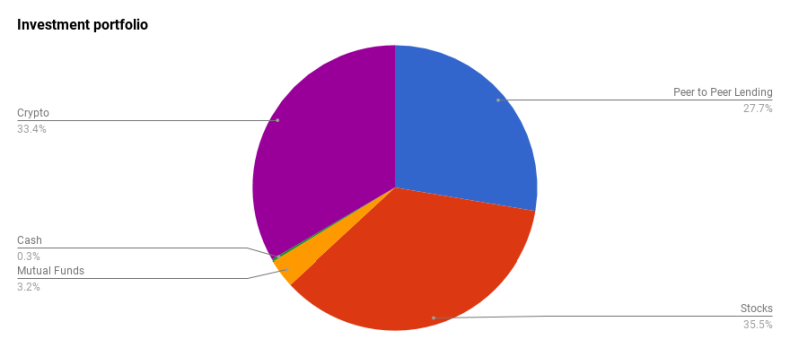

At the end of 2017, mintos.com took the third largest position (after stocks and cryptocurrencies) in my portfolio with 27.7% of my funds invested on Mintos.com marketplace.

Investment portfolio structure at the end of 2017

Learn more: 2017 in Review and Financial Goals for 2018

The overall impact on the total portfolio for Mintos has decreased from all time height at 100% in January 2017 to little less than 30% at the end of the year. And I'm glad. The reason is simple:

- My investment portfolio started just in 2017

- I have diversified it in Stocks, mutual fund, crypto, cash and peer to peer lending

A diversified portfolio helps. Never put all eggs in one basket, as they say.

27.7% seems kind of save level to be exposed in peer to peer lending, but in fact, I would love to limit this number around 20% in 2018, meanwhile by increasing total amount lent via peer to peer lending.

Despite being just third in size Mintos, have been the top earner in terms of dividend income (loan repayment) in 2017, in a passive income earning me EUR 311.42 or EUR 0.85 daily. Dividend income from stocks earned me EUR 264.85 or EUR 0.72 daily.

Learn more: Dividend Income

About interest earned on mintos.com

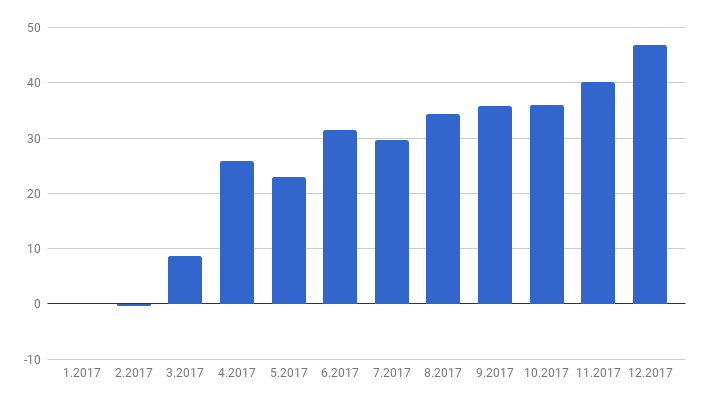

During the past 12 months, I've invested in total EUR 3,922.50 and have made a profit from interest payments EUR 311.42. That would equal to 7.94% year to the date yield. This number is lower than average excepted around ~11-12% annual rate, because of I keep adding more funds month after month.

Monthly income from Mintos.com

Unfortunately, because of I keep investing both in EUR and GEL currencies and because of currency exchange rates, the total value for my investment if converted back to EUR currency at the end of 2017, equals just to EUR 3,688.22, which is a negative -5.97% value growth. In the second half of 2017, Georgian Lari currency lost its value against EUR. Be extra cautious when investing in international currencies.

Mintos.com contributes regularly to my dividend income with little over than EUR 40/mo, and I'm looking to increase interest earned here to about EUR 50, during 2018.

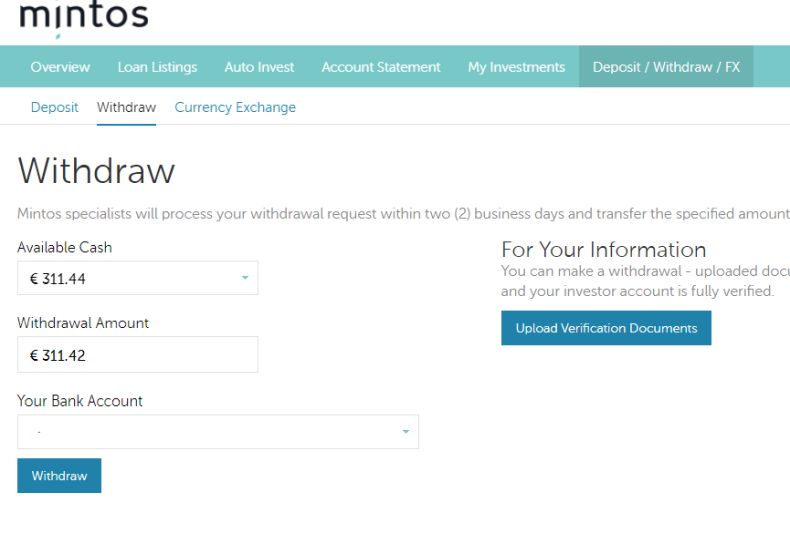

Withdrawing money and paying taxes

At the start of 2018 I decided to withdraw all interest earned on Mintos.com peer to peer marketplace and finance new purchases on Nasdaq Baltics Stock exchange To make withdrawal happen I had to stop Auto Invest function, and in total it took me 21 days to reach EUR 311.42 level. After reaching what I just pressed magical Withdrawal button and got it transferred to my bank account in one working day. Great, now I know I can not only deposit money but also withdraw.

Withdrawing funds from Mintos.com

Now, from money earned on Mintos.com platform I should pay taxes, luckily the platform offers simple tax guidance for the citizens of Latvia, Germany, and other countries.

We are currently able to provide tax statements prepared according to German and Latvian requirements. Please note that tax reports for German investors for the year 2017 will be available from the end of January, 2018. If you are not tax resident of Germany or Latvia, you may still select your prefered country - this data will be used to inform the next countries for which tax statements will be introduced.

I requested my Tax Report, which was shortly emailed, and for 2017 seems I need to pay a tax from EUR 49.99 and not EUR 311 (as I thought at the start). As I'm not a tax advisor, I cannot comment much on here, but I believe tax will be much greater for 2018, as tax seems is calculated only for fully repaid loans in the current year (interest earned + refund of base investment). As I have many long-term (48 months and more loans) these loans seems will be taxed in next years. Not Sure. Consult your tax advisor!

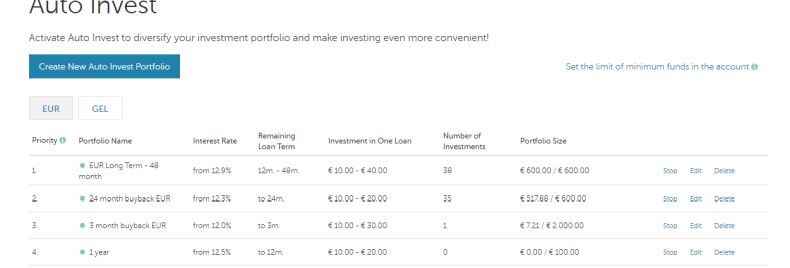

About Auto Invest

Auto Invest works like a charm, I've defined a few auto invest portfolio, all with buyback guarantee and longest remaining loan term 48 months (4 years)

Auto investing on Mintos.com platform

Auto Invest automatically implements your chosen investment strategy. After you have entered your investment criteria, Auto Invest will automatically invest in suitable loans. You can access Auto Invest at any time and follow your portfolio activity in real time to make sure it is working according to your investment goals. Auto Invest is a very effective tool for saving time spent on investing activities. It also allows you to access newly placed loans in the system before manually-made investments.