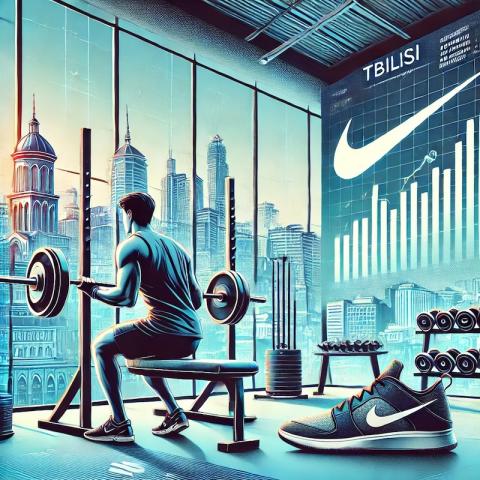

After a two-month hiatus from the gym, during which I gained about 2kg, I decided it was time to get back on track. Today, I renewed my gym membership at Tbilisi Axis Tower and committed to a new fitness and investment strategy: after every workout, I will invest in Nike (NKE) stock by purchasing 0.1 shares.

As someone who aims to visit the gym five days a week, this routine will help me build both physical strength and a growing portfolio. My goal is to eventually own 100 shares of NKE, enabling me to engage in covered call writing—a strategy where I can generate additional income by selling call options on my stock holdings.

At my current rate of five gym sessions per week, it will take me approximately four years to reach 100 shares. While this may seem like a long journey, the consistent investment after each workout session allows me to dollar-cost average into the stock, mitigating the risks of market volatility.

Though my initial focus is on buying shares, I’m also considering more advanced strategies down the line. At some point, I might start selling puts or credit spreads on NKE stock. These options strategies could complement my stock purchases, providing additional income or reducing my cost basis.

This combination of fitness and finance is not just about reaching a goal; it's about building a disciplined approach to both my health and wealth. As I progress in my gym routine and investment strategy, I’ll keep a close eye on the market and adjust my tactics as needed. Time will tell how this strategy pans out, but I'm excited to see where it leads.

Whether you're a gym enthusiast or an investor—or both—this approach offers a unique way to stay motivated and financially savvy. Let's see how far this journey takes us!