I'm raising $10,000 for the covered call crypto fund.

For the past several years I've been trading and investing in crypto with mixed success. I've made my gains and taken my losses. Covered Calls with crypto have been one of the hardest to learn -and I'm still learning.

Over the years I've realized - making money in a growing market isn't hard - preserving and growing in a bear market is much harder. But possible.

Hedging with futures makes it possible. At some point, it can get tricky, but with the right mindset and some expertise, it can be achieved.

Despite, the time has proved that dollar cost averaging investing is one of the best investment approaches when investing with crypto (and most of the other kinds of assets), I have decided to proceed with an idea that has been in my head for the past few years - launching a crypto fund, where myself will be the biggest investor for some time at least.

Here is the plan

Issue a token, with 10,000 coins, each coin worth $1. From the dollar acquired buy Ethereum and sell covered calls on each position. Additionally hedging each position by short-selling Ethereum perpetual futures on the Deribit platform.

At the moment I plan to invest $1,500 in hard cash myself in the newly released token to start trading and growing the crypto fund. 8,500 coins will be available for investment

Strategy

The crypto fund invests in a portfolio of equity securities and writes (sells) call options on those securities. Under normal circumstances, the fund writes (sells) call options on at least 70% of the fund's total assets. The fund normally writes (sells) covered call options listed on the Deribit trading platform to seek to lower the overall volatility of the fund's portfolio, protect the fund from market declines, and generate income.

Risk

The fund can invest in securities that may have a leveraging effect (such as derivatives and forward-settling securities) that may increase market exposure, magnify investment risks, and cause losses to be realized more quickly. Crypto markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, economic or other developments. These risks may be magnified in foreign markets. Not suitable for all investors.

Technicals

- There will be issued 10,000 tokens

- Each tokens base value is $1

- From the funds raised sell Covered calls on Ethereum coin

- The portfolio is rebalanced once per month (on the last day of trading)

- Max investment per investor $1,000

- Buyback with 5% premium from June 2023

- While in the acquisition phase, profit is distributed in form of new tokens

- Once fully invested, profit is distributed in the growth of the coin

Example trade with covered calls on Ethereum

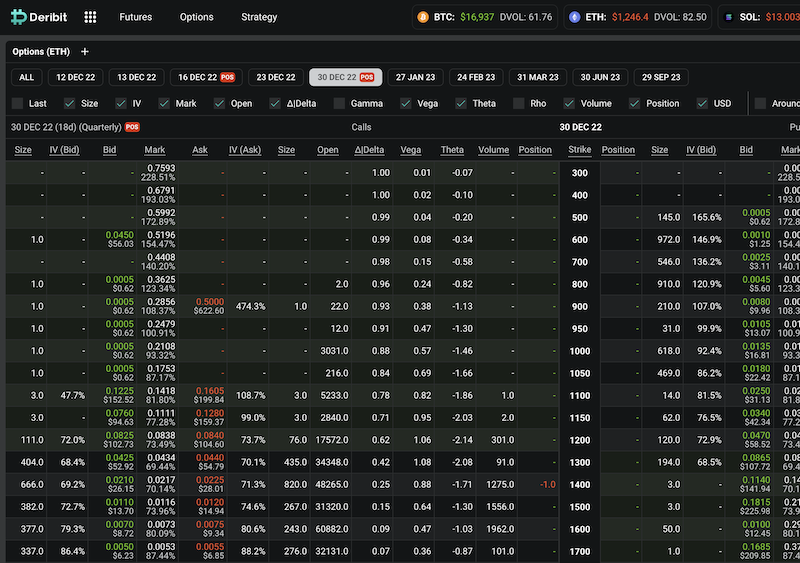

On December 12, 2022, we would buy 1 Ethereum coin on Coinbase paying $1,246 per coin, simultaneously, on the deribit platform we would sell 1 call option with a December 30, 2022 expiry and strike price of $1,300 for this trade receiving 0.0425 ETH / $52.92 premium.

Here are a few possible scenarios of what could happen next:

On the expiry date, December 30, 2022, ETH is trading under $1,300 per coin - options expire worthlessly and we keep the premium and start over. In this case, our crypto fund grew by $52.92 and this money would be split among investors in form of the tokens (until 10,000 are reached)

if ETH trades above $1,300 on the expiry date, we are obliged to pay the difference in crypto. Say ETH trades $1,400 on expiry, we need to pay the difference between the spot price and strike price, which is $100, or 0.0769 ETH if converted back to crypto

We would be left with 1+0.0520-0.0769 = 0.9751 ETH

But as the ETH price actually increased from $1,271 to $1,400, our ETH holding value would equal $1,365.14 (0.9751*1400) or we still would make +$94.14

In case ETH trades $2,000 on expiry and our strike price is $1,300 we need to pay the difference between the spot price and strike price, which is $700, or 0.5384 ETH if converted back to crypto

We would be left with 1+0.0520-0.5384 = 0.5136 ETH

Ouch, doesn't look good at all.

Now as the ETH price actually increased from $1,271 to $2,000, our ETH holding value would equal $1,076.8 (2000*0.5384), despite the rally in price, we would actually lose -$192.4 Ouch, that hurts now! Though highly unlikely, I still have seen this happens several times in the past.

But what to do?

Hedging with futures might mitigate the risk.

For example, we could enter a long trade with ETH futures if the price of $1,300 is touched. In such a case if the strike price reaches $1,400. we will actually make 0.0769 ETH in the long future. The long future will compensate for the loss from the short call.

We would be left with 1+0.0520-0.0769+0.0769 = 1.0520 ETH or $1,472.8

Now, let's look at what happens if the price reaches $2,000 and we hedge with a long future at $1,300.

In such a case if the spot price reaches $2,000 we will actually make 0.5384 ETH in the long future. The long future will compensate for the loss from the short call.

You would be left with 1+0.0520-0.5384+0.5384 = 1.052 ETH or $2,104

Entering with long futures even when set automatically to execute at the market price is not guaranteed

In theory - this is a zero-risk trade, in practice - it will ask very reliable execution plan if the $1,300 gets challenged.

Depending on the success or failures, I might proceed with a larger, say $100,000 or $1M fund in the future.

To sum it up

I'm launching a small crypto fund to grow and preserve capital with covered calls and futures. Total investment available $8,500 (max $1000 per investor)

In the coming days/weeks - I will issue a custom token, most probably on the Solana network, it's planned that it will be available for trading in USDC or USDT pair - at the moment I'm offering also direct ETH or Wire transfers in EU or Georgia for acquiring this token. To give everybody a chance - a $1,000 maximum investment per investor is considered at the moment.

Updates about the crypto fund performance will come via the Terramatris website, my blog and Twitter.

Contact me if you are interested via the blog's contact form, Linkedin or Twitter