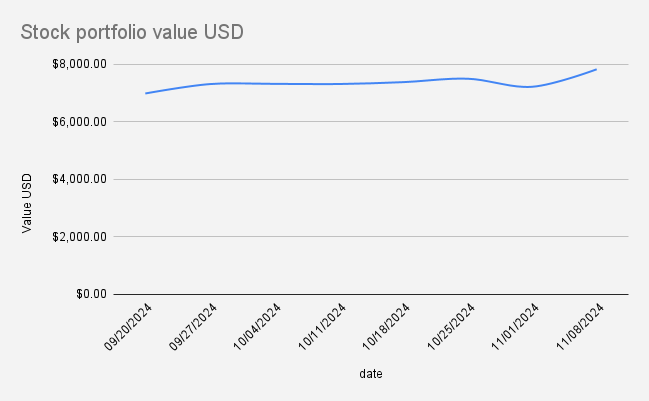

This week brought remarkable growth to our stock portfolio, which surged to $7,830.26, marking a significant +8.43% gain from the previous week.

The recent growth was driven by a combination of overall market momentum and gains from expired options trades. The week was largely influenced by post-election optimism, with former President Donald Trump winning the election as the 47th President of the United States. Congratulations to him and his supporters! With Trump back in office, I believe we may see a shift in policy direction, potentially fostering an environment that encourages stock market growth.

Given the market's response, I wouldn’t be surprised if the S&P 500 were to approach the 10,000 mark by the end of his term.

Key Trades and Adjustments This Week

- Rolling BP Deep In-the-Money Puts

This week, I made strategic adjustments by rolling out deep in-the-money put options on BP. These were rolled further into 2025, allowing us to take advantage of BP’s underlying strength while managing downside exposure. Rolling deep in-the-money puts is an effective strategy for extending the trade’s timeframe without increasing immediate capital exposure, giving us time to benefit from BP’s future market movements. - Morgan Stanley (MS) Weekly Credit Spread

Today, I opened a weekly credit spread on Morgan Stanley, with a 127/121 strike structure. By opening this trade, I aim to capitalize on short-term fluctuations in MS, capturing premiums without taking on excessive risk. Using the premium received from this spread, I bought an additional 0.2 shares of Morgan Stanley, steadily building up our equity position in the stock.

Market Outlook and Closing Thoughts

As we move forward, I’m optimistic about the broader market’s trajectory under the new administration. Given the week’s performance and strategic adjustments, our portfolio is positioned for potential gains in the months to come.

Since September 17, 2024, the total income generated from our options trading has reached $625.28. This income stream continues to provide additional cash flow, which we use to reinvest into stock buys to accelerate portfolio growth.