I once read that an investor can call himself a pro after he/she has survived at least 3 bear markets. I just survived one. At least I hope so.

In fact, from my short active investor's career, I feel this is already my second bear market, with first happening back in December 2018,

March 2020 market was scared from Covid-19, Trump travel Ban for EU citizens, Russia- Saudi oil war. Panic, real panic. It took about 3 weeks from all-time highs at the end of February to a 20% drop in mid-March 2020. And nothing is over yet.

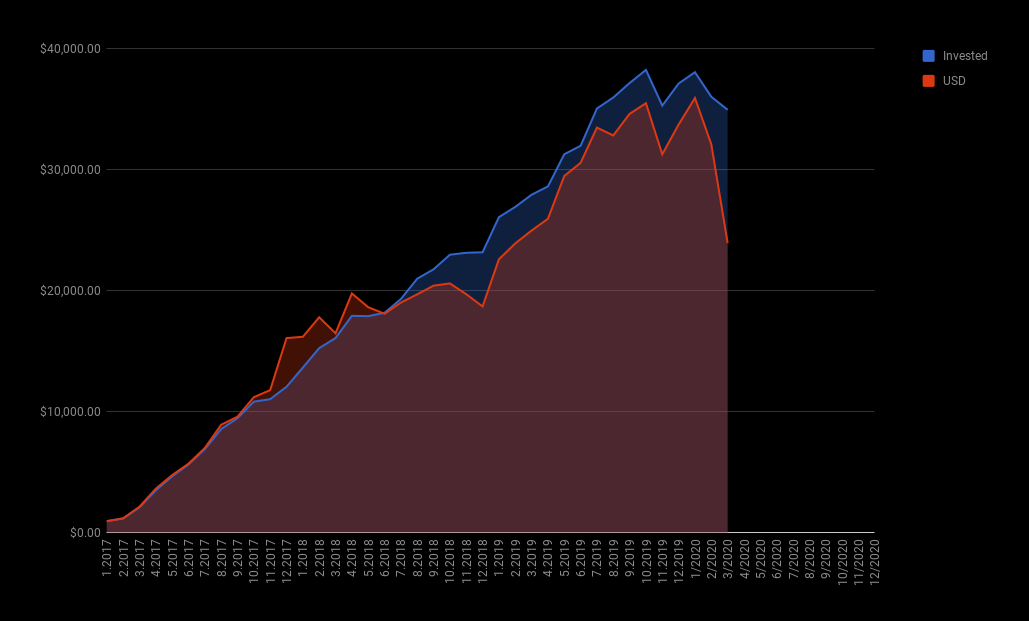

Portfolio value as of March 12, 2020

By March 12, 2020, my total portfolio has lost in value by more than 30%. 30% in 12 days. What a speed.

If counted from my portfolios all-time high at the end of January the drop is even more bearish 37.95% drop. Now these drops are quite Okay for crypto investments but with the stock market, hell this asks a lot of nerves

Entering Negative Value For Ethereum Investment - Crypto Bear Market 2018

For me problems started with my plan buying PFE shares once in a month for my partner, using the so-called wheel strategy. Selling naked puts ask cash locked on margin. About a month ago I took a larger assignment of CSCO stocks and my account balance turned negative, as I was buying on margin. My balance turned to a negative EUR 5,000 which I was able to reduce down to -EUR 3,500 by March 12, 2020, but as the market kept falling with 7% daily I quickly faced liquidity issues

Here is the long story short:

On March 12, 2020, I faced a margin call and the broker closed my positions (with a huge loss) to take my account balance back to positive. As these stocks are a cornerstone strategy for my dividend income, it didn't feel Okay taking an impressive dividend loss.

Here is what was sold:

- Sold 60 RA for $14.85 per share (loss $468.25) / yearly dividend loss $121.80

- Sold 206 PNNT for $3.90 per share (loss $740.07) / yearly dividend loss $126.07

- Sold 17 CSCO for $33.97 per share (loss $233.26) / yearly dividend loss $20.74

- Sold 100 PBCT for $11.38 per share (loss $504.96) / yearly dividend loss $60.30

- Sold 244 XIN for $2.54 per share (loss $506.83) / yearly dividend loss $78.44

- Sold 15 PFE for $30.40 per share (loss $138.72) / yearly dividend loss $19.35

Total sold shares worth $4,494.65

Total loss after sell: $2,592.19 / dividend loss $426.7

After selling these stocks my account balance was brought back to positive and I decided to close some of the suffering options to buyback and increase positions from lost shares

Here is what I bought:

- Bought 100 RA for $15.42 per share / yearly dividend $203.00

- Bought 24 PFE for $30.96 per share / yearly dividend $30.96

- Bought 147 NRZ for $11.28 per share / yearly dividend $243.1

- Bought 100 ET for $6.55 per share / yearly dividend $76.8

- Bought 100 PEI for $1.05 per share / yearly dividend $71.4

Total spend $4,703 / yearly dividend $625.26

To free up some buying power I additionally deposited EUR 700 and closed put option on PFE, took a loss here $542.80

Additionally, I closed with a loss options trades on SPX and Gold futures, took a loss here $894.60. I don't plan to trade options on indexes or futures. The risk is not worth it.

My dividend income for the rest of the year before the margin call was $2,449.38, which lacks behind my goal for $3,600 in 2020

After I bought back and increased some positions my planned dividend income for the rest of the year raised to $2,594.71, that's a growth of $145. Awesome

With markets recovering I believe I will be able to gain big from today's buys + increased dividend will help to get closer to my yearly dividend income goals ($3,600 for 2020)

My real loss today comes from options trades, in total I lost $1,437 here. Unlike in my previous experience with bad managed options trade when I lost about $5,000 I wouldn't say these were bad managed trades. I just faced margin call and wanted to use cheap stock prices fro future growth. Will I turn right, time will show.