Investments

I write about my investor experience by investing in dividend-paying stocks, options trading, cryptocurrencies, peer-to-peer lending, stock IPO's and more. Currently on the road to save 1 million dollars by 2045. Check out my freemium newsletter for investing with covered calls

Capturing Contango with Gold Futures Spread

| 7 viewsOn September 21, 2023, I bought 1 October 27, 2023 expiry long Gold futures contract at 1,919.30 and sold 1 November 28, 2023 expiry short Gold futures contract at 1928.4. The difference between both legs is -9.1. To make any profit the spreads of the legs should be less than -9.1 by October 27, 2023. I have been observing Gold Futres for most of September and in fact, I already opened one such trade in my other stock portfolio, but the reason to open this particular trade comes as a push…

Capturing Bitcoin Contango Trade with Perpetual Futures

| 9 viewsThere are several ways to trade and invest with cryptocurrencies. During the several years since I've been exposed to the crypto market, I have learned quite a lot. Starting simple buy and hold, margin trading, lending, short selling, crypto options, crypto futures, and more. In today's article, I will share some lesser-known, market-neutral, and almost zero risk trade, we use at Terramatris crypto hedge fund to grow our portfolio. Meet - The Contango trade. What is the Contango? Contango is…

#5 Coin of the Week: Stellar XLM

| 3 viewsSince the end of August 2023, I've been working on the Terramatris crypto hedge fund, growing the portfolio from scratch by selling put options on Ethereum. Every week we choose one crypto coin and invest all premium in it. In the last weeks, we have already invested in XLM, ETH, USDC, and BTC. I have decided to stick with these 4 tickers until we grow the portfolio to at least 0.1 ETH or 0.01 BTC, thus enabling covered call writing on these positions. That said on week 5th, we return to XLM…

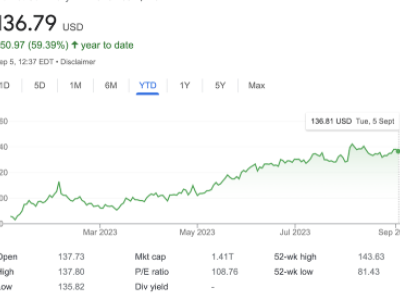

Latest Addition to Stock Portfolio: 2 AMZN shares at $136.60

| 5 viewsOn September 5, 2023, I bought an additional 2 shares of Amazon (NASDAQ: AMZN) stock, paying $138.50 per share for our long-term dividend stock portfolio. Amazon.com, Inc. is an American multinational technology company focusing on e-commerce, cloud computing, online advertising, digital streaming, and artificial intelligence. We are now holding 38 shares of AMZN in our stock portfolio. That represents about 68.5% of the total portfolio. Using dollar-cost averaging our average cost per AMZN…

#4 Coin of the Week: BTC (Bitcoin)

| 3 viewsSince the end of August 2023, I've been working on the Terramatris crypto hedge fund, growing the portfolio from scratch by selling put options on Ethereum. Every week we choose one crypto coin and invest all premium in it. In the last weeks, we have already invested in XLM, ETH and USDC For the fourth week - we have decided to go with Bitcoin, the king of all coins. Every time we are going to take options premiums this week (September 11 - September 17), we will re-invest the premium back…

Latest Addition to Stock Portfolio: 4 MPW shares at $7.05

| 6 viewsOn September 6, 2023, I bought an additional 4 shares of Medical Properties Trust Inc (NYSE: MPW) stock, paying $7.05 per share for our long-term dividend stock portfolio. Medical Properties Trust, Inc., based in Birmingham, Alabama, is a real estate investment trust that invests in healthcare facilities subject to NNN leases. The company owns 438 properties in the United States, Australia, Colombia, Germany, Italy, Portugal, Spain, Switzerland, Finland, and the United Kingdom. We are now…

Bought 2 WBA shares at $24.31

| 3 viewsOn September 1, 2023, I bought an additional 2 shares of Walgreens Boots Alliance Inc (NASDAQ: WBA) stock, paying $24.31 per share for our long-term stock portfolio Walgreens Boots Alliance, Inc. is an American multinational holding company headquartered in Deerfield, Illinois, which owns the retail pharmacy chains Walgreens in the US and Boots in the UK, as well as several pharmaceutical manufacturing and distribution companies. We are now holding 4 shares of WBA in our dividend stock…

August 2023 Dividend Income Report - $1.97

| 3 viewsWelcome to the sixty-second (#62) dividend income report, covering earnings our family has made from dividend-paying stocks in August 2023. Last month I turned 38, and we made a quick trip to London, United Kingdom to celebrate it. Besides fish and chips, we tried some of the most delicious ciders and spent quality time with family there. Kiddo was especially excited about spending a day at London's Kidzania. Besides our travels in August, we also finished most of the exterior works for our…

#3 Coin of the Week: USD Coin (USDC)

| 5 viewsSince the end of August 2023, I've been working on the Terramatris crypto hedge fund, growing the portfolio from put option premiums sold on Ethereum. Every week we choose one crypto coin and invest all premium in it. In the last weeks, we have invested in XLM and ETH. For the third week - we go with the USD Coin (USDC). Every time we are going to take options premiums this week (September 4 - September 10), we will re-invest the premium back in USDC coin for our long-term crypto portfolio…

Bought 1 DIS share at $82.68

| 3 viewsOn August 24, 2023, I bought an additional 1 share of Walt Disney Co (NYSE: DIS) stock, paying $82.68 per share for our long-term stock portfolio The Walt Disney Company, commonly known as Disney, is an American multinational mass media and entertainment conglomerate that is headquartered at the Walt Disney Studios complex in Burbank, California. We are now holding 2 shares of DIS in our stock portfolio. Unlike most of the other stocks from our portfolio, DIS is not a dividend payer, and…