Tail Risk in Crypto: How a “Safe” 1 DTE Bitcoin Put Nearly Went Wrong

| Crypto | 16 seen

At the start of February, I capitulated. Ethereum had pushed our structure into a place I didn’t like. Too many moving parts. Too much sensitivity to short-term price swings. Too much reliance on margin. I made a decision to reset the strategy…

At the start of February, I capitulated. Ethereum had pushed our structure into a place I didn’t like. Too many moving parts. Too much sensitivity to short-term price swings. Too much reliance on margin. I made a decision to reset the strategy…

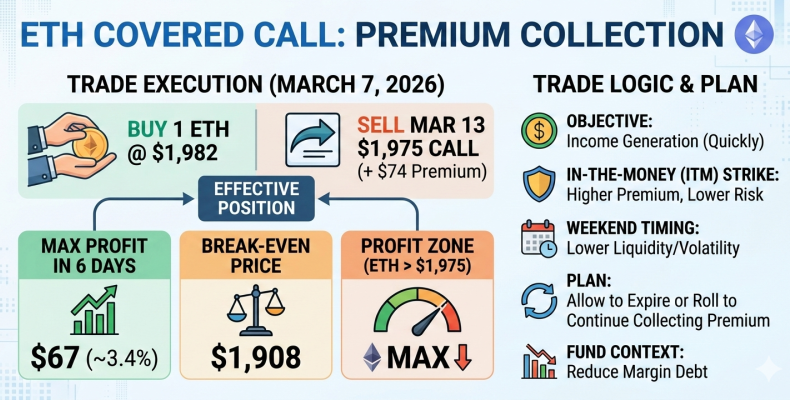

Ethereum Covered Call: Turning 1 ETH Into 3.4% Yield in 6 Days

| Crypto | 29 seen

On March 7, 2026, I opened a short-duration buy-write covered call position on Ethereum. The trade was structured primarily for premium collection, not for capital appreciation.I bought 1 ETH at $1,982 and simultaneously sold a March 13 call option…

On March 7, 2026, I opened a short-duration buy-write covered call position on Ethereum. The trade was structured primarily for premium collection, not for capital appreciation.I bought 1 ETH at $1,982 and simultaneously sold a March 13 call option…

Week 48 / NVDA, PFE Put Roll Brings $99 Options Income

| | 30 seen

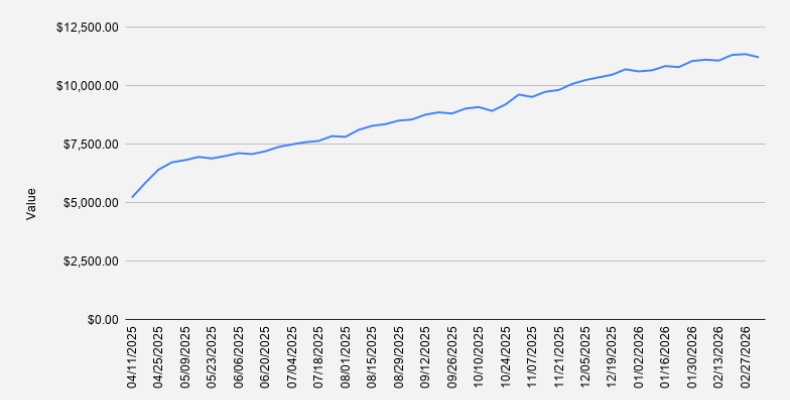

As of March 6, 2026, our covered-call stock portfolio has decreased slightly by -1.16% and closed at $11,211. As our portfolio’s base currency is EUR, the decrease should primarily be attributed to the USD/EUR exchange rate. The greenback…

As of March 6, 2026, our covered-call stock portfolio has decreased slightly by -1.16% and closed at $11,211. As our portfolio’s base currency is EUR, the decrease should primarily be attributed to the USD/EUR exchange rate. The greenback…

I Won’t Sell Ethereum Before It Reaches $10,000

| Crypto | 36 seen

Ethereum has been one of the most important investments in my crypto journey. I started accumulating ETH years ago, held it through multiple cycles, and even at some point I was holding about 12 ETH. Over time I sold portions at different prices.…

Ethereum has been one of the most important investments in my crypto journey. I started accumulating ETH years ago, held it through multiple cycles, and even at some point I was holding about 12 ETH. Over time I sold portions at different prices.…

Magalaant Church Complex

| Churches and Monasteries | 27 seen

I first discovered the Magalaant Church Complex a few years ago during one of our spontaneous road trips to Kavtiskhevi. No fixed plan, no strict itinerary - just a turn off the main road and the usual curiosity about what might be hiding on the…

I first discovered the Magalaant Church Complex a few years ago during one of our spontaneous road trips to Kavtiskhevi. No fixed plan, no strict itinerary - just a turn off the main road and the usual curiosity about what might be hiding on the…

Week 47 / NVDA Post-Earnings Pullback: Covered Call Roll Adds $560 in Potential Income

| | 82 seen

As of February 27, 2026, our covered-call stock portfolio has increased slightly by +0.27% and closed at $11,343. Last week was NVDA earnings week, and the stock moved the market more than expected.Earlier in the week, I decided to proactively…

As of February 27, 2026, our covered-call stock portfolio has increased slightly by +0.27% and closed at $11,343. Last week was NVDA earnings week, and the stock moved the market more than expected.Earlier in the week, I decided to proactively…

How to make Adjarian Khachapuri at Home

| Food blogger | 38 seen

Today we finally got it right — real Adjarian khachapuri at home. This was my second attempt. The first time I made the classic mistake: I thought regular cheese would work. It didn’t. The texture was wrong, the melt was wrong, and the flavor was…

Today we finally got it right — real Adjarian khachapuri at home. This was my second attempt. The first time I made the classic mistake: I thought regular cheese would work. It didn’t. The texture was wrong, the melt was wrong, and the flavor was…

Lemon Tree Premier, Malad Mumbai – Decent Stay, But Know What You’re Booking

| Hotel reviews | 19 seen

At the start of 2026, we spent 2–3 nights at Lemon Tree Premier, Malad, Mumbai while returning from Goa to Tbilisi, with a stopover in Mumbai.We were looking for a practical option rather than a luxury experience. The price made the decision easy:…

At the start of 2026, we spent 2–3 nights at Lemon Tree Premier, Malad, Mumbai while returning from Goa to Tbilisi, with a stopover in Mumbai.We were looking for a practical option rather than a luxury experience. The price made the decision easy:…

week 46 / From PFE Roll to NVDA Earnings: Covered Call Portfolio Now at $11,312

| | 102 seen

As of February 20, 2026, our covered-call stock portfolio has increased by +2.20% and closed at $11,312. Growth remained intact, even after rolling PFE forward and down.For most of the week, my focus was on NVDA, but in the end I had to adjust…

As of February 20, 2026, our covered-call stock portfolio has increased by +2.20% and closed at $11,312. Growth remained intact, even after rolling PFE forward and down.For most of the week, my focus was on NVDA, but in the end I had to adjust…

Leverage Is Not a Strategy: A Conversation About XRP, HBAR, XDC and Tail Risk

| Crypto | 19 seen

Recently, an investor friend Rob reached out with a familiar question:“Can I add XDC and HBAR to my portfolio? Prices look cheap.”On the surface, this sounds reasonable. Markets were consolidating. Sentiment was mixed. Some high-utility tokens were…

Recently, an investor friend Rob reached out with a familiar question:“Can I add XDC and HBAR to my portfolio? Prices look cheap.”On the surface, this sounds reasonable. Markets were consolidating. Sentiment was mixed. Some high-utility tokens were…

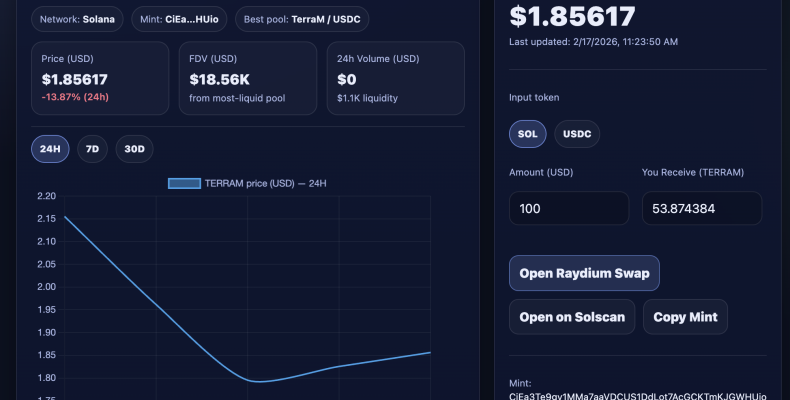

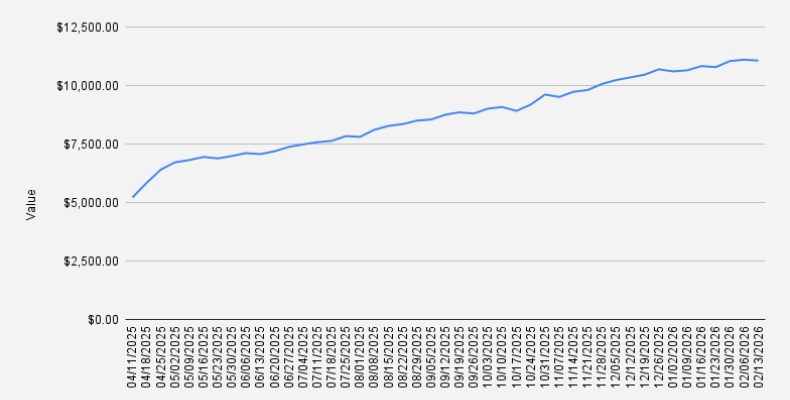

How TerraM Plans to Reach a $100,000 Fully Diluted Valuation

| Crypto | 32 seen

TerraM token was launched with a simple structure: 10,000 tokens in existence and a disciplined, performance-driven capital strategy. Today, with the token trading at 1.85 USDC, the fully diluted valuation (FDV) stands at 18,500 USDCThat is far…

TerraM token was launched with a simple structure: 10,000 tokens in existence and a disciplined, performance-driven capital strategy. Today, with the token trading at 1.85 USDC, the fully diluted valuation (FDV) stands at 18,500 USDCThat is far…

What Are the Main Challenges Running a Solana Covered Calls Growth Portfolio?

| Crypto | 24 seen

Solana covered calls sound straightforward: hold SOL, sell calls, collect premium, compound. Back in September 2025 we launched Solana strategy at Terramatris crypto hedge fund, mostly focused on buy/write operationsMmost of the usual “covered call…

Solana covered calls sound straightforward: hold SOL, sell calls, collect premium, compound. Back in September 2025 we launched Solana strategy at Terramatris crypto hedge fund, mostly focused on buy/write operationsMmost of the usual “covered call…

Week 45 / Using Cash-Secured Puts to Accumulate Pfizer (PFE) Shares

| | 136 seen

As of February 13, 2026, our covered-call stock portfolio has decreased slightly by -0.33% and closed at $11,069. Since I couldn’t continue with weekly NVDA spread trades — having already rolled them out to the February 27 expiry — I focused…

As of February 13, 2026, our covered-call stock portfolio has decreased slightly by -0.33% and closed at $11,069. Since I couldn’t continue with weekly NVDA spread trades — having already rolled them out to the February 27 expiry — I focused…

Why I Added Pfizer (PFE) Back to My Portfolio

| Stock Portfolio | 34 seen

Pfizer (PFE) is not a new name in my investing history. I was investing in PFE well before Covid, with fairly high expectations for the stock as a stable pharmaceutical blue-chip with strong cash flows and a reliable dividend profile. During the…

Pfizer (PFE) is not a new name in my investing history. I was investing in PFE well before Covid, with fairly high expectations for the stock as a stable pharmaceutical blue-chip with strong cash flows and a reliable dividend profile. During the…

Why Invest in MicroStrategy (MSTR) When You Can Buy Bitcoin Directly?

| Crypto | 28 seen

Like everyone in crypto should have heard about MicroStrategy by now. It’s impossible to miss it — Michael Saylor, massive debt issuance, billions in Bitcoin on the balance sheet, and MSTR trading like a leveraged BTC ticker. But what has always…

Like everyone in crypto should have heard about MicroStrategy by now. It’s impossible to miss it — Michael Saylor, massive debt issuance, billions in Bitcoin on the balance sheet, and MSTR trading like a leveraged BTC ticker. But what has always…