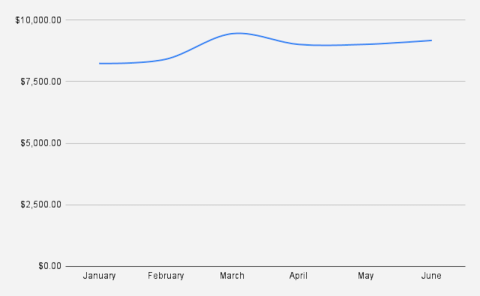

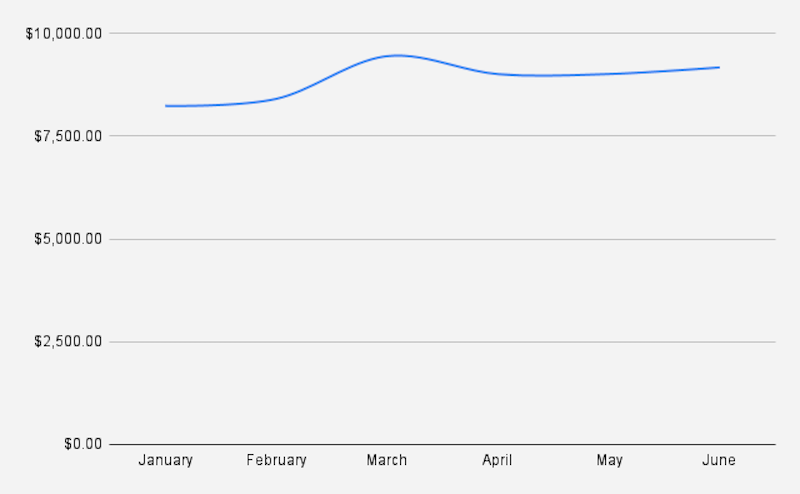

At the end of June 2024, the total value of our stock portfolio was USD 9,173 (EUR 8,431). What is a small, but increase of EUR 226, if compared to the previous month

Most of the June we spent in Georgia, enjoying Summer, taking part in trail runs, while at the end of June we traveled to Latvia to work with our frame house, did some good job, installing outdoor patio, wiring, and even installing drywall.

The increase in the stock portfolio comes from the market appreciation itself and additionally from options trades, while small part of the growth can be attributed to the dividends.

One of my short-term goals is to grow our portfolio to USD 10,000. With USD 827 to go, I believe this target is achievable in the next few months through a combination of selling options and stock appreciation.

The main longer-term goal for our portfolio is to grow it to 100 fully covered Morgan Stanley (MS) shares, supported by an additional 100 British Petroleum (BP) shares. This strategy will enable us to sell covered calls on these shares while also benefiting from dividend payments.

Stock Portfolio

Year to Date (YTD) our stock portfolio was up + 11.37% at the end of June, which ir more or less the same as SP 500.

I have made a few investing mistakes in the past months, which have been costly, and if not those mistakes, our portfolio definitely would be already over $10,000, but what can I do. Just make better, edicated trading decissions in the future.

Options trades

We actively sell weekly put options on MS and BP, reinvesting the premiums back into stocks. Besides these two, in the month of June was selling options on few other tickers, like PM, TEVA and more.

I keep a separate newsletter for my stocks buys and options trades, make sure to check it out if you are intersested to learn more, subscribe at OptionsBrew.com

Dividend income

Our current yearly dividend from the portfolio stands at USD 165.5, yielding 3.99%.

While this is not yet enough to retire comfortably, it is a solid foundation upon which we can build. In the month of June we managed to add about $13 of dividend to our portfolio.

I believe by the end of the year we should be able to push our dividend portfolio to $200/yearly

Plans for July 2024

For the month of July, we are looking to invest with options, while reinvesting premiums in MS, JNJ, MPW, TEVA, PM and maybe some other ticker.

How was your investments performing in the month of June? Leave a comment!