I'm 34 years old now and I have a goal to save one million dollars by the time I will turn 60. Just 26 years to go. I've been documenting my journey towards financial independence for the last three years already.

In today's article, I will review the past year of 2019 and take a quick glimpse at the New Year of 2020.

Make sure to check out previous yearly review articles here:

In 2019 I made a huge shift from a focus on peer to peer lending and cryptocurrencies to option trades..For now, I can surely tell - options trading is the best thing I have discovered in 2019.

Naked puts on dividend stocks I would like to hold forever; covered calls and vertical spreads on SPX (SP 500 index) and GC (gold futures).

I was introduced to the options world from a fellow Italian investor/trader Massimo, who I first met at the start of January in Tbilisi, we have been in close contact ever since. Last time we met in person in Milan, Italy at the end of 2019 at the lovely family-run Osteria. Guess what we talked about? Verticals, iron condors, straddles, call bears, put bulls, ratio back spreads, you name it.

Massimo! If you are reading this - Ciao to you!

Options trading is like a game of chess. It's a strategy. And you can earn quite good money if you master the game.

You can lose even greater amount though. As they say, it eats like a sparrow, but shi*ts like an elephant. So did happened to me, when in November I lost more than $5,000 from bad managed options trades.

Investment Goal #7 - Selling Puts to Own / Generate Income

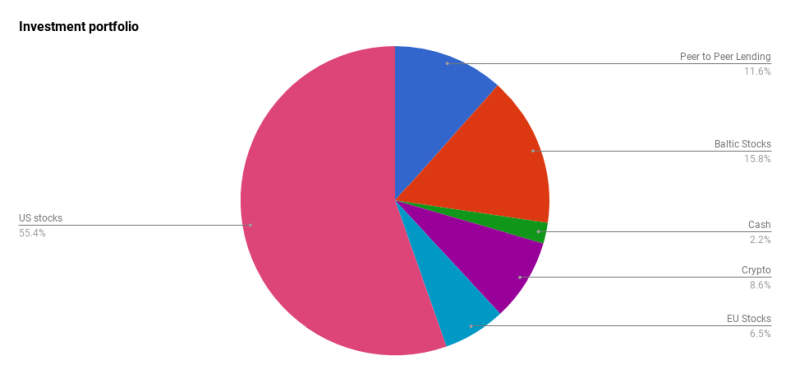

Structure of Investment portfolio

Structure of the investment portfolio at the end of 2019

Investments in stocks take the biggest share from the pie. Combined value from US stocks (55.4%), Baltic stocks (15.8%) and other European stocks (6.5%) in total makes 77.7% from my investment portfolio. The rest is left for peer to peer lending (11.6%), Crypto (8.6%) and some little cash waiting to be deployed (2.2%)

In 2019 I was focusing solely on the US stock market. To increase my investments there I sold off some of my Baltic stocks and decreased stake with peer to peer lending. This is the trend I'm looking to continue in 2020 as well.

At the start of 2019, I planned to invest about 53% from my annual net income (money I made in 2018), the planned amount for 2019 was $11,871.70, I managed to invest some $2,000 more ($13,936.62) by the end of the year. I exceeded my initial plan by $2,064.92 In 2019, on average I was investing at the pace of $1,161/mo. In 2018 the ratio was $922/mo, while back in 2017 ($1,000).

That's the growth I like. I should note that the real boost to the portfolio comes from the options trades, which helped to make about $10,000 gross.

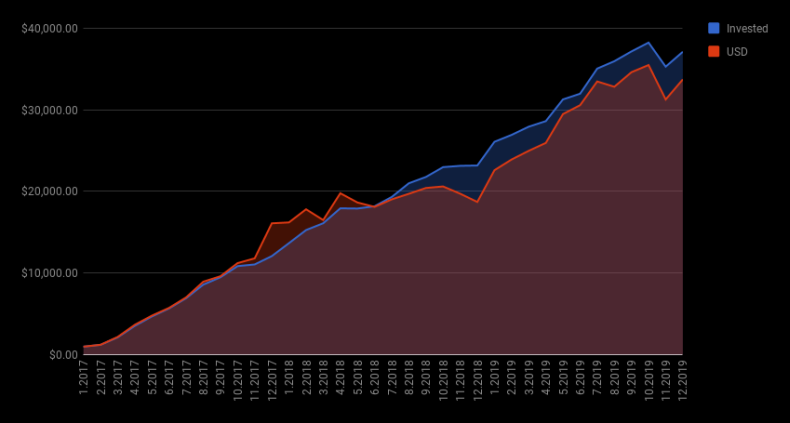

Net Worth value

Net Worth value at the end of 2019

At the end of 2019, my total net worth was $33,712.35, while the highest recorded net worth was at the end of October 2019 - $35,475.40, but the come the November and I was hit by bad managed options trades and took a big loss. Luckily I almost recovered by the end of the year.

Also, I should note that the difference from Invested and the end Value at the end of 2019 was negative -$3,387.52 if counted since the inception in 2017.

In other words - the value growth since inception has been negative -9,13%, while year to date value growth rate was positive +2,95%

I have been into this negative territory since June 2018. By the middle of 2019 almost recovered and then again dropped a bit.

Now, the good news - In 2019 dividend yield (on cost) for my investment portfolio was 6.88% (6.30% in 2018; 5.50% in 2017), here is the breakdown by positions

- Mintos.com peer to peer lending: EUR 575.35 (yield 14.78%)*

- Nasdaq Baltics: EUR 404.49 (yield 7.19%)*

- EU stocks: EUR 264.47 (yield 12.82%)*

- US stocks: EUR 1064.60 (yield 5.71%)**

- Poloniex.com crypto lending: EUR 12.17 (yield 0.43%)***

Now, in total in dividend income for 2019 I received €2,321.04 / $2,590.95)

*during the year I have made several withdrawals from Nasdaq Baltics, Mintos and EU stocks, that's the reason why yield might look so hight at the first sight.

** In the case with US stocks I mostly invest in high yield stocks and ETF's but as I invest very active, the yield is lower as the capital hasn't accumulated yet.

*** I completely withdraw from crypto lending in 2019, Instead, I trade options with Bitcoin and Ethereum

In general, it means that in a true passive income I made $7.10 daily, by doing nothing much, just keeping stake at great companies and lending out money via peer to peer platforms. On the other hand, I can spend about an hour a day to research, analyze, make future decisions.

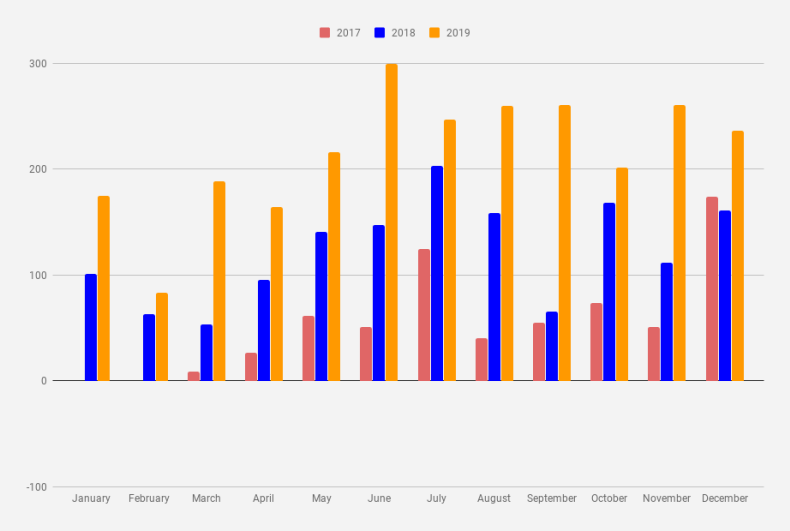

Dividend income 2017-2019

In three years, since 2017, the portfolio has earned pretty decent $4,722.05 dividend ($664 in 2017; $1.466.83 in 2018; $2,590.95 in 2019)

When looking at TTM (trailing twelve months) at the start of 2020 I can already see a TTM at $2,637.71 for 2020.

Speaking of what:

Financial goals for 2020

This is probably my favorite part of these income type series blog posts - forecasts/ goals. Before setting financial goals for 2020, let's see what I said for this year:

I'm looking to invest 53% (my age + 10%) from income I've made in 2018, that's about $11,871.70.

Also, I would love to keep at least 5% in cash.

For 2019 I'm looking on a minimum $2,045 annual dividend income (about $170/mo or $5.60 daily)

I'm looking to reach net worth value $30,000 by the end of 2019.

I reached most of my goals, except I run short with a 5% cash goal (at the end of 2019 it was just 2.2%) but overall - wow, what an amazing year. Reaching most of my goals feels awesome.

For 2020 I'm looking to invest 54% (my age + 20%) from income I've made in 2019, that's about $16,313.79. Investing more than $16K a year would ask to invest at a rate of $1,333/mo - it might look hard but is doable. I believe most can be achieved using dividend income + income from options trades.

For 2020 I have a minimum $3,600 annual dividend income (about $300/mo or $9.86 daily) Also I'm looking to generate a minimum $6,400 from options trades

I'm looking to reach a net worth value of $50,000 by the end of 2020.

Last, but not least - income generated form dividend income + options trading + options trading on crypto helped me to generate about $10,000 or a 29.79% yield in 2019. I'm looking to have at least 30% yield in 2020