Options trading

Why I Don’t Like Selling Credit Spreads Without Owning the Underlying Asset

| 90 viewsCredit spreads are popular for a reason. They look elegant on paper: defined risk, high probability, steady income. I trade them myself - regularly. But over the years, one conviction has…

Road to a $25,000 Stock Portfolio with Options Trading

| 123 viewsWith the new year of 2026 fast approaching, I’ve decided to start another challenge.This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not…

Why I Stopped Selling Put Options on Micro Gold Futures (MGC)

| 28 viewsAs a seasoned trader and CEO of Terramatris crypto hedge fund, I have explored various trading strategies over the years. One strategy I have experimented with is selling put options on Micro gold…

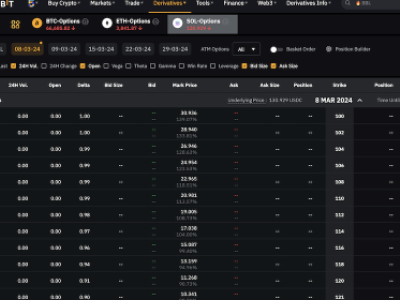

How To Sell Covered Calls with Solana on ByBit

| 328 viewsByBit is my new favorite crypto trading platform, I switched from Deribit to ByBit around August 2023, with the launch of TerraMatris crypto hedge fund. I like trading on Bybit because, unlike…

Invest in These 5 Stocks From The Dow Jones list With Covered Calls and Collect Dividend

| 26 viewsOne of my preferred investing strategies is investing in stocks from The Dogs of The Dow List. Currently (2021), these are the Small Dogs of The Dow stocks: DOW, VZ, WBA, CSCO, and KO.In…

Investing With Covered Calls in Dow Inc. 365 days challenge / 8 year blog anniversary

| 37 viewsHere at ReinisFischer.com I love challenges, whether they are about blogging, learning new skills, or financial oriented.As my blog is turning 8 years old on October 10, 2021, I decided to launch…

7 Dividend Stocks To accumulate while selling Put options for extra income

| 114 viewsIn today's article, I'm going to talk about 7 dividend stocks I don't mind having in my portfolio and how I'm generating additional semi-passive income by selling put options (or credit spreads) on…

Invest in The Small Dogs of The Dow with Covered Calls and Collect Dividend

| 33 viewsThe Small Dogs of the Dow, are the five lowest-priced Dogs of the Dow stocks. Currently (2020), these are the Small Dogs of The Dow stocks: DOW, PFE, WBA, CSCO and KOIn today's article, I will take a…

3 Trades to Generate $200/mo Selling Naked Puts on Dividend Stocks

| 56 viewsSelling naked puts on dividend stocks is one of my favorite income-generating strategies. I've been selling options since the end of March 2019, and as a seasoned dividend income investor, I…

What Happens to Options While Stock is Doing Reverse Split

| 150 viewsStock splits are not rare, they happen quite often. In this article, I'm going to try to shed some light on what happens to options when stock is doing a reverse split.Subscribe to the…

Surviving Bear Market - Margin Call

| 36 viewsI once read that an investor can call himself a pro after he/she has survived at least 3 bear markets. I just survived one. At least I hope so.In fact, from my short active investor's career, I…

0 DTE SPX Trading Challenge

| 56 viewsI've been trading options since March 2019, I have been trading verticals since September 2019. Option trading is not easy, it can hurt. Money can be made and more money can be lost - been there seen…

Tesla Stock Project

| 50 viewsIt was on early November 5th, 2019 morning, I was reading an interesting story about a guy buying a Tesla car for his sons 9th birthday, here is the story in brief: What is #TSLA4Tesla project…

My First Iron Condor Trade - Lessons Learned

| 42 viewsThis article has been in the blog's draft section for a couple of months and as it still bears some useful information I decided to publish as it is with little comments at the end.On August 13, 2019…

My First Option Trade: FTR Aug16'19 2 Put @0.45

| 45 viewsNow, this is exciting - in the late evening of March 28th, 2019 (GMT) I made my first options trade (s).To get to this point it took me a couple of months and a lot of reading, talking and…