Welcome to the twenty-eight (#28) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in August 2019.

Last August, I turned 34. For this years birthday celebrations, we traveled to Baku, Azerbaijan and had some really good time there.

Fairmont Baku hotel at Flame Towers (Read my review here)

As I've reached the age of 34, starting the next year I will put aside at least 54% from my yearly income. Here is the formula = my age + 20 = 54%. I'm raising this number every year.

Now, the last August was very good and even had a surprise dividend from Silvano Fashion Group. At the end of the month, I have collected $259.58 -what is about $100 more I was looking to get this month.

Disclosure: This article contains affiliate links to mintos.com peer to peer lending and deribit.com options trading websites, by clicking on links on this page and by making investment mintos.com or derbit.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Sign up for Mintos.com here. By using my affiliate link for registration both you and I will receive — 1% of our average daily balance which should be paid in 3 installments for the first 90 days.

Additional $955.00 were made from options trading, but as options trading is not actually a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income report. Also, there were many roll forwards last month.

Last but not least, last August I traded options on cryptocurrencies using Deribit platform, which resulted in + 1.22 ETH ($206.93) and + 0.037 BTC ($353.94). In total $560.87

When counted all together (dividends + options + crypto options), it seems I have made $1,775.45 in total last month. Wow.

Last month, income from dividends + options + crypto options helped to generate a 5.41% yield from the total value of the portfolio. That's about 64.92% annually.

Market Sentiment

Before diving in the details of interest received, I would like to introduce a new section - Market Sentiment

Last August was a month of tweets, China-US trade war, G7 summit in France.

Because of the treats to put on additional tariffs on Chinese goods - my broker account for the first time experienced a margin call. In fact, it did so almost twice - at first at the start of the month, while I was on a trip in Azerbaijan, luckily I managed to pour in additional funds in my brokerage account to prevent a margin call, and second at the end of the month. In total 8 shares of CODI were sold to return my portfolio back to a positive balance. Not a huge loss, but still hurts.

Anyway right now I have more than $20,000 put on Margin (for option trades) which is way more than I can actually afford and in the coming months I plan to decrease the margin down to 70% from my total stock portfolio, see: Investment Goal #8 - Limiting Margin to Max 80% from Stock Portfolio for Options Trades

S&P 500 Index chart August 2019

Uhh, what a roller coaster we had last month (I should note that I don't care much about S&P 500 as a dividend investor, it concerns me as an options trader).

S&P 500 was in the range from high $2,938 to low $2,840

Interest income in August 2019

From the stocks and Mintos.com peer to peer lending I got following income last month:

Ticker | Earnings |

€49.33 | |

BGLF | €48.00 |

FGB | €40.79 |

SFG1T | €23.40 |

ETF | €17.56 |

NHCBHFFT | €15.60 |

EDF | €13.99 |

EDI | €11.74 |

CLM | €5.58 |

RA | €4.32 |

NCV | €3.88 |

AWP | €3.11 |

Total: EUR 235.98 / USD 259.58

In total there were 12 great companies paying us dividends in August, that's 6 companies more than in August 2019

Mintos has regained the first place in terms of interest income generated

Mintos.com Review After 24 Month of Investing in Peer to Peer Lending

The YoY growth rate for my dividend income in August 2019 was + 63.87% or $101.27 more than a year ago in August 2018. That's the growth rate I really like.

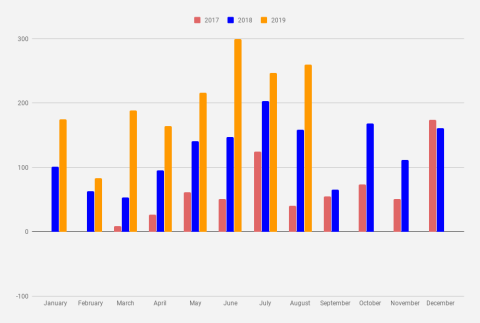

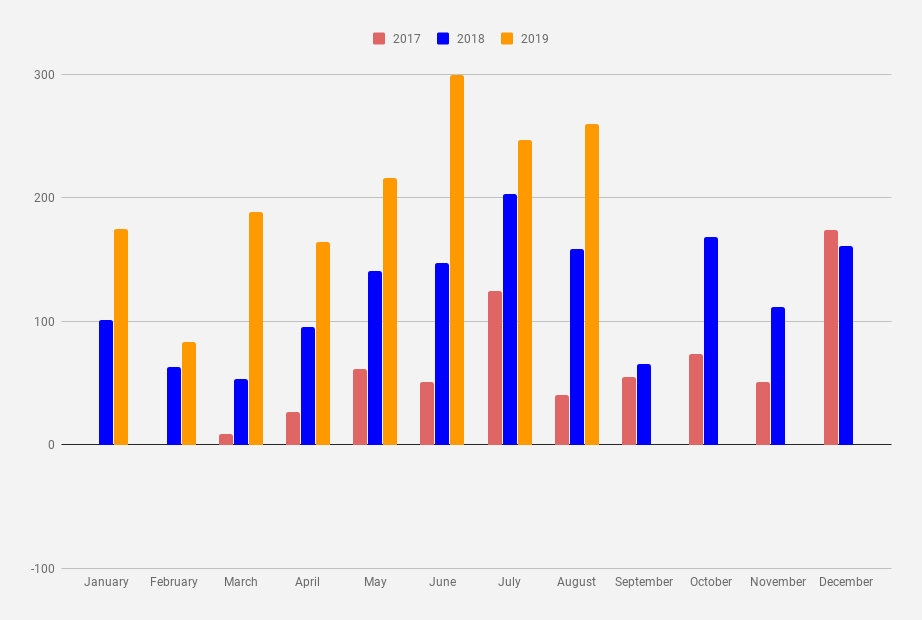

Monthly income

My journey towards million dollars in savings account now is more than 2 and a half years old. The result, so far, looks quite good. Dividends are growing.

Monthly Income chart as of August 2019

The cumulative earnings for 2019 now are $1,632.88 which is exactly 79.85% from my goal of 2019 ($2,045). On average, it would ask me to generate $103.03 every month for the next 4 months to reach my goal. Looks very easy.

It's fun to note that last August the cumulative dividend income of 2019 surpassed the income I made in 2018 ($1466.83)

2018 in Review and Financial Goals for 2019

Goals for August 2020

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (August 2018)

Now, when speaking about August 2019 - I will set a humble goal to crack $160. Shouldn't be problematic with adding more US monthly and quarterly dividend-paying stocks.

Wow, not only I reached $160, but I almost surpassed it by another $100. Awesome. As noted last year, because I have added more US stocks it was not a problem to reach this goal at all.

When setting goals for August 2020 - I will be quite optimistic - I'm looking to crack $400. I hope to get there with more US monthly and quarterly stocks and also might use dividend capture strategy