Time flies and so did last February disappeared like a flicker. Now it's time to look back and see how did it go for me in terms of dividend income.

February marks already the tenth (#10) dividend income report, covering earnings I've made from dividend-paying stocks, peer to peer lending (both fiat and cryptocurrencies)

Surprisingly, but February turned out much better than I thought before - after a few e-mail and support tickets forth and back with bank and fund I was looking to have in my portfolio since August 2017, I finally managed to add this fund to my portfolio. The fund dividends helped to boost a little bit dividend income in February, and I was able to generate $62.89 income in a very passive way. Hopefully, this fund will contribute also in May, August, and November.

I'm speaking about Baltic Horizon Fund - and there is one bold reason I like this fund, quarterly dividend payments (at least in 2017, and hopefully in 2018), the yield is around 7-9%, which is among the highest yields in the Nasdaq Baltics, on the other hand ,Baltic Horizon Fund is kind of like the first REIT in the Baltic's and shouldn't be viewed as a dividend stock. But I will. Because that's what it's doing - paying a fat 7-9% yield (or at least that's what the fund did in the past).

Learn more: Why I'm Investing in Baltic Horizon Fund (NHCBHFFT)

As usual, I was doing nothing much, just investing in great companies, playing a little bit with cryptocurrencies and lending out money via peer to peer marketplace. Most of the February was on autopilot, just at the start of the month I deposited some chunk of money to Mintos.com peer to peer lending marketplace, bought Silvano Fashion Group, OlainFarm and Baltic Horizon Fund stocks at Nasdaq Baltics.

Additionally I continued to experiment with cryptocurrency mining, with my custom built ethereum mining rig, and investing in Hashflare.io cloud mining contracts, but for right now these mining operations don't fits in my philosophy of a true passive income, I'm not planning to add earnings made in crypto mining to these monthly dividend income reports. On the other hand, in February cryptocurrency mining operations made me about $4.35 daily if combined and I want more, way more.

Please note - I'm not a financial advisor, services mentioned in this article use at your own risk and remember your capital is at risk, you could lose some or all of your money.

The lions share for the earnings in February comes from the Mintos.com peer to peer lending operations.

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos. At the moment, US citizens or taxpayers cannot register as investors at Mintos.

Affiliate link here: Sign up to Mintos.com here. By using this affiliate link for registration both you and I will receive — 1% of your average daily balance which should be paid in 3 installments for the first 90 days.

Remember - investments are risky, never invest more you can afford to lose.

Interest income in February 2018

From investments in stocks, peer to peer lending marketplace Mintos.com and from cryptocurrency lending on Poloniex.com I got following income last month:

- Baltic Horizon Fund: EUR 5.17

- Mintos.com: EUR 44.43

- Poloniex.com: EUR 1.59

Total: EUR 51.19 / USD 62.89

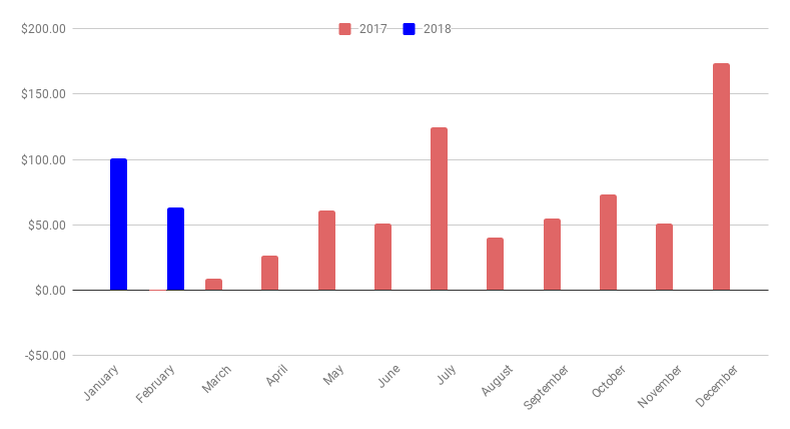

Year over year growth rate for dividend income

The fun fact is - the YoY growth rate for my dividend income in February is more than 15,000%. A year ago I just started my way to the financial freedom and laid first bricks with Mintos.com peer to peer lending. Unfortunately, my first month with Mintos.com was with a negative -0.42$ sign (because of the service charges on the platform)

February 2017 | February 2018 | |

Baltic Horizon Fund | €0.00 | €5.17 |

Mintos.com | -€0.41 | €44.43 |

Poloniex.com | €0.00 | €1.59 |

Total | -€0.41 | €51.19 |

Now, a year later I have greatly increased my investments on Mintos.com peer to peer lending marketplace, have added one ETF from the Baltics and of course some humble earning from crypto lendings on Poloniex.co

Monthly income to the date

My portfolio is now more than one year old. As I was just starting out last year, the first months of the year didn't generate me much. Just starting with March, April and May the journey started to roll.

Monthly Income chart as of February 2018

The cumulative earnings for 2018 are $163.84 which is about 13.6% of my goal for 2018 ($1200).

Learn more: 2017 in Review and Financial Goals for 2018

On the average, I should pull about $103 each month for the next 10 months to reach this goal. Right now it seems I'm on the right track, as there are already a few months in 2018 I'm looking on close to $150/mo and in fact will try to crack $200/mo milestone this year.

About investments and return 2018

Since the begging of the year, I've additionally invested $3,192.53 what is about 29.84% of the total $10,700.18 planned investments in 2018. Also, I've reached 1.78% in value for my planned 1 million dollar savings account by 2045.

On the average, I should invest about $750.77/mo until the end of the year to reach my goals.

YTD value for the entire portfolio at the end of February is down by - 8,54% but still positive since the begging in 2017 with a positive 16.15% value growth.

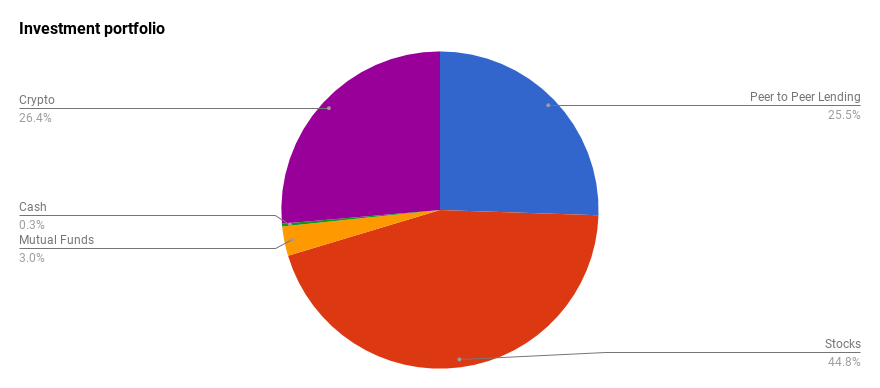

Investment portfolio structure February 2018

February was pretty stable at YTD growth rates. Crypto's seems have stabilized for a while after a more than 28% drop at the beginning of the year, and in fact, I'm looking on some bull trend in cryptos for the next couple of months.

As you can see from the graph above cryptos (26.4%) now is the second largest position in the portfolio after stocks (44.8%), followed by Mintos.com peer to peer lending (25.5%).

I'm lacking cash reserves (0.3%) in the portfolio, to change that starting March 2018 I decided to run a 52-week money saving challenge and looking to increase cash reserves to about 5% from the portfolio value by the end of the challenge.

The challenge is simple - to deposit in the first week one euro, in the second week - two, third week - three, etc. The amount after each week continues to grow, up to the last week of the year, when it is 52 euros.

Also, I started to build up an emergency starter fund with $1,000 and hope to reach this target by the end of the year. By the end of February, I've reached about 7.3% from this goal. My current emergency starter fund is in value about 0.41% of the net worth. From the downside, I should add - that with current emergency fund I could sustain the comfort of our family living just for one day. With reaching $1,000 it could sustain about 2 weeks. Yikes. But better have one

Goals forecasts for February 2019

This is my favorite part of the reports - trying to forecast/set goals for the next year. Despite I made more than 15,000% growth this year I'm more humble when looking on next year. It would be cool to reach $100/mo a year after. From today's perspective speaking that would mean to increase investments on Mintos.com peer to peer lending and buy additional Baltic Horizon Fund shares and still I might be short. I hope to start buying US stocks closer the end of 2018, and if, then hopefully US stocks will help me to achieve $100 goal for February 2019.