ByBit is my new favorite crypto trading platform, I switched from Deribit to ByBit around August 2023, with the launch of TerraMatris crypto hedge fund.

I like trading on Bybit because, unlike on the Deribit, options are settled in USDC, not in crypto itself, which makes it much easier to calculate and actually grow the portfolio.

In this article I will shed some light on how I'm selling covered call options on Solana using ByBit trading platform.

Before that, make sure to check out my previous articles about options selling with Solana

- I'm making $0.21/daily* by selling covered calls on Solana coin

- How to Sell Covered Call Options with Solana on Deribit?

First things first - ByBit re-introduced Solana options on March 6, 2024, about a week ahead the Deribit, despite Deribit was the first announcing Solana options, already back in October 2023. In short both Deribit and ByBit already had Solana options, but they stopped issuing new contracts shortly after FTX crash back in November 2022.

Now, once we are done with history, lets dive in:

As I already had 1 SOL coin in our crypto portfolio, it was no brainer to go and start generate some income from it, as we were buying small bits with Solana during the past few weeks we had a nice buying price of slightly under $100 per coin, while the actual coin price was about $130. We were already gaining 30% from this holding (Sadly, we didn't bought 100x more) and now I just wanted to squeeze out some extra USDC by selling call options.

Your case will be different, a popular covered call trading strategy is buy/write, something I would recommend to be really careful, especially with crypto.

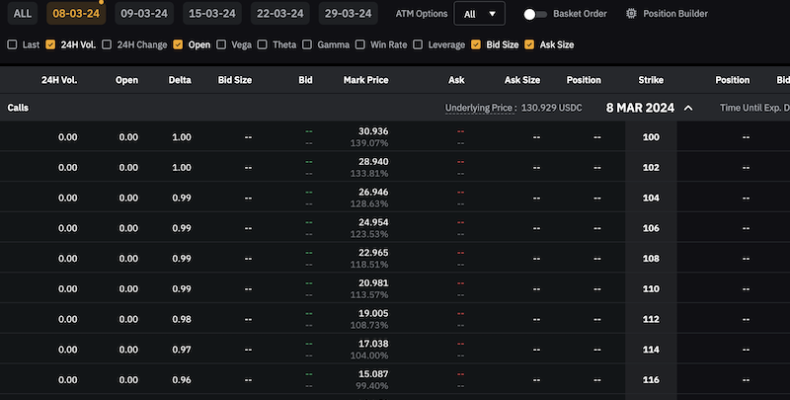

Once the Solana options were once again enabled on ByBit I opened following, 2 days to expiry call, option on Solana coin

Sold 1 SOL-8MAR24-146-C for 0.6

Let me translate that for you, on March 6, I sold one call contract on Solana and with expiry on March 8, 2024 (2 days to expiry) with a strike price of 146 for what I was rewarded with 0.6$ per contract. In total 0.60 (before commissions)

What happens next?

On the expiry date, March 8, 2024, SOL is trading under $146 per coin - options expire worthlessly and I keep the premium and start over - if SOL trades above $146 on the expiry date, I pay the difference in USDC. Say SOL trades $150 on the expiry date, I will need to pay the difference between the spot price and strike price, which is $4.

But as our actual buying price for one SOL coin is just $99, we will actually make a huge gain of $47.

Now, as we already had SOL in our long term crypto portfolio, I look on his covered call writing strategy as a form of passive income, and actually not encouraging on aggressive buy/sell approach. Something i have done a lot in the past, especially on stocks, unfortunately with quite mixed results.

But if you have few SOL laying around, why not generate some income from them?!

At Terramatris crypto hedge fund we sell both put and call options to boost our portfolio performance while investing in different crypto assets. Visit our website to learn more.