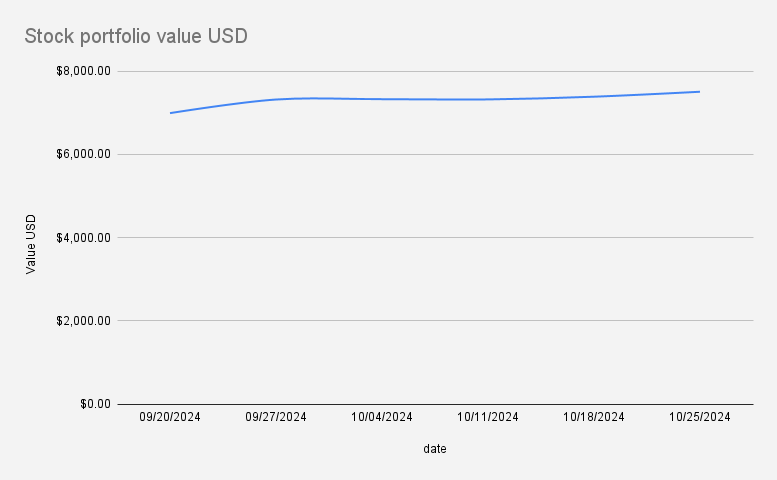

Our stock portfolio has reached $7,501.68, reflecting a 1.61% growth week over week — an increase of $119.11. With earnings season underway, we’re seeing positive momentum across several stocks, yet there are underlying concerns. I am cautious of potential negative news that could emerge next week, though I’m hopeful it won’t disrupt this upward trend.

This Week’s New Stock Additions:

- Nike (NKE)

- Alphabet (GOOG)

- Deutsche Bank (DB)

- Teva Pharmaceuticals (TEVA)

- Microsoft (MSFT) – the latest addition to the portfolio, motivated by the potential growth stemming from Microsoft’s partnership with ChatGPT and the AI-driven future it suggests.

Options Trades:

- New Credit Spread on Amazon (AMZN): Using the premium collected from this trade, I purchased an additional 0.1 AMZN share.

- Teva Pharmaceuticals (TEVA): Sold two puts expiring December 20, collecting enough premium to add two more TEVA shares to the portfolio.

- Intel (INTC) Adjustment: Rolled out the November 29 put to a May 2025 put with a $28 strike. This adjustment brought in about $40 in premium and lowered our breakeven price on Intel.

With earnings season in full swing, I’ll be watching closely to see how the market reacts, especially with potential headwinds. Let’s keep our fingers crossed for more green in the coming weeks!

Options Income

Since September 17, 2024, the total income generated from my options trading has reached $424.02. This income stream continues to provide additional cash flow, which I plan to reinvest into the portfolio to accelerate growth.

Join my 100K options trading challenge on Facebook