Welcome to the twelfth (#12) dividend income report, covering earnings I've made from the Baltic dividend-paying stocks and peer to peer lending (both fiat and cryptocurrencies).

Wow, already twelve dividend income reports, that's one year of tracking my road to the million dollars by the time I will turn 60. The last April marked also a small one-year anniversary since I've been investing in the Baltic stocks, you can read my review here: Baltic Dividend Stock Market Review - Thoughts After Investing for a One Year

April turned out neither good, neither bad. I was looking to crack $100 milestone this month, but because of one dividend payment been paid in May, instead of April, the total income was lower as expected. (That's for the bad news, but still, nothing bad here, as I still will get paid in May).

Disclosure: This article contains affiliate links to mintos.com peer to peer lending website, by clicking on links on this page and by making an investment on mintos.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Interest income in April 2018

From the Baltic stocks, Mintos.com peer to peer lending and from cryptocurrency lending on Poloniex.com I got following income last month:

- Mintos.com: EUR 48.11

- Poloniex.com: EUR 1.44

- Tallinna Kaubamaya Group: EUR 21.73

- Lietuvos Energijos gamyba EUR 7.43

Total: EUR 78.71 / USD 95.47

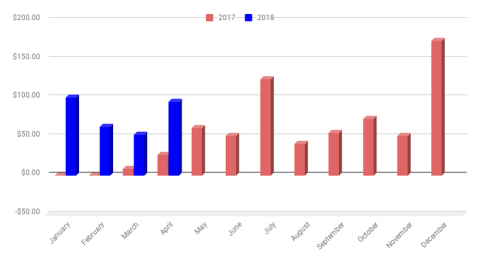

Year over year growth rate for dividend income

The YoY growth rate for my dividend income in March is 261.49%

April 2017 | April 2018 | Change | |

€25.83 | €48.11 | €22.28 | |

Poloniex | €0.00 | €1.44 | €1.44 |

Tallinna Kaubamaya Group | €0.00 | €21.73 | €21.73 |

Lietuvos Energijos gamyba | 0 | €7.43 | €7.43 |

Total | €25.83 | €78.71 | €52.88 |

The growth has happened because of the increased investment on Mintos peer to peer lending platform and two additional dividend paying stocks from the Baltics.

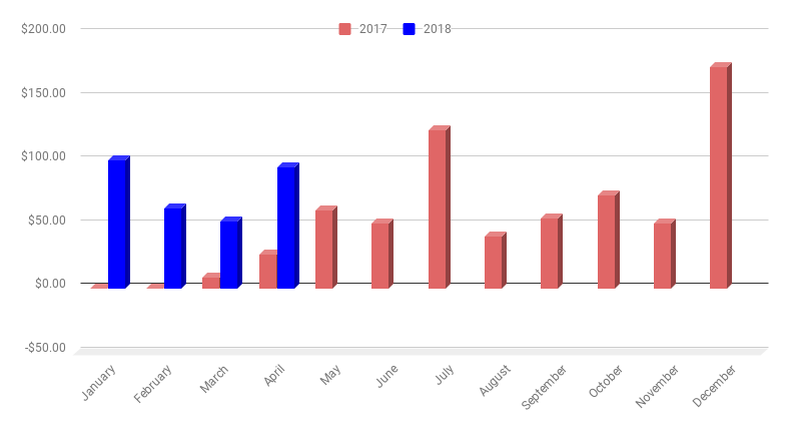

Monthly income to the date

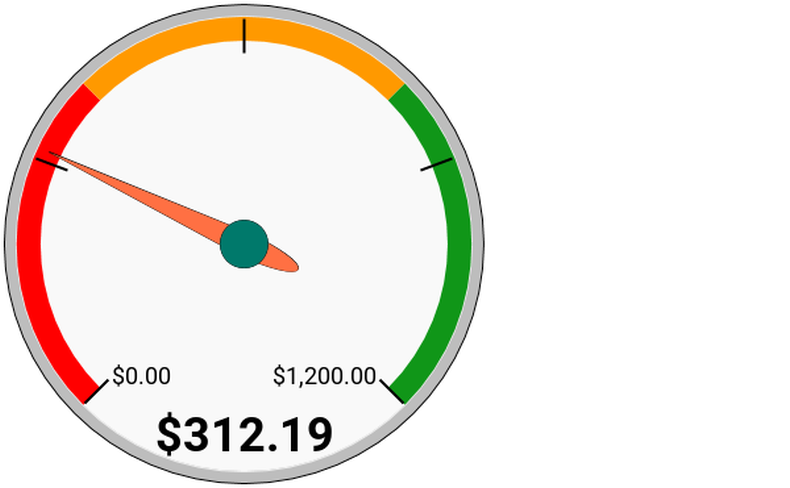

The cumulative earnings for 2018 are $312.19 which is about 26.02% of my goal for 2018 ($1200)

Monthly Income chart as of April 2018

On the average, I should pull about $110.98 each month for the next 8 months to reach my $1200 goal for 2018. Right now it seems I'm on the right track, as there are already a few months in 2018 I'm looking on close to $150/mo and in fact will try to crack $200/mo milestone this year.

Dividend Income Radar April 2018

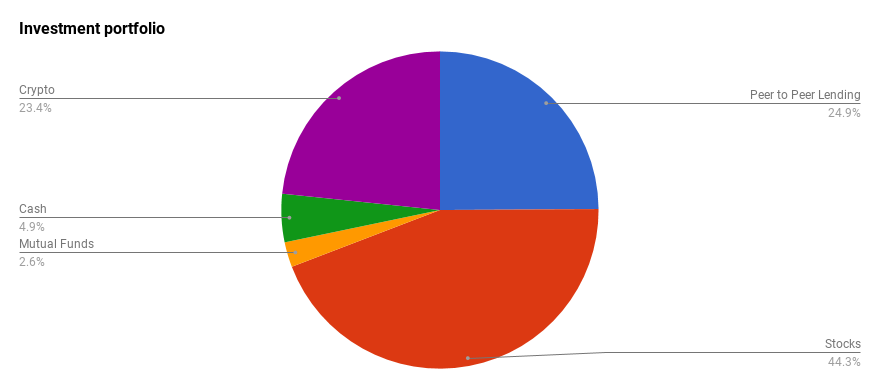

About investments and return 2018

Since the begging of the year, I've additionally invested $5,859.19 what is about 54.76% of the total $10,700.18 planned investments in 2018. Also, I've reached 1.98% in value for my planned 1 million dollar savings account by 2045.

On the average, I should invest about $605.12/mo until the end of the year to reach my goals.

YTD value for the entire portfolio at the end of March is down by - 10.46% but positive since the begging in 2017 with a positive 10.31 % value growth.

Investment portfolio structure April 2018

Crypto regained some value back in April.

Goals forecasts for March 2019

This is my favorite part of the reports - trying to forecast/set goals for the next year. When looking on April 2019 dividend income, it would be cool to reach $150/mo a year after. From today's perspective - hard, but doable. There are a few scenarios I'm considering now - one it would ask to boost my deposit on Mintos or and buy more Baltic stocks or I should start adding US dividend-paying stocks to the portfolio. I'm looking on both now.