Welcome to the thirty-sixth (#36) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in April 2020.

Last April we spent in a self-isolation (because of Covid-19) here in Georgia. Baby girl is doing her online class, learning about animals, shapes, continents, and even planets. Quite fascinating what a 21-month-old can do. Development is very rapid.

King Davids Tower (s) in Tbilisi

It was on the evening of April 27, 2020, I decided to switch glass (from the kit lens to telephoto) and make some photo for the month of April to put in the description for the monthly dividend income report.

From the perspective of the market, last April was quite good, we recovered some 15% from the lost value, but still are under the water. From the perspective of dividends - this was a complete disaster - most ot the dividends were trimmed, some cut down to 0. Before the World's health crisis is was planned to take about $230 in dividends last April, but we managed to book only $78.40.

That's one of the worst dividend months in years - the sad news, this is not over - it will take many months, if not years to recover.

Compared to the previous April in 2019, that is a decrease of -52.26% (-$85.84)

Options trades helped a little to offset the losses, but also were nothing impressive - I made some money with calls and puts, but lost some money with vertical spreads. At the end of the month, we were able to book $41.33 from options trades.

For a now I have decided to pause my adventures with crypto options, but I made some $9.28 last month

When counted all together (dividends + options + crypto options), it seems I have made $129.01 in total last month. Effective income yield last April was 0.76% (about 9.12% annually) Which is humble for me, but anything positive in these times is good.

One of my monthly goals is to generate at least 2.5% income yield from a portfolio. Let's see, can I get on the track in the futures months (Spoiler alert - the only way I see this happen is from option trading

Interest income in April 2020

From the stocks and peer to peer lending I got following income last month:

Ticker | Earnings |

EDI | €27.26 |

EDF | €21.33 |

Mintos | €8.09 |

RA | €7.81 |

NCV | €3.88 |

AWP | €3.76 |

Total EUR 71.83 / USD 78.40

In total there were 6 companies paying us dividend in April 2020 that 5 companies less than in April 2020

We didn't get payments this April from, NRZ (dividend will be paid in May, but is cut by 90%), PNNT (we still hold the stock, but our stock was sold on div ex-day back in March, so we didn't qualify for a dividend this April, hopefully, things will get better in July.

If things were at the pre-COVID-19, we would collect at least $138.45 from NRZ and PNNT, but we didn't.

Monthly income

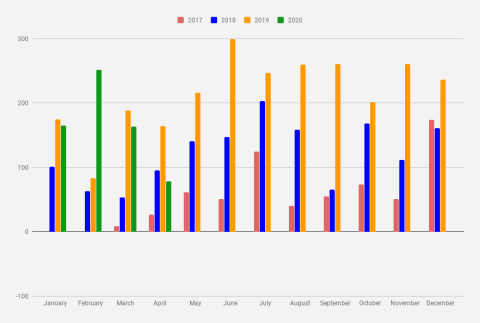

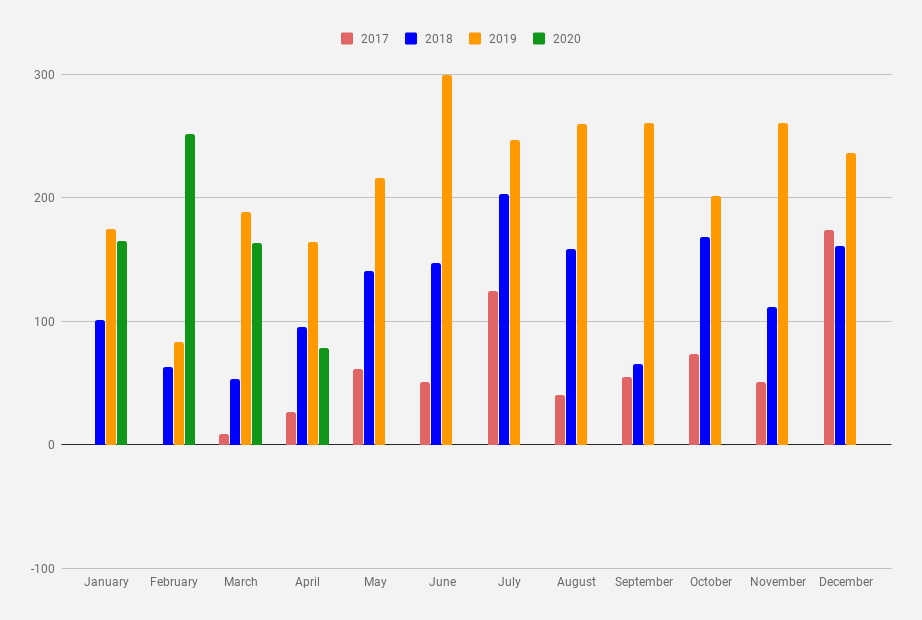

I've been tracking my journey towards million dollars in a savings account since January 2017. More than three years already. The result for 2020 is lagging behind

in 3 out of 4 months this year, the dividend income has been lower than in 2019

Monthly dividend Income chart as of April 2020

The cumulative dividend earnings for 2020 now are $657.55 which is exactly 18.27% from my goal of 2020 ($3,600). On average, it would ask me to generate $367.81 every month for the next 8 months to reach my goal. With 90% confidence, I'm saying this goal won't be reached this year.

2019 in Review and Financial Goals for 2020

Goals for April 2021

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (April 2019)

When setting goals for April 2020, I will say I want to increase dividend income by at least $70 - it translates in $234. Let's keep an odd number. I like them. lol

Wow, a total failure. I wasn't' smart enough to build Covid-19 proof dividend portfolio and instead of an increase of $70, we are now experiencing a decrease of more than $80.

When setting goals for 2021 - I will say anything above $200 will be a great result. To get there it will ask a lot of smart investments and a lot of cash deployed