Welcome to the twentieth (#20) dividend income report, covering earnings I've made from dividend-paying stocks, peer to peer lending (both fiat and cryptocurrencies) in December 2018.

In case you are wondering why I'm sharing online my earnings - the answer is pretty simple - back in January 2017, I set a goal to reach one million dollars in my bank account by the time I will turn 60 26 years still to go). I believe in transparency and sharing dividend income reports every month helps me to observe my personal progress or bounces. Hopefully, those reports can give some inspiration to you as well. (If so, please leave a short comment below).

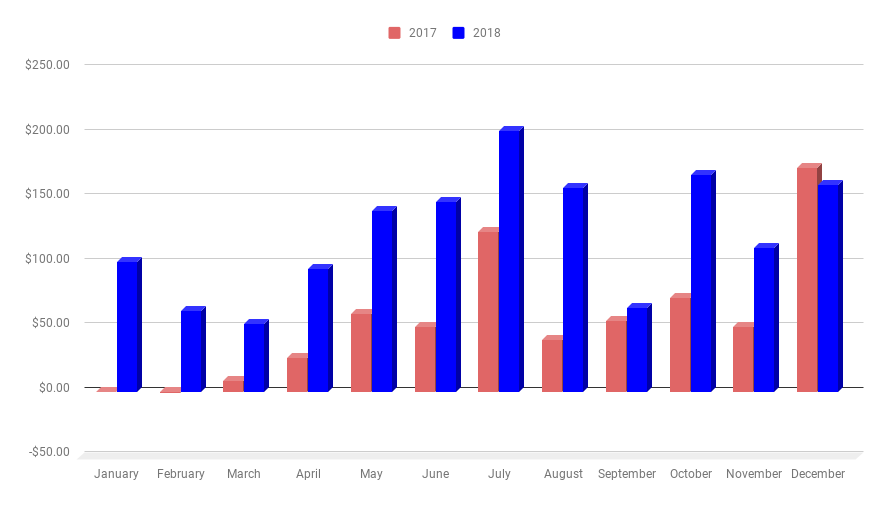

In short, last December turned out much better as I thought before. Despite last December was the first month when YOY growth was negative, I still really love this December. More on that bellow.

Disclosure: This article contains affiliate links to mintos.com peer to peer lending website, by clicking on links on this page and by making an investment on mintos.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Both individuals and entities can invest through Mintos. Individual investors must be at least 18 years old, have a bank account in the European Union or third countries currently considered to have AML/CFT systems equivalent to the EU, and have their identity successfully verified by Mintos. At the moment, US citizens or taxpayers cannot register as investors at Mintos.

Sign up for Mintos.com here. By using my affiliate link for registration both you and I will receive — 1% of our average daily balance which should be paid in 3 installments for the first 90 days.

Interest income in December 2018

From the stocks, Mintos.com peer to peer lending and from cryptocurrency lending on Poloniex.com I got following income last month:

Ticker | Earnings |

€49.94 | |

NCN1T | €24.00 |

WPG | €16.32 |

XIN | €12.25 |

FGB | €10.60 |

EPA:VTA | €9.28 |

EDF | €6.68 |

CLM | €6.14 |

EDI | €5.04 |

Poloniex | €2.13 |

Total: EUR 142.10 / USD 160.57

In total there were 10 great companies paying us dividends in December.

The YoY growth rate for my dividend income in December was negative - 7.53%. or it was 13.07 less than a year ago. The explanation is simple - SAF Tehnika from the Nasdaq Baltics decided not to pay out dividends this year and there were no extra from Latvijas Gāze, as it was in 2017... Despite I made less than a year ago I feel really strong regarding December, it's much better diversified than a year ago, and when speaking about goals for December 2019 I can see really good month here, but more on that at the end of the article.

Monthly income to the date

The cumulative earnings for 2018 now are $1,466.83 which is exactly 122.24% from my goal of 2018 ($1200). Awesome I have beaten my yearly goal by extra $266. Isn't that awesome?

2017 in Review and Financial Goals for 2018

Monthly Income chart as of December 2018

Goals for December 2019

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting goals for December 2019 dividend income, let's see what I forecasted for this December year ago:

I'm looking to get about $200 in December 2018 dividend income

Boom. I missed my goal by about 40 bucks. It feels bad. To compensate that, I will direct an extra $40 USD toward investment on Mintos.com peer to peer platform next month. (Matching interest earned on Mintos.com Peer to Peer Lending Platform)

Now, when setting goal/forecast for December 2019 I have a $240 goal for the December 2019. From today's perspective looks very possible.