Welcome to the forty-fifth (#45) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in January 2021.

The last January we spent in Latvia, did a lot of planning with our flat in Vilgāle, order new windows, got a construction permit, and started the first renovation works (hired local contractors). At the end of January, we relocated to Jūrmala, where we plan to spend the next two months.

On January 2, we paid a shot visit to Cēsis and Valmiera in Latvia

From the perspective of dividend income - Last January was one of the lowest in the already 4-year-old dividend income portfolio. My dividend income keeps falling because I'm shifting away from junk stock. In total, we took just shy $50.95 in dividend income last month. I would wish more for a 4 years old dividend portfolio, but things are as they are.

Compared to the previous January in 2020, when we took $164.99 in dividend income, our monthly dividend has decreased by -65.27% (-$114.04). A year ago we did set a goal to take at least $300 this month, now this didn't happen.

Luckily, an additional $3,284.99 was made from options trading.

As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports.

Check out our options income report here: January 2021 Options Income Report - $3,284.00

If counted all together (dividends + options) it seems we have made $3,334.95 in total last month. That's a great way to start a year. If we would be able to take at least $3,334 every month for the next 11 months we would finish 2021 with +$40.000 income. Which is one of my options income goals

We were able to generate about 9.7% income yield from our portfolio value last January.

One of our monthly goals is to generate at least a 2.5% income yield from the portfolio. As longs it's above it - it's awesome.

Interest income in January 2021

From the stocks and peer to peer lending we got the following income last month:

Ticker | Earnings |

USA | €13.92 |

RA | €7.04 |

O | €5.80 |

XIN | €5.30 |

Mintos | €5.17 |

EDF | €4.53 |

Total EUR 41.76 / USD 50.95

In total there were 6 companies paying us dividend in December 2020 that is 6 companies less than in January 2020

Monthly income

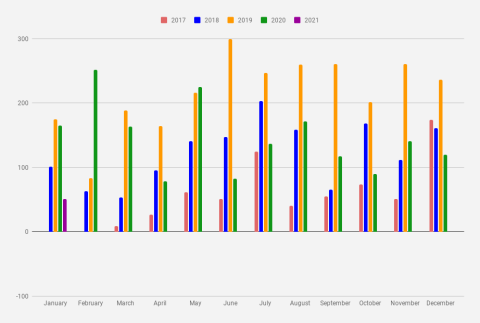

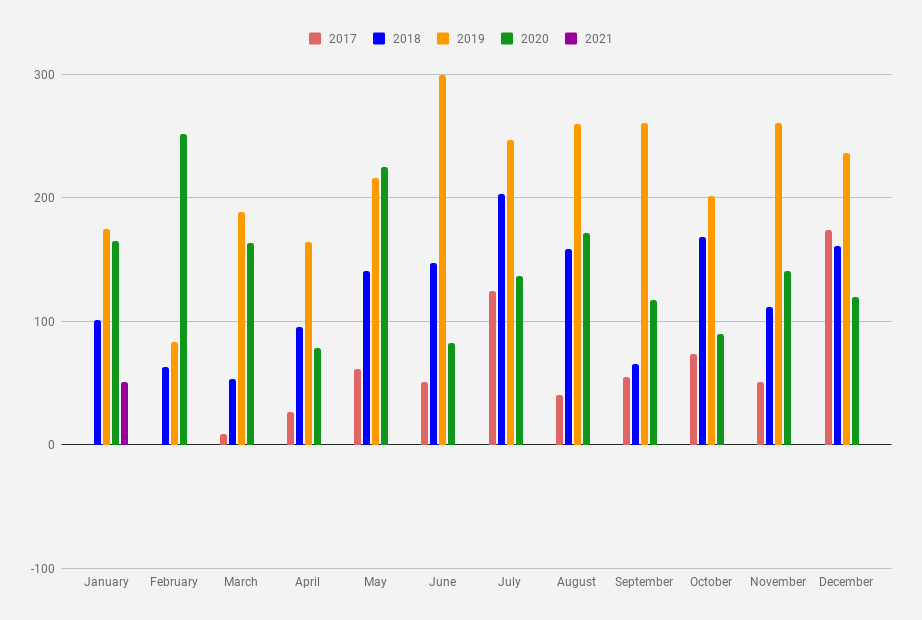

I've been tracking my journey towards million dollars in a savings account since January 2017. 4 years already.

Monthly dividend Income chart as of January 2021

The cumulative earnings for 2021 now are $50.95 which is exactly 1.95% from my goal of 2021 ($2,600). On average, it would ask me to generate $231.73 every month for the next 11 months to reach my goal. Right, now this goal looks pretty hard, but I will try even harder to get there by the end of the year.

2020 in Review and Financial Goals for 2021.

Goals for January 2022

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2022, let's see what I forecasted/said a year ago (January 2020)

When setting goals for January 2021 I have a minimum $300 goal from dividend income. It will be probably very hard, as I need to raise my current dividend income by about $140, to get there I plan to use quarterly paying stocks, like NRZ, PNNT, and others.

nope, month after month I keep missing my dividend income targets. When setting goal for January 2022 I will go with a humble $100