Welcome to the thirty-seventh (#37) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in May 2020.

Just like the previous month of April, in May we also spent in a self-isolation (because of Covid-19) here in Georgia. Some of the strict lockdown measurements were lifted (like using a private vehicle and going from city to city) we did a few road trips here in Georgia. Baby girl is doing her online class, learning about animals, shapes, continents, and even planets. Quite fascinating what a 22-month-old can do. Development is very rapid.

Saint Dimitri Tesalonikeli Fathers Moanstery near Mtksheta

May come with very sad news - my dad passed away, some 11 days before his 66 year birthday. My dad was like a best buddy to me, we talked a lot about investments, stocks, politics, we argued, disagreed, we had opinions - most of our conversations were on WhatsApp chat, he was very tech guy, into gadgets.. dad I miss you. Everything's gonna be alright - this was his favorite phrase. His last message on WhatsApp was on May 8:

Last message from Dad on May 8, 2020

The loss of dad will leave a space in my life that can never get filled.

From the perspective of dividend income - last May was very good, we were able to take $225.17, despite most of our dividends are trimmed by half and more. Back in March's market panic, we bought for a cheap a lot of FGB stock, this stock helped to boost this May's dividend income. FGB is not the stock we would like to keep for life, but I feel happy I bought it back in March.

Compared to the previous May in 2019, our monthly dividend has increased by a mere 4.16% (+$9.00). Despite I was looking at a $300-$350 dividend this month a year ago, I will say the overall result is very good, taking into account the market downturn.

An additional $595.43 was made from options trading. As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports. As we love selling options a lot, during the month of May I launched a separate website - Investing with covered calls - OptionsBrew.com You can read our first options income review here: May 2020 Options Income Report - $595.43

If counted all together (dividends + options) it seems we have made $820.6 in total last month.

Effective income yield last May was 4.36% (about 52.32% annually) Which is great. One of my monthly goals is to generate at least 2.5% income yield from the portfolio. As longs it's above to it - it's awesome.

From dividends + active trading taking 30% year seems quite doable. The first five months of 2020 have been a bumpy road, but we have been able to take more than 2.5% from the market in 3 out of the 5 months.

Interest income in May 2020

From the stocks and peer to peer lending I got following income last month:

Ticker | Earnings |

FGB | €75.23 |

BGLF | €36.30 |

XIN | €17.52 |

EDI | €14.04 |

Mintos | €11.26 |

EDF | €9.77 |

NRZ | €9.54 |

KNF1L | €9.05 |

RA | €7.60 |

NCV | €6.48 |

ET | €5.44 |

AWP | €3.66 |

Total EUR 206.58 / USD 225.17

In total there were 12 companies paying us dividend in May 2020 that is 3 companies less than in May 2019

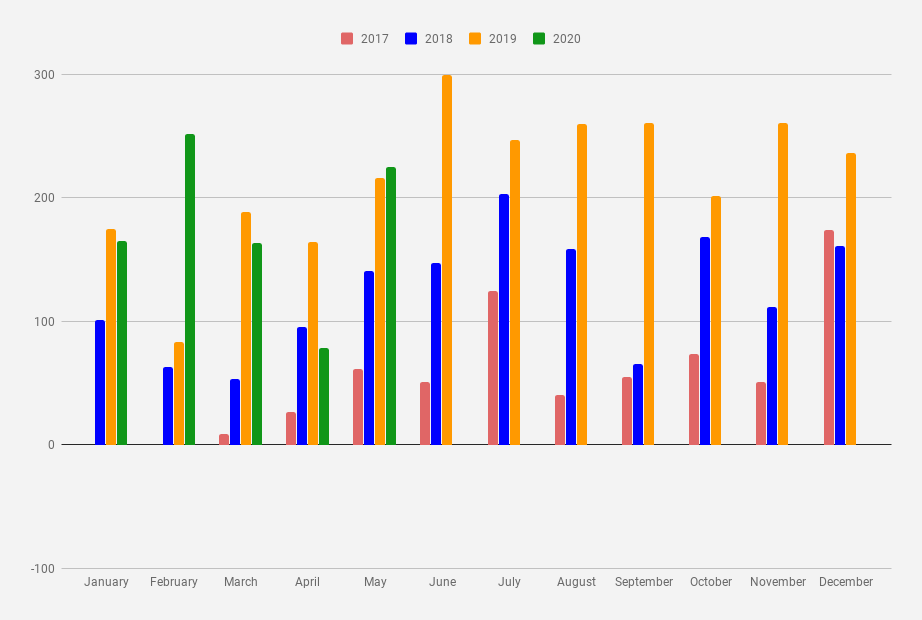

Monthly income

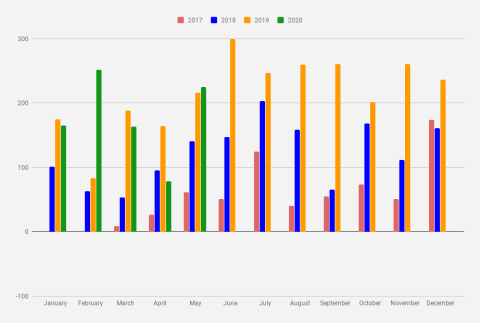

I've been tracking my journey towards million dollars in a savings account since January 2017. More than three years already. The result, so far, looks quite good. Dividends are growing (even when they are not)

Monthly dividend Income chart as of May 2020

The cumulative earnings for 2020 now are $882.72 which is exactly 24.52% from my goal of 2020 ($3,600). On average, it would ask us to generate $388.89 every month for the next 7 months to reach this goal. Right, now the goal looks unattainable, as for now, I cannot see even a single $300 month for 2020, but this could change later, during the year as we are trying to add more quality stock to the portfolio.

Goals for May 2021

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (May 2019)

When setting goals for May 2020, I will say $300 seems a good number to work with, but I want more - at least $350 for May 2020

None of the numbers were reached. Taking into account the downturn in the markets and many dividend trims. I will say that it is quite acceptable.

For May 2021 I have a goal to crack finally that $300 milestone, to get there will add more quarterly stocks paying dividends in May (like FBG, PBCT, and T). From today's perspective looks quite possible.