Welcome to the forty-first (#41) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in September 2020.

Just like in the previous months, we spent the last September here in Georgia. We did a few road trips across the country.

Also, I managed to crash and lose my DJI Mavic mini drone and had to order a new one, which got delivered at the end of the month, so more cool drone videos can be done.

I had a chance to visit this monastery at the end of September 2020 and capture really awesome drone photography / catching colors of the fall

The baby girl attends her pre-school, she is doing great - talking, singing, dancing Awesome. She started her singing and kickboxing training at the pre-school Quite fascinating what a two-year and 3 months old can do. Development is very rapid.

Last, but not least I won an online auction and bough a flat in rural Latvia: Today I bought my first flat on online auction site

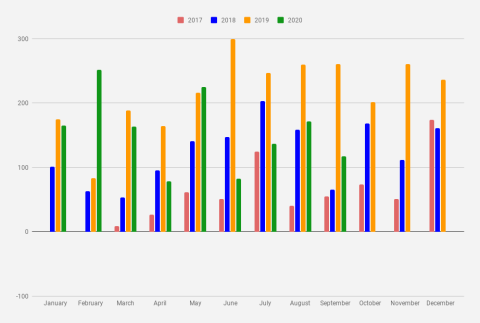

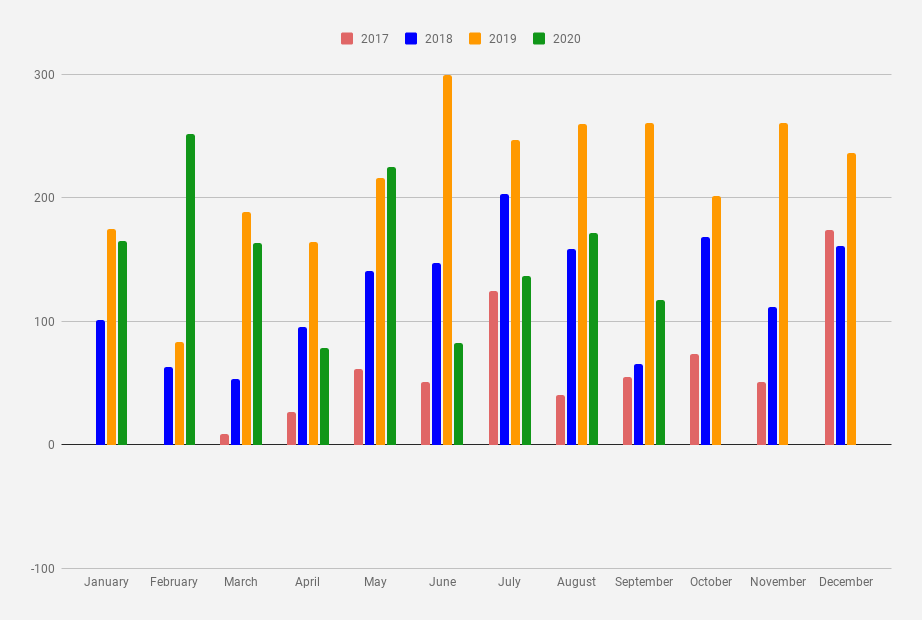

From the perspective of dividend income - last September was pretty catastrophic if compared to the previous years, we keep suffering from trimmed dividends, and by the end of the month, we barely took $117. Relying on dividends these days is very hard.

Compared to the previous September in 2019, when we took $260 in dividend income, our monthly dividend has decreased by -55.05% (-143.32). A year ago we did set a goal to take at least $400 this month, now this didn't happen.

Luckily, an additional $715.35 was made from options trading.

As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports.

Check out our options income report here: September 2020 Options Income Report - $715.35

If counted all together (dividends + options) it seems we have made $832.29 in total last month.

We were able to generate about 5.24% income yield from our portfolio value last September (that's about 62.88% annualized)

One of our monthly goals is to generate at least 2.5% income yield from the portfolio. As longs it's above to it - it's awesome.

Interest income in September 2020

From the stocks and peer to peer lending we got the following income last month:

Ticker | Earnings |

BAC | €16.01 |

USA | €14.23 |

ARCC | €11.57 |

PFE | €9.34 |

EDF | €9.25 |

Mintos | €7.22 |

RA | €7.20 |

EDI | €6.65 |

NCV | €5.97 |

XIN | €5.74 |

INTC | €4.30 |

O | €0.67 |

WFC | €0.07 |

Total EUR 98.35 / USD 117.04

In total there were 13 companies paying us dividend in September 2020 that is 1 company less than in September 2019

Monthly income

I've been tracking my journey towards million dollars in a savings account since January 2017. More than three years already. The result, so far, looks quite good. Dividends are growing (even when they are not)

Monthly dividend Income chart as of September 2020

The cumulative earnings for 2020 now are $1,390.08 which is just 38.61% from my goal of 2020 ($3,600). On average, it would ask us to generate $736.64 every month for the next 3 months to reach this goal. Right, now the goal looks unattainable, as for now, I cannot see even a single $200 month for 2020,

2019 in Review and Financial Goals for 2020

Goals for September 2021

This is my favorite part of these reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (September 2019)

When setting goals for September 2020 - I will be quite optimistic - I'm looking to crack $400. I hope to get there with more US monthly and quarterly stocks and also might use a dividend capture strategy.

Ahh, what a surprise, we didn't get there, not even close. our dividend stock portfolio wasn't immune against the market downturn and most of our stocks get trimmed or halted dividend payments. In the case of the recovery, there is hope.

I will be optimistic and say we are still looking to crack that $200/mo goal in September 2021

So what can $117 month buy you in 2020? This money is enough to pay a two week salary to a nanny here in Tbilisi.