Welcome to the twenty-ninth (#29) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in September 2019.

Last September we spent in Georgia, traveling around the country a bit, in September the grape harvest time (Rtveli) is celebrated in Georgia.

So we headed off for a weekend to the region of Kakheti and actually for the first time I was eating grapes from the field.

Luxury stay at Akhasheni Wine Resort in Georgia

It was my pleasure selling covered calls with a view.

The last September was very good in terms of passive income. At the end of the month, I have collected $260.36 from dividend stocks and Mintos peer to peer lending platform. Compared to the previous September in 2018, that is a quite impressive 298.53% growth ($195.03)

Disclosure: This article contains affiliate links to mintos.com peer to peer lending and deribit.com options trading websites, by clicking on links on this page and by making investment mintos.com or derbit.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Sign up for Mintos.com here. By using my affiliate link for registration both you and I will receive — 1% of our average daily balance which should be paid in 3 installments for the first 90 days.

An additional $1,387.70 was made from options trading (covered calls, naked puts, iron condors, and vertical spreads), but as options trading is not actually a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income report.

Last but not least, last September I traded options on cryptocurrencies using Deribit platform, which resulted in an additional $105.06

When counted all together (dividends + options + crypto options), it seems I have made $1,753.12 in total last month.

Last September was the second month in a row when income from dividends + options + crypto options helped to generate more than a 5% yield from the total value of the portfolio.

Effective income yield last September was 5.07% That's about 60.84% annually. Awesome.

Interest income in September 2019

From the stocks and Mintos.com peer to peer lending I got following income last month:

Ticker | Earnings |

PEI | €48.78 |

€47.95 | |

SFG1T | €23.40 |

XIN | €21.67 |

WPG | €17.03 |

EDF | €13.93 |

VIE:ATRS | €13.40 |

USA | €12.10 |

EDI | €11.70 |

EPA:VTA | 9.38 |

CLM | €5.56 |

RA | €4.32 |

NCV | €3.87 |

AWP | €3.10 |

Total: EUR 236.69 / USD 260.39

In total there were 14 great companies paying us dividends in September, that's 9 companies more than in September 2018

Mintos has slipped to second place in terms of interest income generated

Mintos.com Review After 24 Month of Investing in Peer to Peer Lending

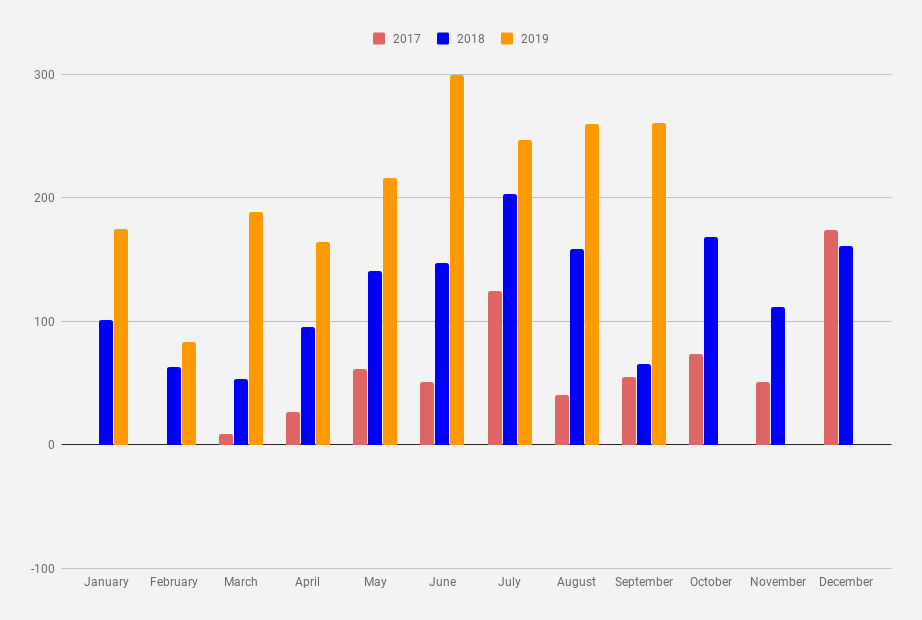

The YoY growth rate for my dividend income in September 2019 was + 298.53% or $195.03 more than a year ago in September 2018. Now, that' s some serious dividend income growth in just one year.

Monthly income

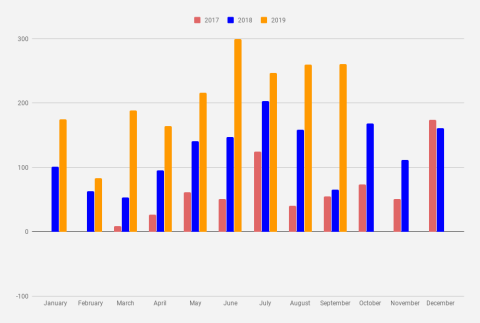

I've been tracking my journey towards million dollars in a savings account since January 2017. The result, so far, looks quite good. Dividends are growing.

Monthly dividend Income chart as of September 2019

The cumulative earnings for 2019 now are $1,893.24 which is exactly 92.58% from my goal of 2019 ($2,045). On average, it would ask me to generate $50.59 every month for the next 3 months to reach my goal. I believe that I crush this goal at the end of October already. Generating $50/mo now is soooooo easy.

2018 in Review and Financial Goals for 2019

Goals for September 2020

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (September 2018)

When setting goal/forecast for September 2019 I will take that in an account and will set a more humble $120 goal for next year.

Holy smokes, I just smashed that goal. I actually doubled income this September I forecasted a year ago.

When setting goals for September 2020 - I will be quite optimistic - I'm looking to crack $400. I hope to get there with more US monthly and quarterly stocks and also might use a dividend capture strategy.