Welcome to the twenty-seventh (#27) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in July 2019.

Hawk-eyed blog readers will notice that I have dropped cryptocurrency lending from the top. And that's true, I have stopped lending crypto online on Poloniex.com, instead, I'm trading crypto options on Deribit.

Our baby daughter last July turned 1, and for that special event we traveled back to Latvia (spent 2 weeks there) - had a nice family gathering and very awesome 1-year birthday celebrations at Baltvilla hotel

Birthday decorations for our baby girls birthday at Hotel Baltivilla restaurant terrace

Disclosure: This article contains affiliate links to mintos.com peer to peer lending and deribit.com options trading websites, by clicking on links on this page and by making investment mintos.com or derbit.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Sign up for Mintos.com here. By using my affiliate link for registration both you and I will receive — 1% of our average daily balance which should be paid in 3 installments for the first 90 days.

$247.06 was taken from dividend stocks and peer to peer lending in July 2019. That's actually about $50 less than expected, but I will take that.

Additional $527.20 were made from options trading, but as options trading is not actually a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income report. On the other hand option income is a nice way to give a boost to the overall portfolio.

Last but not least, last July I traded options on cryptocurrencies using Deribit platform, which resulted in + 1.738944 ETH ($374.88) and + 0.00851 BTC ($85.19). In total $460.07

When counted all together (dividends + options + crypto options), it seems I have made $1,234.33 in total last month. Wow.

Last month, income from dividends + options + crypto options helped to generate a 3.69% yield from the total value of the portfolio. That's about 44.28% annually.

Interest income in July 2019

From the stocks and Mintos.com peer to peer lending I got following income last month:

Ticker | Earnings |

GZE1R | €49.49 |

NRZ | €48.70 |

€47.92 | |

PNNT | €21.39 |

EDI | €11.59 |

OLF1R | €8.10 |

CODI | €7.78 |

EDF | €6.90 |

CLM | €5.51 |

RA | €4.27 |

NCV | €3.83 |

AWP | €3.83 |

Total: EUR 218.64 / USD 247.08

In total there were 12 great companies paying us dividends in July, that's 4 companies more than in July 2018

Mintos has slipped to 3rd place in terms of interest income generated, that's because I got yearly payment from Latvijas Gāze (GZE1R) and quarterly payment from New Residential Investment Corp (NRZ)

Mintos.com Review After 24 Month of Investing in Peer to Peer Lending

The YoY growth rate for my dividend income in July 2019 was + 21.80% or $44.22 more than a year ago on July 2018. Now, this is not quite the growth rate I'm happy with, would love to see at least $60-$70 growth in a year. But I will take it.

Monthly income

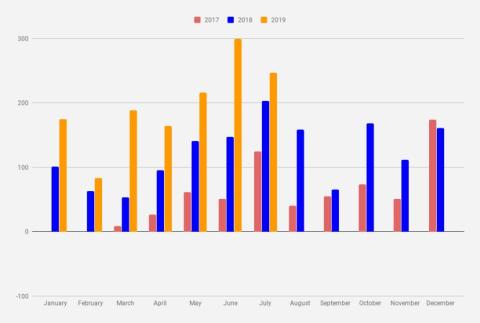

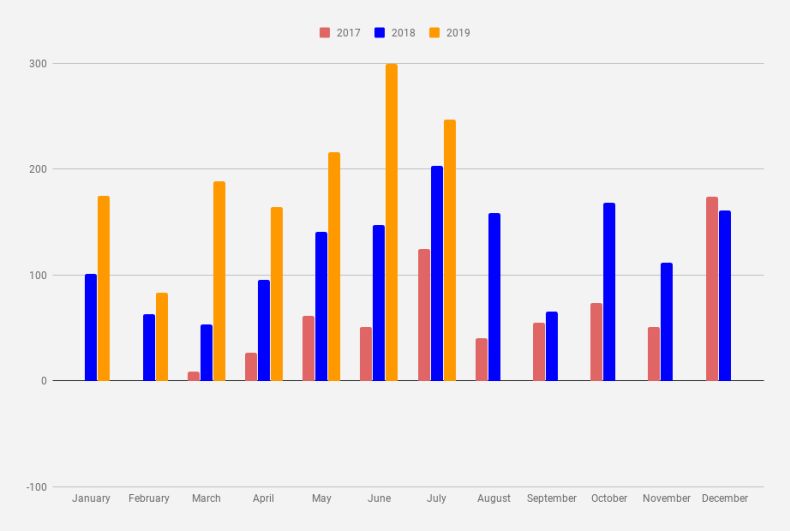

My journey towards million dollars in savings account now is more than 2 and a half years old. The result, so far, looks quite good. Dividends are growing.

Monthly Income chart as of July 2019

The cumulative earnings for 2019 now are $1,373.30 which is exactly 67.15% from my goal of 2019 ($2,045). On average, it would ask me to generate $134.34 every month for the next 5 months to reach my goal. Looks quite doable

2018 in Review and Financial Goals for 2019

Goals for July 2020

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (July 2018)

Now, when speaking about July 2019 - I will set a goal to crack $300. Hard but doable.

Now, I missed my goal by some lame $50, on the other hand, I made more than $1,000 with the help of options trading. So I will take that!

For 2020, I'm looking to take at least $400 in dividend income. I believe to get there I will increase my stake with NRZ, PNNT (quarterly big payers) and probably some monthly dividend-paying stocks (EDI, EDF, RA, AWP)

Now, how about you? Did you make some extra last month? Leave me a comment, readers and I would love to hear!