As the founder and CEO of TerraMatris crypto hedge fund I keep analyzing and backtesting different options trading strategies every day.

In this article I decided to take a closer look and backtesting selling 1 DTE put options on Bitcoin for one year, seeing how many times there have been more than 4% price drop (thats important for options adjustment strategies)

1 DTE put options trades are actually the backbone core strategy at TerraMatris crypto hedge fund and we sell them since August 22, 2023 (have backtest data to compare with)

Backtesting is a valuable tool that allows traders to assess the viability of their strategies by analyzing historical data. In this article, we delve into backtesting a 1-Day Expiry Put Options Strategy on Bitcoin, focusing on identifying days with significant price drops exceeding 5% over the past 365 days.

Time period: March 13. 2023 - March 13, 2024

Backtesting involves simulating trading strategies using historical data to evaluate their performance. By applying a strategy to past market conditions, traders can gain insights into its potential effectiveness and refine it before risking capital in live trading.

For testing purposes I took raw data for Bitcoin closing price for the last 365 days and imported them to Google Spreadsheet to make some calculations

For most of the time Bitcoin has traded sideways, just with the end of 2023 it turned into very strong bull market.

Using Bitcoin's price data from the past 365 days, we aim to identify instances of significant daily price drops exceeding 5%. These abrupt declines can present opportunities for profit when employing a put options strategy.

It is interesting to note, that during the 365 days trading period, 173 days bitcoin price was trading lower that in the previous day, thats about 47% . Now, when trading put options small movements doesn't mean much. We are looking out for larger moves, something like 10% daily drop.

Upon analyzing the data, we found that Bitcoin experienced more than 5% daily price drops on several occasions over the past year. These instances varied in frequency and magnitude, highlighting the inherent volatility of the cryptocurrency market.

When analyzing data for given 365 days period, the largest daily drop was -7.59% recorded on January 12, 2024

In total, there were 7 days form 365 with daily price drop larger than 5%, and 12 days with daily drop larger than 4%.

For traders considering the implementation of a 1-Day Expiry Put Options Strategy on Bitcoin, the analysis of historical price data provides valuable insights. Understanding the frequency and magnitude of significant price drops can inform decision-making regarding entry and exit points, risk management, and position sizing.

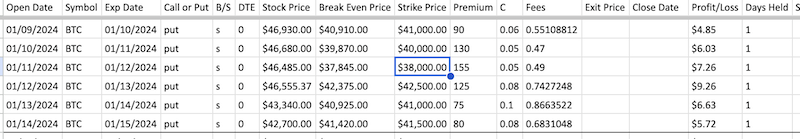

Now, lets see how did our put options strategy worked out on January 12, 2024 when price for Bitcoin dropped more than $3,500 from $46,368 on January 11, to $42,853 in January 12.

From our trade journal it is clearly visible that we went for a strike price more than $8,000 under spot price, targeting still very hefty premium, thus limiting our position size. When choosing our put strike price we went with a strike price under more than 18%. Now apparently volatility was extreme, If I remember correct on that day Bitcoin ETF approval was waited, and thus not excluded some sharper drop of -20% if not approved.

Luckily for us our trade expired worthless and we entered new one already on the next day with new strike prices and other volatility.

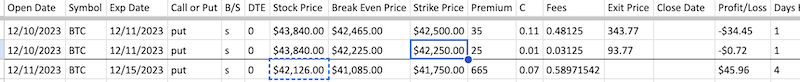

Now, luck was not on our side when we experienced second sharpest drop for Bitcoin on December 11, when BTC price dropped from $43,840.00 to $42,126.00, while our strike price was $42,250.

Bitcoin dropped by more than 5% and our put options was in money, and we had to roll it out, again luckily we managed to roll it out in just a few days, and turned back into profit zone.

When rolling we managed to downsize position size from 0.11 to 0.07 while still squeezing out some profit. The best part in total we stayed in this trade just 4 days in total.

in fact most of our rollings happened when BTC price dropped my more than 5%. Something to consider when selling put options, to stay in safer side looking for trades with more than 5% downside protection.

Volatility, market sentiment, regulatory developments, and other factors can influence price movements and impact the performance of trading strategies.

Backtesting a 1-Day Expiry Put Options Strategy on Bitcoin using historical price data allows traders to assess its potential effectiveness in capturing profit from significant downward price movements. By analyzing instances of more than 5% daily price drops over the past year, traders can refine their strategies and make informed decisions in the dynamic cryptocurrency market.

As cryptocurrency markets continue to evolve, incorporating backtesting and data analysis into trading practices can enhance decision-making and increase the likelihood of success in volatile environments.

Interested to learn more visit Terramatris crypto hedge fund, we trade 1 DTE options every day.