Lately, I have been trading 1 DTE options with Ethereum on the Deribit platform. In the past, I have traded quite a lot of Bitcoin and Solana coins (until the November 2022 Crypto Crash)

Unlike stock options, trading crypto options might get more complicated, a lot more complicated and I wouldn't actually recommend them if you are a novice. My biggest learning curve so far has been the fact that crypto options are settled in crypto itself.

Disclosure: This article contains affiliate links to the deribit.com options trading website, by clicking on links on this page and by making an investment on deribit.com, I might earn affiliate income at no cost to you.

I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Anyhow, after a losing trade with a call ratio bacskpread I was looking for a "revenge" trade (something you should always avoid at all cost) and thought - what If instead of selling options premium I will actually buy one?

The thing is - As I don't have any clue which direction crypto will move in the next 24 hours I decided it would be advisable to buy a straddle - the same strike price for both calls and puts.

What is a Straddle

A straddle is a neutral options strategy that involves simultaneously buying both a put option and a call option for the underlying security with the same strike price and the same expiration date.

A trader will profit from a long straddle when the price of the security rises or falls from the strike price by an amount more than the total cost of the premium paid. The profit potential is virtually unlimited, so long as the price of the underlying security moves very sharply.

Example buying straddle options with Ethereum

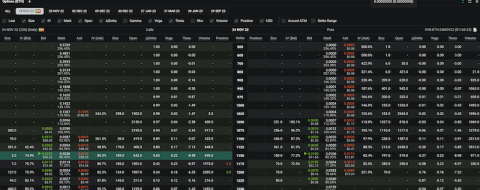

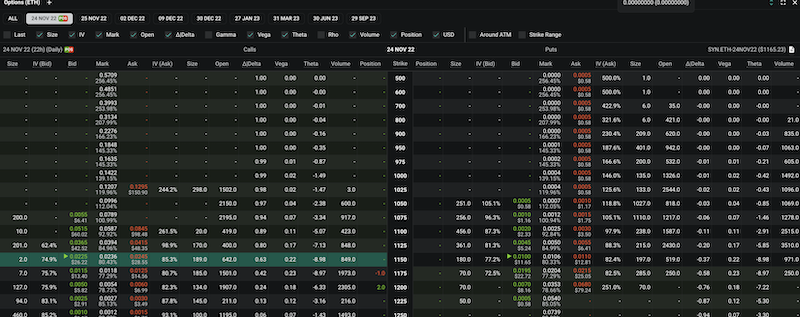

On November 23, 2022, ETH was trading at $1,165

I decided to open straddle with a $1,150 price, and got filled at the following rates:

- Buy 1 Nov 24, 2022 $1,150 put @ 0.01 ETH

- Buy 1 Nov 24, 2022 $1,150 call @ 0.0235 ETH

Total premium paid: 0.0335 ETH / $39.02

What happens next?

On November 24 at the expiry Ethereum trades at $1,150 - our worst-case scenario - we lose the premium we paid

If ETH trades at $1,200 - we lose the premium we paid for the put option (0.01ETH) but gain on the call side $50, converted to crypto 0.0434 ETH (50/1150). We earn 0.0104 ETH / $12.48

In case ETH trades $1,100 we lose the premium paid for the call side (0.023) but gain on the put side $50, converted to crypto 0.0434 ETH (50/1150). We earn 0.0104 ETH / $11.44

Break-even: $1,100.98 and $1,189.02

Anything in between our break-even prices and we actually lose the premium paid.

Example buying straddle options with Bitcoin

On November 23, 2022 BTC was trading $16,520

I decided to open straddle with a $16,520 price, and got filled at the following rates:

- Buy 0.1 Nov 24, 2022 $16,500 put @ 0.00105 BTC

- Buy 0.1 Nov 24, 2022 $16,500 call @ 0.0012 BTC

Total premium paid: 0.00225 BTC / $41.30

What happens next?

On November 24 at the expiry Bitcoin trades at $16,500 - our worst-case scenario - we lose the premium we paid

If BTC trades at $17,000 we lose the premium we paid for the put option (0.00105 BTC) but gain on the call side $50 (0.1*500), converted to crypto 0.00303 BTC (500/16500/10). We earn 0.00078 BTC / $13.26

In case BTC trades $16,000 we lose the premium paid for the call side (0.0012 BC) but gain on the put side $50 (0.1*500), converted to crypto 0.00303 BTC (500/16500/10). We earn 0.00078 BTC / $12.48

Break-even: $16,089 and $16,910

Anything in between our break-even prices and we actually lose the premium paid.

Interested to learn more about trading crypto options? Visit Terramatris website to learn more about cypto coaching