Welcome to the thirty (#30) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in October 2019.

Wow, thirty income reports so far, that's a quite impressive track of the record, covering more than 2 years of dividend income.

Last October, just like September, we spent in Georgia, some relatives visited us and we made a nice day trip to the Kazbegi in Georgia at the start of October

The last October was quite OK in terms of passive income. At the end of the month, I have collected $201.36 from dividend stocks and Mintos peer to peer lending platform. Compared to the previous October in 2018, that is a growth of 19.09% (+$32.09). The growth could be better, but as long as there is a growth on a yearly basis I will take it

Disclosure: This article contains affiliate links to mintos.com peer to peer lending and deribit.com options trading websites, by clicking on links on this page and by making investment mintos.com or derbit.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

An additional $2,777.23 was made from options trading (mostly vertical spreads on SPX, GC, AEX and ES, but also a few regular puts and calls on stocks I own or would like to have). As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports.

Last but not least, last October I traded options on cryptocurrencies using Deribit platform, which resulted in an additional $227.30

When counted all together (dividends + options + crypto options), it seems I have made $3,294.29 in total last month. That's absolutely the best income month from the financial markets so far.

Effective income yield last October was 9.29% That's about 111.48% annually. Holy smokes!

Interest income in October 2019

From the stocks and peer to peer lending I got following income last month:

Ticker | Earnings |

NRZ | €48.74 |

€46.32 | |

PNNT | €21.41 |

LNR1L | €15.40 |

EDF | €13.81 |

EDI | €11.59 |

RA | €9.16 |

CODI | €6.69 |

CLM | €5.52 |

NCV | €3.83 |

AWP | €3.07 |

Total: EUR 184.99 / USD 201.36

In total there were 11 great companies paying us dividends in October 2019, that's 2 companies less than in October 2018.

Mintos has slipped to second place in terms of interest income generated

Mintos.com Review After 24 Month of Investing in Peer to Peer Lending

The YoY growth rate for my dividend income in October 2019 was + 19.09% or $32.09 more than a year ago in October 2018. Could be better (I aim to at least $70 growth YoY) but as long there is a growth I'm a happy hippo.

Monthly income

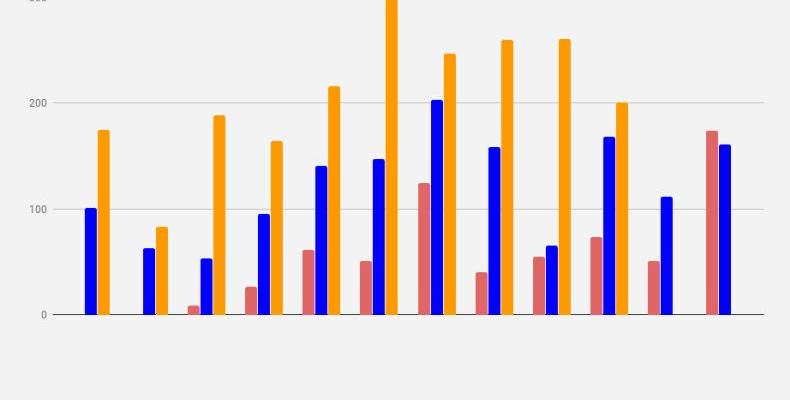

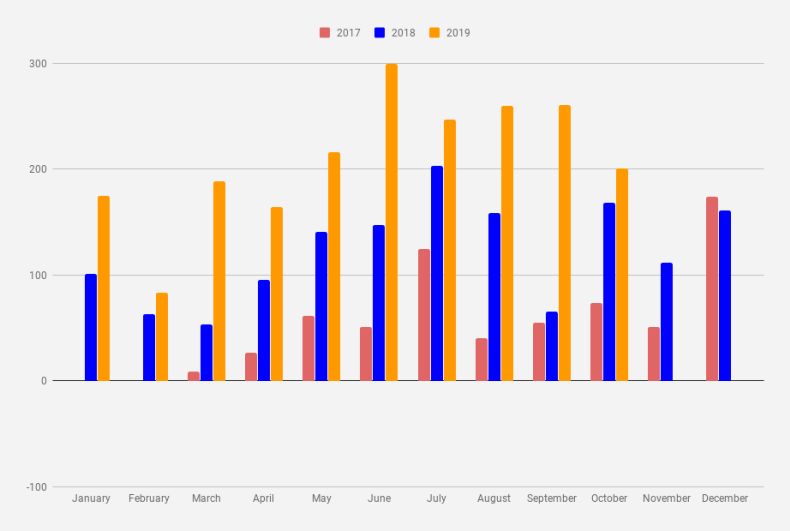

I've been tracking my journey towards million dollars in a savings account since January 2017. The result, so far, looks quite good. Dividends are growing.

Monthly dividend Income chart as of October 2019

The cumulative earnings for 2019 now are $2,093.43 which is exactly 102.37% from my goal of 2019 ($2,045). As it happened in last year's October I've reached my yearly goal 2 months ahead of the schedule. Now, the next two months are like a bonus.

2018 in Review and Financial Goals for 2019

Goals for October 2020

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (October 2018)

When setting goal/forecast for October 2019 I will forecast $230 goal for next year. It should be easy!

In the end, it wasn't so easy after all, and I didn't reach that $230 goal this year. I should take that in the account and when setting goals for October 2020, be more humble, that's why I will set a quite doable $300 goal for next year. I hope to get there with more US monthly and quarterly stocks