Welcome to another article in the series of stock picking.

The other morning I was talking with my fiancee over the Whatsapp chat and as she works in the translation field, she suggested taking a closer look at the RWS company.

She sent me the following URL: RWS shares drop 19% after BPEA abstains from takeover

As I've been already looking into translation, and machine translation stocks in the past, most I was able to find were London or Hong-Kong based, which kind of is not attractive to me (I prefer US or Continental European stocks). But fiancee insisted and I indeed took a closer look.

Here is what we know:

About RWS

RWS Holdings plc provides technology-enabled language, content management, and intellectual property (IP) services. It operates through four segments: Language Services, Regulated Industries, IP Services, and Language and Content Technology. The company primarily operates in the United Kingdom, the United States, Continental Europe, and internationally. RWS Holdings plc was founded in 1958 and is headquartered in Chalfont St Peter, the United Kingdom.

Share price

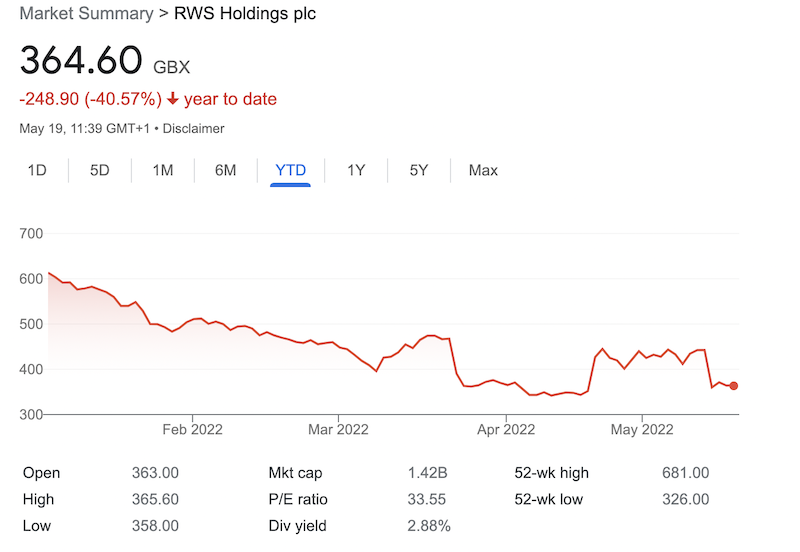

RWS is traded on Lonond in Sterling pounds.

YTD the share price is down more than by -40%, while SP 500 is down by some -20%.

I decided to take a look how does the Technical analysis look and found something interesting

Anything below the white line is anomaly and seems as a buying opportunity to me, as long if company is not going bankrupt, which I doubt. As we are in the market selloff I would wait for a few days, weeks before jumping in and potentially sell once getting back to the white line.

White line represent 200 weeks moving average. Only on deepest market selloff stocks tend to fell below it. This time the sell off seems quite overreacted, but could also be a potential red flag.

Due your own research.

Additionaly, stock offers decent above 2% dividend yield, which might be quite interesting for dividend investors.