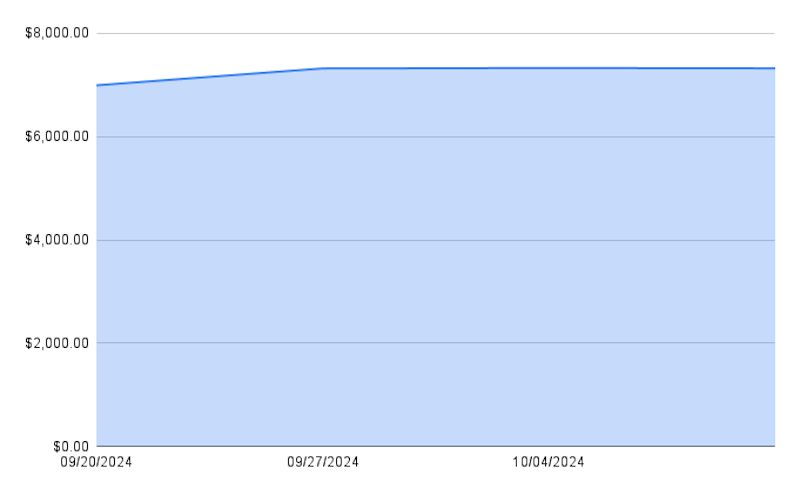

This week, the stock portfolio saw minor adjustments, growing to $7,317, a slight decrease of -0.08%. If it weren't for an ill-timed short trade on Roblox, the week would have ended on a more positive note. A partial recovery from the INTC put trade helped offset some of the losses.

Here’s the breakdown of this week’s moves:

Additions to the Portfolio:

- Google (GOOGL): After each Google Meet, I aim to invest in 0.1 shares of Google. This week, I had three online meetings, all tied to raising funds for TerraMatris. Although the funding efforts didn’t yield success, they brought some valuable ideas. As a result, I added 0.3 Google shares.

- Thermo Fisher Scientific (TMO): I bought 0.05 shares. This addition is tied to a new agreement my partner made with the company for the translation industry—a small stake in the portfolio, reinforcing the idea of investing in what you know and use.

A Misstep with Roblox:

Midweek, I decided to short 100 shares of Roblox following a report by Hindenburg Research. I also sold a naked call spread on Roblox, which turned out to be a poor decision. The move highlighted an important lesson: sticking to simple, time-tested strategies is paramount. Combining short selling with complex options trades led to unnecessary risk and losses this week.

New Options Trades:

Today, I opened two new bull put credit spreads:

- MS (Morgan Stanley): Sold a bull put credit spread at the 104/99 strikes.

- Roblox (RBLX): Sold a bull put credit spread.

Using the premium from these trades, I purchased 0.2 shares of MS and 1 share of RBLX, adding to the portfolio's growth potential despite the earlier setback.

This week's focus on sticking with simple strategies is a reminder that the journey toward building a strong portfolio relies on consistent, disciplined investing.

Options Income

Since September 17, 2024, the total income generated from my options trading has reached $272.21. This income stream continues to provide additional cash flow, which I plan to reinvest into the portfolio to accelerate growth.