Lately, I've been diving deep into the strategy of fully cash-secured puts without using margin—a method we've also been employing at TerraMatris Crypto Hedge Fund and our CryptoRentalYield Fund. This strategy provides a conservative yet effective way to generate income and potentially acquire stocks at a discount.

Today, I want to share how we're applying this approach specifically with Bank of America (BAC) stock, a position I've been actively involved in for quite some time.

Why Cash-Secured Puts?

A cash-secured put involves selling a put option on a stock while holding enough cash in the account to purchase the stock if assigned. This strategy has become increasingly appealing to me, as it eliminates the risks associated with using margin. By securing each put option with actual cash, we can ensure a controlled and predictable approach to trading, which aligns with the strategies we use at TerraMatris

My Experience with BAC Stock

Bank of America has been one of my go-to stocks for options trading. Over time, I have been selling options on BAC and currently hold 3 shares in our dividend portfolio. These shares, interestingly enough, were essentially acquired for free as they were paid for by the premiums collected from selling options on the stock. This experience reinforces the effectiveness of options trading as a tool for income generation and portfolio growth.

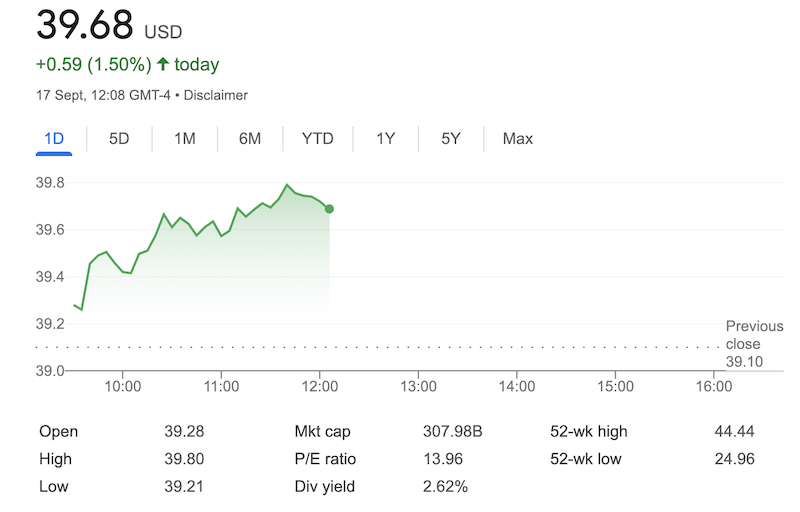

The Recent Trade: September 17, 2024

On September 17, 2024, I sold a cash-secured put option on BAC with a strike price of $39. For this trade, I received a premium of $0.19 per share (before commissions). This put option has a 3-day holding period, making this a quick income-generating opportunity. To put this in perspective, the potential return on this trade can be calculated as follows:

- Premium Received: $0.19 per share

- Strike Price: $39 per share

- Percentage Yield: 0.44% in 3 days

This 0.44% yield for a mere 3-day holding period is quite compelling, especially when annualized. This shows how even short-term options trading can significantly enhance the return on cash that would otherwise remain idle.

Why BAC?

BAC is an attractive stock for this strategy due to its liquidity and relatively stable price movements. Furthermore, BAC is a reliable dividend payer, providing an additional layer of return for investors. This makes BAC suitable for both short-term option income and long-term portfolio growth. The premiums on BAC options are generally favorable, providing a steady income stream.

The Strategy Going Forward

For the time being, I have decided to focus on selling cash-secured puts against BAC stock. The primary goal is to collect the premium and grow our cash position. Should the stock price drop and the put options get assigned, I'll be more than happy to acquire additional BAC shares at a lower price. From there, we would move into selling covered calls on these newly acquired shares—commonly referred to as the "wheel strategy."

The Wheel Strategy in Action

The wheel strategy is a straightforward yet powerful approach to options trading. It involves selling cash-secured puts until you are assigned the stock. Once you own the shares, you then sell covered calls to continue generating income. In the case of BAC, this means collecting premiums whether the stock price goes up, down, or stays the same. It's a win-win situation: either you keep the premium and maintain your cash, or you acquire shares at a discount and sell covered calls for additional income.

Growing Our Cash Position

By selling cash-secured puts on BAC, we are not only generating income through premiums but also growing our cash reserves. This cash can then be reinvested into further option trades or used for other investment opportunities. At TerraMatris, this approach helps us maintain a robust cash position while actively engaging in the market.

Final Thoughts

Selling cash-secured puts on BAC is a conservative yet effective strategy for income generation and potential stock acquisition at a discount. It aligns with our approach at TerraMatris Crypto Hedge Fund, where we prioritize risk management and steady growth. By employing this strategy, we aim to continue growing our cash position while remaining flexible to market conditions. If assigned, we'll gladly pivot to selling covered calls, completing the wheel strategy and maximizing our return on investment.