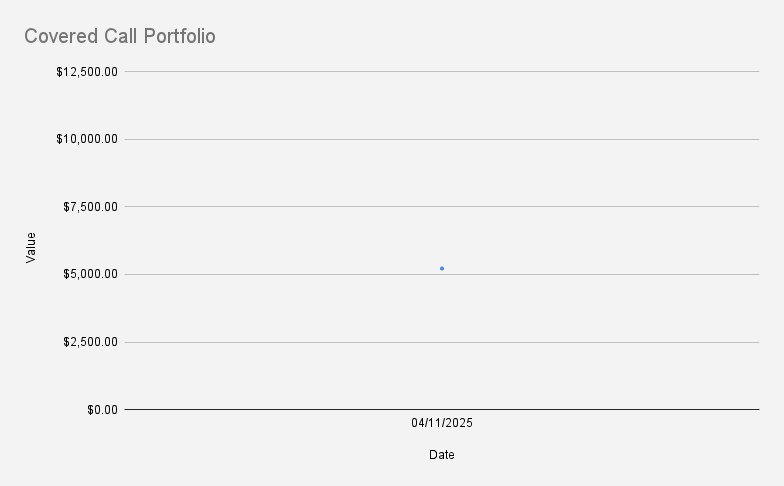

As of April 10, 2025, the value of our covered call stock portfolio stood at $5,219.50, reflecting a -28.65% decrease year-to-date. Despite the broader market volatility and economic headwinds, I'm doubling down on a focused strategy to stabilize and grow the portfolio.

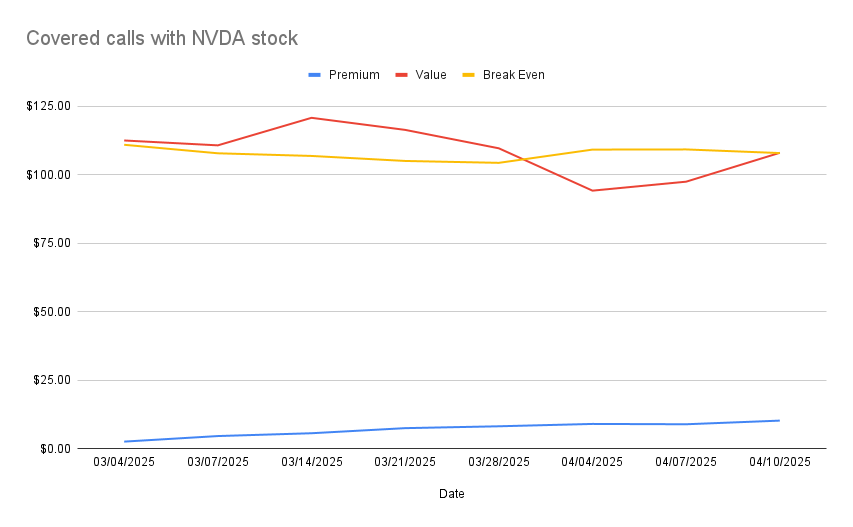

This week I was managing a covered call on NVIDIA. Currently we are holding 100 shares of NVDA, acquired at an average buy price of $118.22 (using margin), though due to previously collected option premiums, our effective break-even point was already $109.31.

The core rationale? NVDA’s dominant position in AI, data centers, and gaming graphics continues to give it long-term upside. Concentrating our capital and covered calls on this name allows us to develop a tighter feedback loop of premium income and stock appreciation.

On April 10, the day before our existing options expiry, I decided to roll up and away this covered call position:

- Bought back the April 11 $104 call for $5.18

- Sold the April 17 $105 call for $6.53

- Net premium collected: $1.33 per share

- New effective break-even: $107.98

This roll gave me more breathing room in case of a bullish move in NVDA while still collecting solid premium. It also incrementally moved me toward my target of owning shares outright, funded by option income.

These trades are currently financed using margin, and my total margin debit stands at -$6,739. While margin adds leverage and risk, it also enables premium capture while gradually building our NAV. The goal is clear: generate enough options income over the next 12 months to fully own 100 NVDA shares, debt-free.

If we might average $130 per week it would ask 51.83 weeks to fully cover debt (not counting in margin)

Stay ahead of the market — subscribe to Covered Calls newsletter and never miss an update!