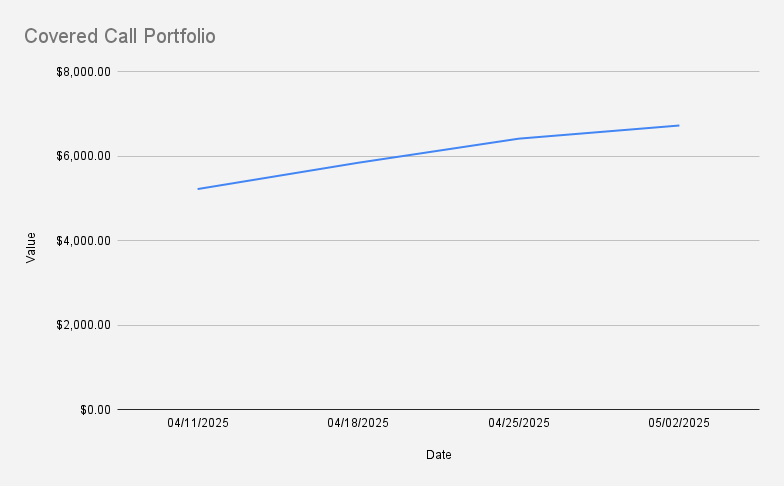

As of May 2, 2025, our covered call stock portfolio was valued at $6,722, reflecting another strong 4.85% week-over-week gain. However, we still remain down -11.61% year-to-date.

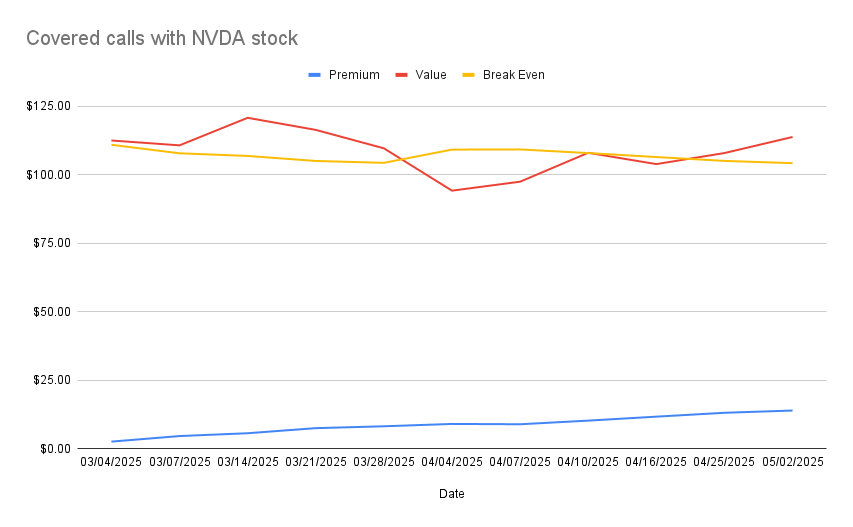

Our covered call portfolio at the moment is centered around NVDA stock exclusively.

As of today our covered call position was in the money and, I decided to roll forward this position,

Here is the trade setup:

- Bought back the May 2 $107 call for $7.75

- Sold the May 9 $107 call for $8.59

- Premium collected: $0.83 per share

- Break-even: $104.29

I initially wanted to roll this position up and away, but since it was already deep in the money, doing so would have required either choosing a different expiry or paying down debt. I preferred not to do the latter, as we’re using margin to finance the NVDA trade. One of our main goals is to reduce margin exposure as quickly as possible. That’s why I decided to stick with the same strike and simply collect premium instead.

Week after week we are improving our cash balance from collecting solid premium. It also incrementally moved me toward my target of owning shares outright, funded by option income.

Currently, most of these shares are financed using margin, with a total margin debit of -$6,322. The objective is straightforward—generate enough options income over the next 12 months to fully own the NVDA position debt-free.

Assuming an average weekly premium of $83, it would take approximately 76 weeks to eliminate the margin debt (excluding margin interest), We might be debt free around October 16, 2026. Encouragingly, our debt-to-cash ratio continues to improve week over week.

Subscribe to the Covered Calls newsletter to stay updated on each step of the journey!