Investing in individual stocks through dollar-cost averaging (DCA) is an effective way to manage risk and gradually build a position. However, options trading can introduce additional complexity—especially when managing losing short put positions. In this post, I’ll share my experience of using call options and DCA to navigate a troubled short put trade on Intel (INTC) stock.

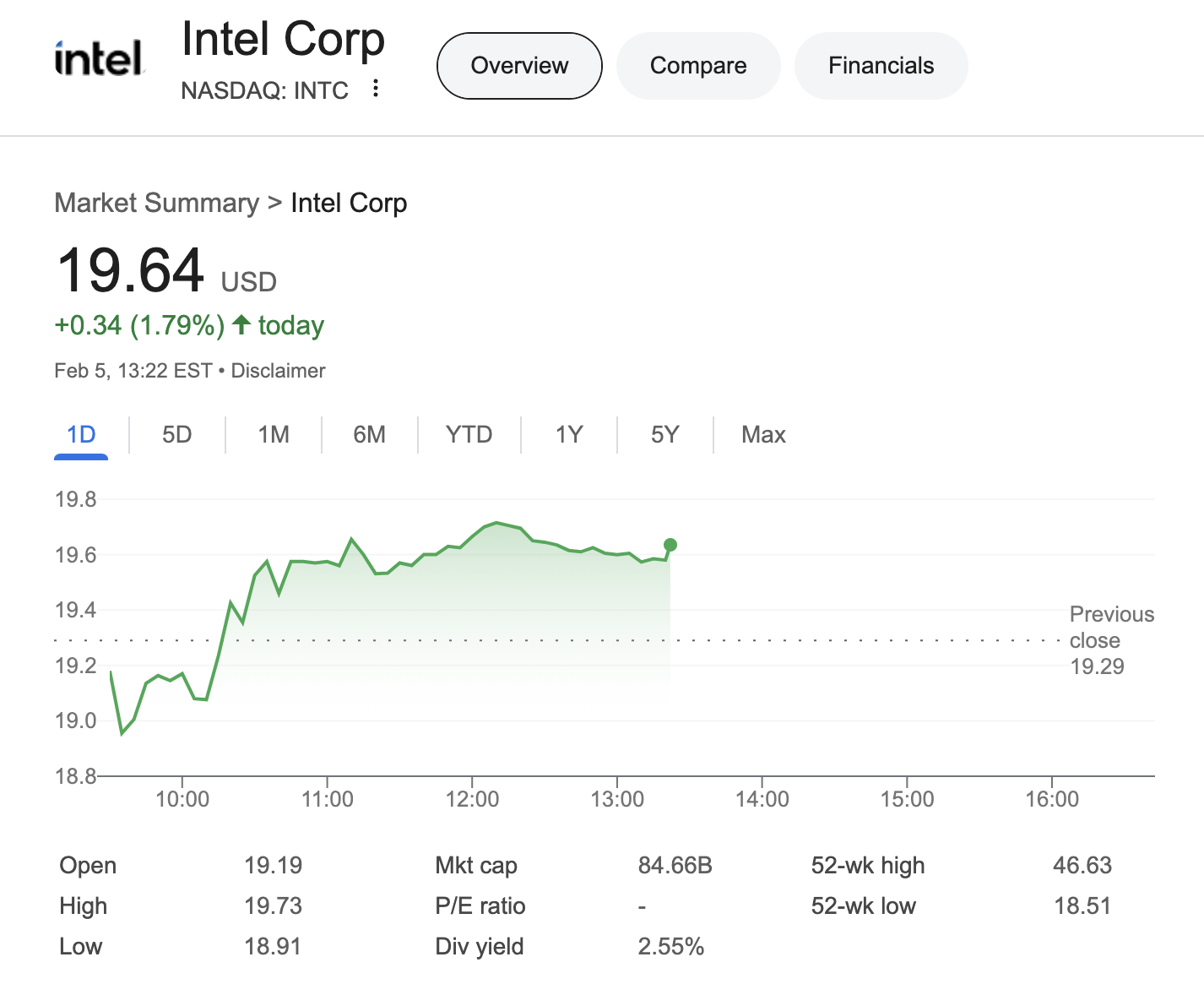

I was holding a short put on Intel with a strike price of $28 and an expiration date in May 2025. I have been troubled with this position since late August 2024. With INTC stock trading at around $20 I was losing about $800 with this position and had to figure out how to roll it out in the future.

On way to squeeze extra from loosing trade is selling call options

As part of my strategy to hedge this losing short put, I continued dollar-cost averaging into Intel stock. By February 5, 2025, I had accumulated 1.3 shares with an average buy price above $32. With the put trade still open and unfavorable, I needed a way to reduce risk and improve my cost basis.

On February 5, 2025, I decided to take an aggressive approach by selling a near-naked call option with the following details:

- Strike Price: $25

- Expiration Date: March 21, 2025

- Premium Received: $0.25 per share

While this was not a fully covered call due to my small holdings, it provided immediate income and helped me mitigate the risk of my losing put position.

Rather than pocketing the premium, I reinvested it into additional Intel stock. The premium received allowed me to purchase more shares, bringing my total Intel holdings up to 2.3 shares and decreasing my average buy price to $20. This move helped lower my cost basis and strengthened my position in Intel.

As long as INTC doesn't go above my strike price of $25, with this additional call option trade I have managed to lower my break even price for short put to: $27.37

Why This Strategy Works This approach serves multiple purposes:

- Hedging a Losing Short Put Position – Selling a call option helps offset potential losses from an assigned put.

- Reducing Cost Basis – Using the premium to purchase additional shares brings down the overall average buy price.

- Generating Income – Even in a challenging trade, options premium provides cash flow that can be reinvested.

- Flexibility in Trade Management – Selling calls while averaging down gives me more control over how I respond to market fluctuations.

This experience highlights how investors can manage options-related risks while continuing to build long-term positions in quality stocks like Intel. By using a combination of DCA and options strategies, I am gradually improving my cost basis while mitigating the downside of a short put trade. I will continue to track this trade and adjust my strategy as needed.

What are your thoughts on using options to hedge DCA investments? Let me know in the comments!