I started this year (2017) with a goal to save one million dollars in savings accounts by the time I will turn 60 (that's in 2045). For some such goal might sounds unrealistic, for others nothing so special.Anyway it's not about who is right and who is not. It's all about finance discipline and hopefully sunny days in retirement age.

It was decided that I will invest $8,561 in 2017, in different investment opportunities- peer to peer lending, dividend paying stocks and mutual funds.

I've written several articles about my investments in peer to peer lending already, see:

- Review of Mintos Peer to Peer Lending After One Month of Investing

- Mintos.com Review after 3 month investing in Peer to Peer loans

- and Q1 2017 Online Income Report - $5,886.46

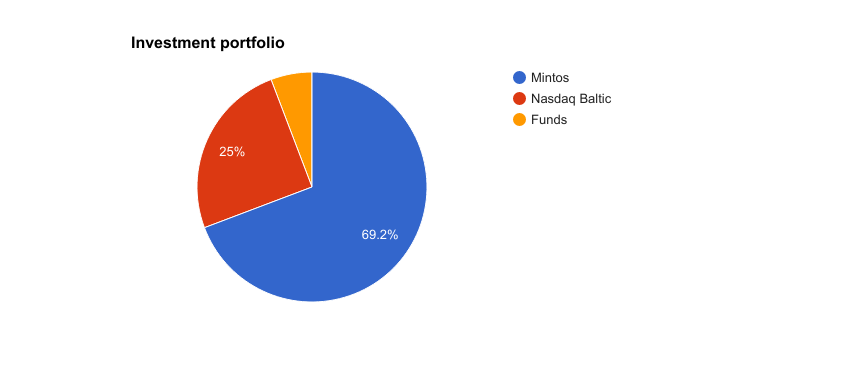

By now investments in Nasdaq Baltics in my portfolio makes 25%, without doubts I'm looking to increase investments here to at least 40% by the end of year.

Investment portfolio May 2015

It was around the end of April 2017, when I decided to diversify my portfolio, and without any doubts I looked on dividend paying stocks as the next big think for my portfolio. I re-opened my old SEB banka bank account in Latvia (it turns out I've been their customer since 2002 already), paid some inactivity fees and deposited money. All investments I was able to perform using online banking, but here is the catch - each order placed in Baltic market will be charged minimum 3 EUR fee, that's the reason I decided to stick with 3 stocks in first month. And here is what I bought:

- Zemaitijos Pienas

- SAF Tehnika

- OLYMPIC ENTERTAINMENT GROUP

You can read more about my planned investment strategy here: Dividend Paying Stocks In Nasdaq Baltic Market By Yield

It turned out that I still have 10 shares from 2002 or 2003 with:

- Latvijas Kugnieciba

As my investment strategy involves to get monthly interest payments, decision acquiring above mentioned stocks was based on two principles:

- high dividend yield stocks

- shortest future dividend paying stock

If there is nothing much to discuss about why I chose to stick with high dividend yield stocks, there is still a room for explanation why I opted to take next closest dividend payment. In order to build monthly dividend paying stock portfolio I need stocks in my portfolio paying out at different intervals of year. As my initial investments were made at the end of April, I decided to go with Zemaitijos Pienas and Olympic Entertainment Group, each promising 0.1 EUR dividend per share in May.

The Portfolio

From my initial investment of EUR 860.5 in dividend paying stocks, I bought 200 shares of Lithuanian Zemaitijos Pienas, 200 shares of Estonian Olympic Entertainment Group and 50 shares of Latvian SAF Tehnika.

Zemaitijos Pienas | SAF Tehnika | Olympic E Group | Total | |

Bought | 298 | 202.5 | 360 | 860.5 |

Value | 300 | 230 | 342 | 872 |

Growth | 2 | 27.5 | -18 | 11.5 |

My Nasdaq Baltic stock portfolio value as of May 15, 2017

In first month, the total growth for my investment was EUR 11.5, which equals to about 1.33%, as you can see one stock declined by EUR - 18, but as I had a liitle diversification, the overall portfolio performance was rather good. The best, that's not all. As I bought stocks just before dividend payment dates, I got first dividend payments:

Dividends

Invested | Dividend | Yield % | |

Zemaitijos Pienas | 298 | 17 | 5.70 |

Olympic Casino Group | 360 | 18 | 5.00 |

SAF Tehnika | 202.5 | 0 | 0 |

Total | 860.5 | 35 | 4.07 |

Dividend payments and yield

I got EUR 35 in dividend payments during month of May, making 4.07% dividend yield.

Bank fees

As I submitted 3 orders, in bank fees I paid EUR 9, which is a lot in fact. On the other hand, I'm buy and hold type investor, not planing to sell any of above listed stocks in foreseen future, my interest lies in fixed monthly dividend payments instead.

What's next

There are two companies listed on Nasdaq Baltic I'm really interested acquiring of - Tallinna Vesi and Latvijas Gāze, offering highest dividend yields in the Baltics. Those are among next ones I'm looking to acquire. Technically speaking I'm looking to acquire about 2 new dividend paying stocks each month, building kind of Baltic dividend paying stock index. Sad, there is no such dividend paying fund available yet. Could save a lot on commission fees.