This article has been in the blog's draft section for a couple of months and as it still bears some useful information I decided to publish as it is with little comments at the end.

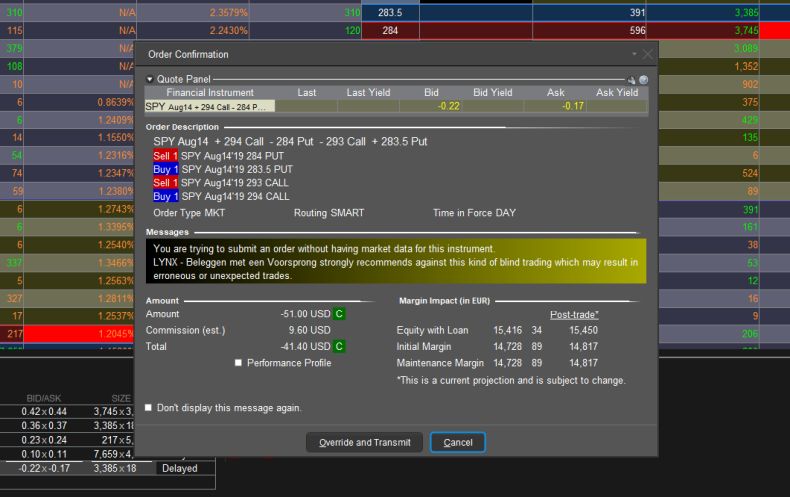

On August 13, 2019 I made my first Iron Condor trade - I sold following IC SPY AUG 14'19 294 / 284 / 293 / 283.5 @ 0.51

This trade was with a 1 day to expiration (DTE), I collected 51 USD from this trade, and paid in fees 9.6 USD (Interactive Broker charges each direction, and Iron Condor consists from 4 legs - 2 puts and 2 calls)

Opening Iron Condor trade Interactive Brokers

Everything seemed good, except market quickly moved against me and SPY reached 293 just some 15 minutes after I entered this trade, and here I started to make mistakes - I decided to open one more Iron condor trade for August 16.

In parallel, my 13-month-old baby asked for attention, and I made a serious mistake - I entered second trade without double-checking the numbers, instead of opening second iron condor with 3 DTE - I closed some positions from the first one and at the end, I was left with something like two calls for August 14 and two puts for August 16 - a complete mess. Strange but for the second trade I collected some USD 70 in premium (before commissions)

I was freaking out. Though nobody in the family noticed that, I stayed poker-faced.

I decided to close all positions (with loss) - but after closing some two positions (with loss) broker was informing me, in case I will proceed with one more trade - Pattern day trader rule will apply on me. I learned something new - Pattern day trader:

Pattern day trader is a FINRA designation for a stock market trader who executes four or more day trades in five business days in a margin account, provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period.

A FINRA (formerly National Association of Securities Dealers, Inc. or NASD) rule applies to any customer who buys and sells a particular security in the same trading day (day trades), and does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. A pattern day trader is subject to special rules. The main rule is that in order to engage in pattern day trading you must maintain an equity balance of at least $25,000 in a margin account. The required minimum equity must be in the account prior to any daytrading activities. Three months must pass without a day trade for a person so classified to lose the restrictions imposed on them. Pursuant to NYSE 432, brokerage firms must maintain a daily record of required margin.

As I didn't have an equity balance of at least $25,000 I was left with no options as to wait for the second day and see can I close positions tomorrow or should I wait till the end of expiration and hope for the best.

At the end I closed these trades with loss of about $200, and decided to stay away from Iron Condors for at least next 6 month, as I understood I should learn more this topic.

Soon though (in next couple weeks) I started selling vertical spreads and was back in trading, though avoiding Iron Condors.

Now looking on this trade I wouldn't probably repeat it with SPY (American style), but instead with SPX (European style), and I would most probably construct wings much wider ($25-$40) range.