Welcome to the thirty-fourth (#34) dividend income report, covering earnings I've made from dividend-paying stocks and peer to peer lending in February 2020.

Last February we spent both in Georgia and Latvia, with a small stop to Istanbul, Turkey (layover flight). Our daughter has started to visit English preschool in Tbilisi and now she is really fast picking up new things and words. Amazing.

Latvian National Library in Riga

They have a great kid room on the 7-th floor with great views towards Old Riga.

From the perspective of the market, last February was a bloodbath, the Corona Virus dominated the news and all major indexes (S&P 500, Dow Jones) were down 10-15%. Our nest egg suffered a lot, but I'm not worried because dividends should provide a stable monthly income.

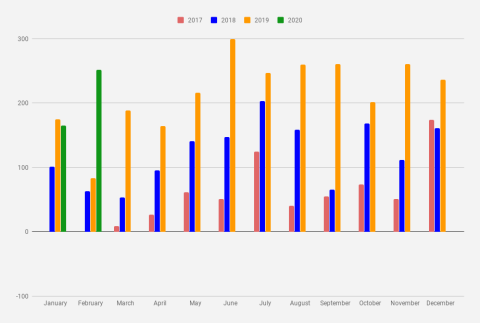

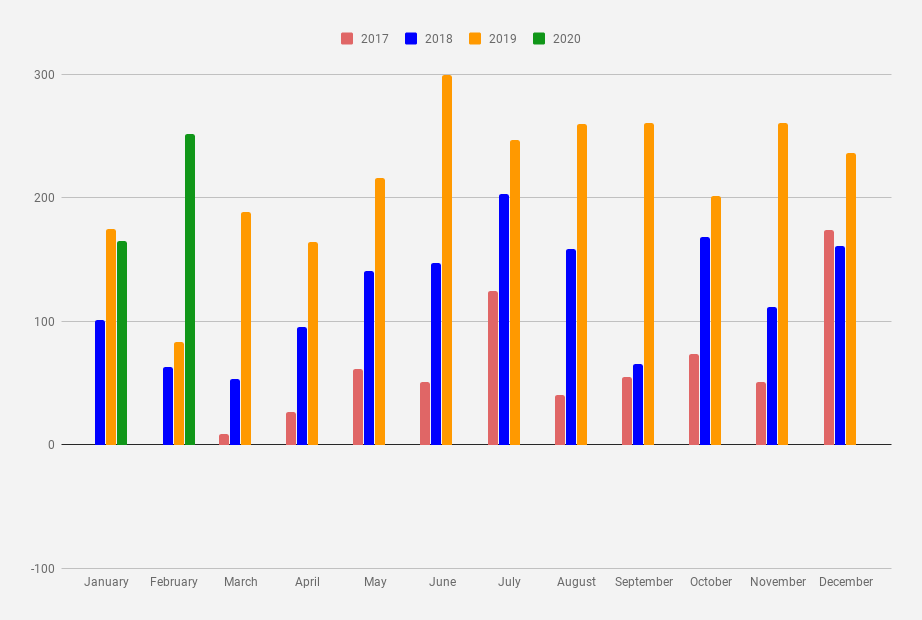

Speaking of them (dividends) - Last February was brilliant, and for the first time income in February cracked $100 milestone with a huge reserve, reaching pretty solid $251.15. Compared to the previous February in 2019, that is an increase of +201.68% (+167.90). I wish there were more months with growth like this.

An additional $500 was made from options trading. I was trading SPX, Gold futures and of course, regular puts and calls on dividend stocks. As options trading is not a passive form of making money while you are sleeping it wouldn't be fair to include them in dividend income reports.

Last but not least, last February I traded options on cryptocurrencies using Deribit platform, which resulted in an additional $45.41

When counted all together (dividends + options + crypto options), it seems I have made $796.56 in total last month. That's slightly less than my plan for Q1 2020 (the plan is to make at least $1,200/mo from the market), but I will take it.

Effective income yield last January was 2.48% (about 29.76% annually) Which is great. One of my monthly goals is to generate at least 2.5% income yield from a portfolio. As longs it's close to it - it's awesome. From dividends + active trading taking 30% year seems quite doable. The first two months of 2020 at least says so (despite uncertainty in the market)

Disclosure: This article contains affiliate links to mintos.com peer to peer lending and deribit.com options trading websites, by clicking on links on this page and by making investment mintos.com or derbit.com, I might earn affiliate income at no cost to you. Also, I'm not a financial advisor and I don't give you any advice, I'm just sharing my own experience. Investments in stocks, funds, bonds or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Interest income in February 2020

From the stocks and peer to peer lending I got following income last month:

Ticker | Earnings |

BGLF | €60.50 |

FGB | €44.18 |

EDF | €20.70 |

EDI | €19.54 |

ET | €17.20 |

NHCBHFFT | €16.80 |

€15.01 | |

PBCT | €13.51 |

RA | €9.09 |

NCV | €3.80 |

AWP | €3.04 |

T | €2.77 |

Total: €228.32 / $251.15

In total there were 12 great companies paying us dividends in February 2020, that's double the year ago.

Mintos is not anymore #1 in terms of interest generated, I'm slowly withdrawing money from the platform to re-invest in the stock market.

Mintos.com Review 2020 (36 Month of Investing in Peer to Peer Lending)

Monthly income

I've been tracking my journey towards million dollars in a savings account since January 2017. Three years already. The result, so far, looks quite good. Dividends are growing.

Monthly dividend Income chart as of February 2020

The cumulative earnings for 2020 now are $416.14 which is exactly 11.56% from my goal of 2020 ($3,600). On average, it would ask me to generate $318.39 every month for the next 10 months to reach my goal. Right, now this goal looks very hard, as now I cannot see a single $300 month for 2020, but this should change latter, during the year. It will be tough to get to my $3,600 dividend income goal this year, but I will try even tougher to get there.

2019 in Review and Financial Goals for 2020

Goals for February 2021

This is my favorite part of the reports - trying to forecast/set goals for the next year. But before setting a goal for 2020, let's see what I forecasted/said a year ago (February 2019)

When setting goals for February 2020, I will say - $120 is what I'm looking now. Looks quite possible. Should add/increase few quarterly (Feb, May, Aug, Nov) paying stocks + few monthly stocks. Looking on both now,

Wow, not only I reached this $120 goal but also doubled that. Awesome.

For February 2021 I have a goal to reach $320, to get there will add more quarterly stocks paying dividends in Feb (like FBG, PBCT, and T) + also a few monthly paying dividend stocks. From today's perspective looks quite possible.