I'm not a huge fan of any secondary markets (Except probably just Tbilisi flea market), but at the end of February 2019 Mintos run out of the GEL loans (the last time it happened at the end of August).

As more than half of my portfolio consists of investments in GEL and I have no plans to exchange them overnight to EUR or any other currency I decided to explore my options.

And here comes in the secondary market.

In the past, I've used Mintos secondary market just twice, first time I used it in March 2017 ( seems just to experiment) and the second time on February 22, 2019, to buy GEL loans from the secondary market.

No loans in the Primary market

A huge was my surprise seeing no GEL loans available.

In short, I believe it's more a temporary issue than a long term problem. On the other hand, I remember from August 2018 GEL loan shortfall I got about half of my loans bought back and one of the loan originators (BIG) left the marketplace.

I hope this is not the case now. As there are just a few GEL loan originators (Creamfinance, Lendo and ID Finance).

Now it was the time to head to the secondary market and see what's in the offer for GEL loans:

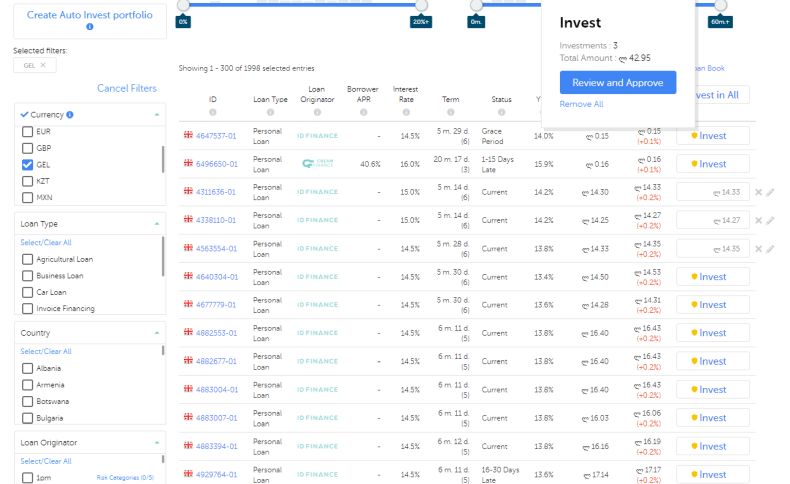

Secondary market on Mintos platform

The secondary market for GEL loans was pretty active (almost 2000 loans available). Unfortunately, all come with a premium ranging 0.15%-20% obliviously I filtered out the lowest premium and highest interest rate.

In case of GEL loans, they all are with buyback guarantee by default.

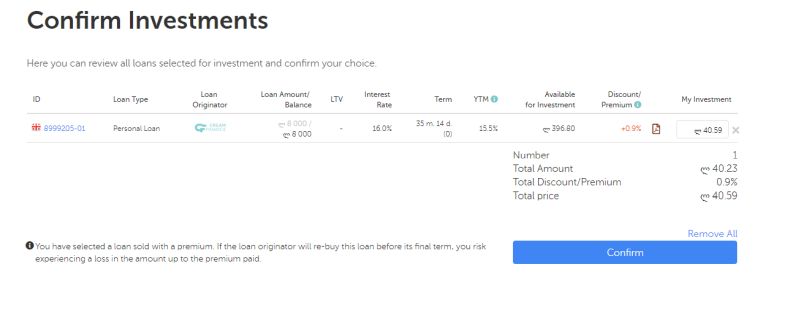

In total I invested in the secondary market this time GEL 220 and paid in premium GEL 0.67, that equals to about 0.03%. Seems OK.

Confirm investments

Please note, if the loan originator will re-buy loan before its final term, you risk experiencing a loss in the amount up to the premium paid