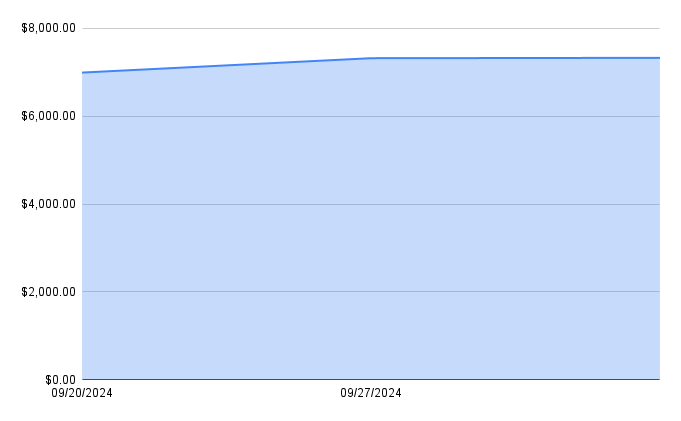

This past week, my stock portfolio showed a modest but positive movement, closing at $7,322.70, marking a +0.11% increase from the previous week. While this growth is slight, it's a sign of steady progress. Here's a breakdown of the latest moves in the portfolio.

New Stock Acquisitions

During the week, I made several strategic buys to strengthen my long-term positions:

- 4 shares of Heinz (KHC) - Heinz continues to be a reliable staple in my portfolio, and I added four more shares to bolster my dividend income.

- 1 share of Altria (MO) - This purchase is particularly meaningful as it follows an interesting development. I recently contacted Philip Morris to inquire about potential stock ownership by my grandfather before World War II. While the investigation is ongoing, I decided to add another MO share to my portfolio.

- Google (GOOGL) - As part of my regular habit, I purchased 0.1 shares of Google after each Google Meet. This week, I had several meetings related to our crypto hedge fund, which led to a few more additions to my GOOGL holdings. Slowly but surely, my position in this tech giant grows.

- 1 share of Morgan Stanley (MS) - Morgan Stanley remains a cornerstone of my long-term strategy. I aim to accumulate 100 shares and leverage covered call option. I added one more share to this plan this week.

Options Trading Update

On the options front, I sold a weekly put option on MS stock with a strike price of $104. Selling puts is part of my broader strategy to acquire more MS shares at a better price while generating income along the way.

Options Income

Since September 17, 2024, the total income generated from my options trading has reached $222.20. This income stream continues to provide additional cash flow, which I plan to reinvest into the portfolio to accelerate growth.

Final Thoughts

While the portfolio's performance this week wasn't dramatic, each small step contributes to the bigger picture of long-term growth. I remain focused on my key stocks like Morgan Stanley and Altria, alongside new opportunities in tech and consumer goods. Looking ahead, I hope to continue growing my positions, especially in MS, and hitting the 100-share goal.