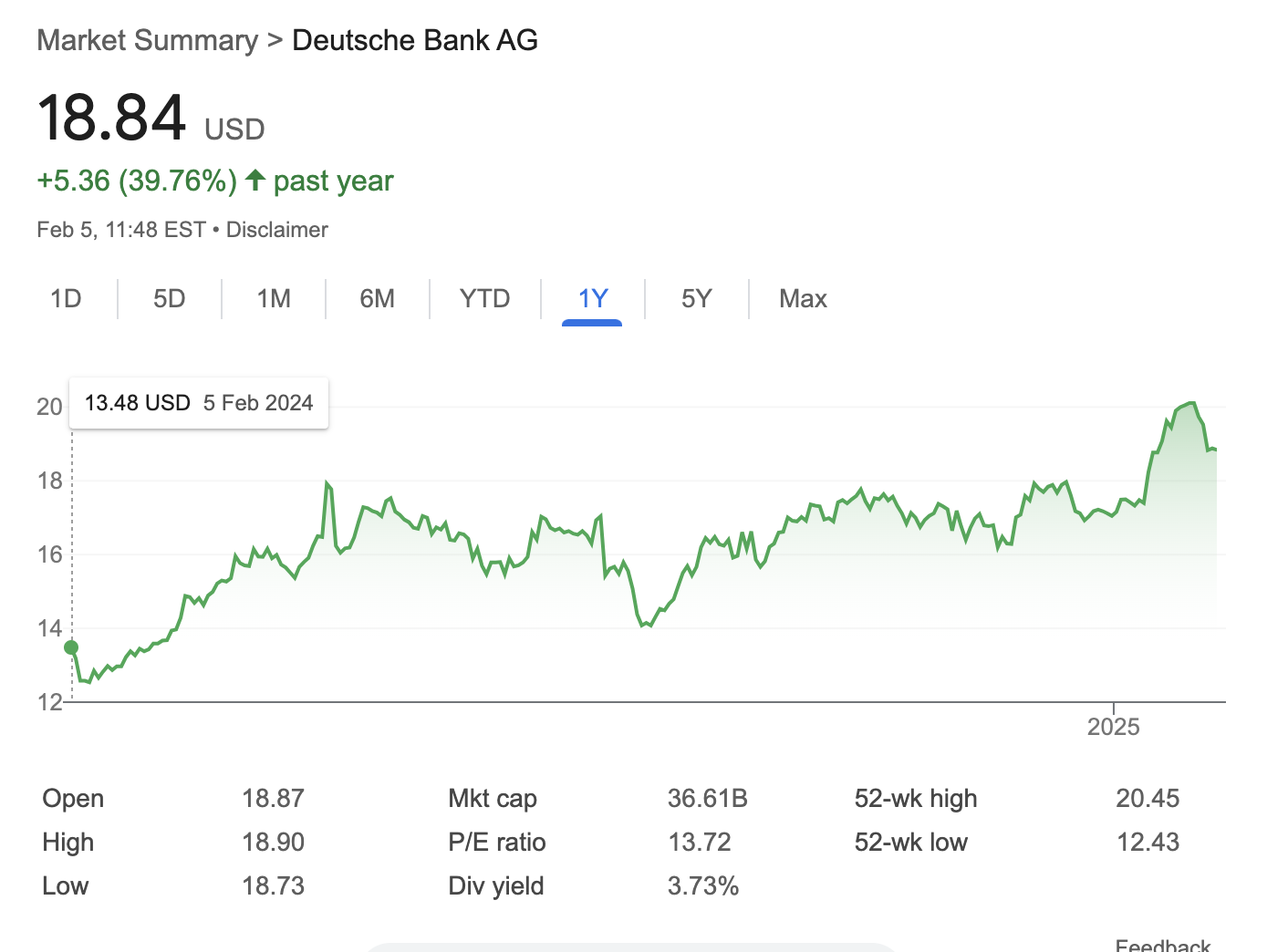

Investing in individual stocks using a dollar-cost averaging (DCA) approach is a great way to accumulate shares while mitigating market volatility. My goal has been to build a sufficient position in Deutsche Bank (DB) stock to start generating income through covered call writing.

As of February 4, 2025, I have accumulated 18 shares at an average purchase price of $17.74. With this position, I decided to sell my first partially covered call option.

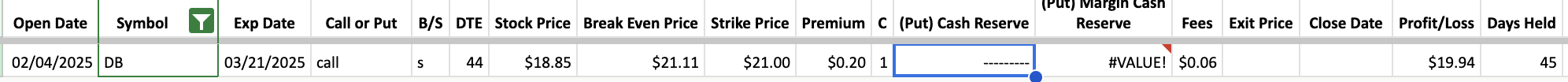

On February 4, 2025, I sold a call option on my Deutsche Bank stock with the following details:

- Strike Price: $21

- Expiration Date: March 21, 2025

- Premium Received: $0.19 per share

- Shares Held: 18

Potential Scenarios

- Stock Stays Below $21 at Expiration

- The option expires worthless, and I keep the full $0.19 premium.

- I continue holding the 18 shares and can sell another covered call for additional income.

- Stock Rises Above $21 Before Expiration

- The shares may be called away if the price exceeds $21.

This partially covered call strategy is an effective way to generate passive income while holding Deutsche Bank shares. As I continue to accumulate more shares using the DCA approach, I aim to eventually own at least 100 shares, allowing for fully covered call writing. The key to success with this strategy is managing risk, selecting appropriate strike prices, and ensuring that option premiums provide an adequate return. I will continue to document my journey and share insights on income generation through options trading.

Would you consider covered call writing as part of your investment strategy? Let me know in the comments!