Credit Spread

Week 41 / NVDA Credit Spread Strategy: 0.43% Weekly Return if Expires Worthless

| 71 viewsGreetings from Tbilisi. After more than three weeks in India, we are finally back—welcomed by temperatures below 0°C and already missing Goa and its +31°C.Last week, we also held our annual office…

Why I Don’t Like Selling Credit Spreads Without Owning the Underlying Asset

| 88 viewsCredit spreads are popular for a reason. They look elegant on paper: defined risk, high probability, steady income. I trade them myself - regularly. But over the years, one conviction has…

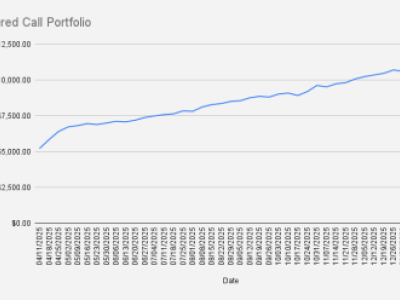

Road to a $25,000 Stock Portfolio with Options Trading

| 122 viewsWith the new year of 2026 fast approaching, I’ve decided to start another challenge.This one is deliberately smaller than my previous ambitions of building a $100K or even a $1M portfolio. Not…

Week 33 / How We Earned $166 in Options Premium This Week with NVDA and BMY Credit Spreads

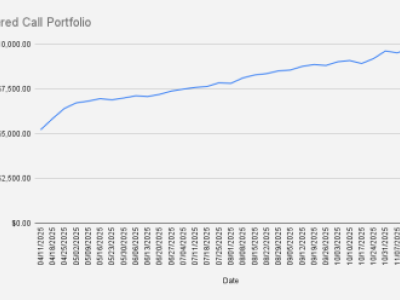

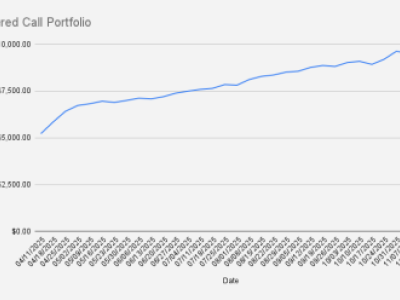

| 154 viewsAs of November 21, 2025, our covered call stock portfolio has slightly increased to $9,810, what is another minor weekly increase of +0.77% (+$74 if compared to the previous week. $10,000 feels…

Week 32 / Weekly NVDA Options Income: $75 in Premiums and a 2.32% Portfolio Rise to $9,735

| 154 viewsAs of November 14, 2025, our covered call stock portfolio has slightly increased to to $9,735, what is a minor increase of +2.32% (+$220 if compared to the previous week. $10,000 feels within reach.…