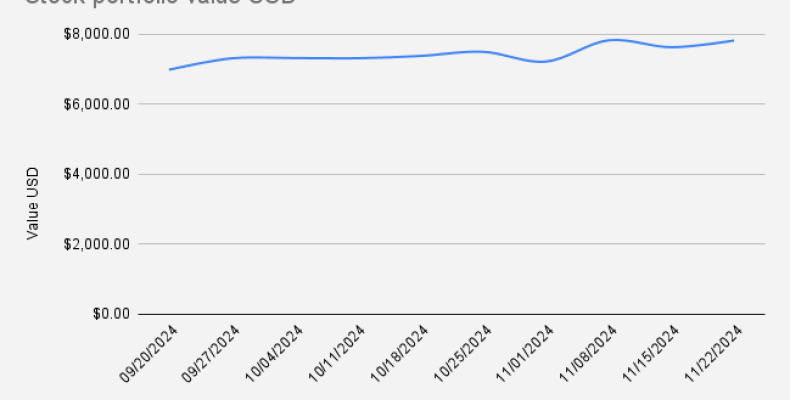

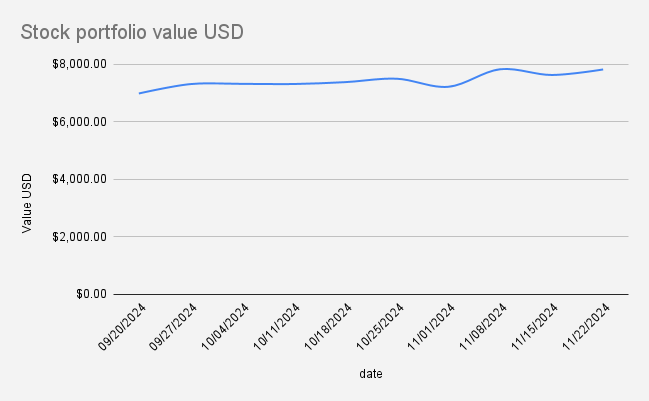

This week, our portfolio demonstrated resilience and growth, closing at $7,824.96, reflecting a +2.52% increase compared to the previous week. Here's a breakdown of the key updates and strategies implemented over the past week:

Options Expiry and New Positions

- Expired Options: All options expiring today— MS (Morgan Stanley) and RBLX (Roblox)—expired worthless.

- New Credit Spreads:

- A weekly credit spread on Morgan Stanley (MS) was opened to capitalize on short-term price action.

- Additionally, a longer-term credit spread (90+ days) on Bank of America (BAC) was initiated, aiming to generate steady premiums over time.

Reinvestment from Premiums

Proceeds from the received premiums were strategically reinvested:

- Purchased 1 additional share of BAC.

- Added 0.15 fractional shares of MS to our holdings.

Dividend Growth

Our total annual dividends now stand at $209.14, reflecting a modest but meaningful increase of $1.24 compared to the previous week. This steady rise underscores the portfolio's long-term focus on income generation alongside capital appreciation.

This week’s growth highlights the importance of diversification and reinvestment. With dividends steadily growing and the portfolio showing consistent gains, the outlook remains optimistic for the coming weeks.

Since September 17, 2024, the total income generated from our options trading has reached $802.65. Which already represents 0.8% from our 100K options trading challenge.