In today's article, I'm going to talk about 7 dividend stocks I don't mind having in my portfolio and how I'm generating additional semi-passive income by selling put options (or credit spreads) on them.

Disclosure: I'm not a financial advisor and I don't give you any advice here, I'm just sharing my own experience. Investments in stocks, funds, bonds, or cryptos are risk investments and you could lose some or all of your money. Do your due diligence before investing in any kind of asset.

Subscribe to the Covered Calls with Reinis Fischer newsletter

Dividend stocks

Dividend stocks are companies that pay out regular dividends. Dividend stocks are usually well-established companies with a track record of distributing earnings back to shareholders.

Put options

A put option is a contract giving the owner the right, but not the obligation, to sell–or sell short–a specified amount of an underlying security at a pre-determined price within a specified time frame. This pre-determined price that buyer of the put option can sell at is called the strike price.

Credit Spreads

A credit spread involves selling, or writing, a high-premium option and simultaneously buying a lower premium option. The premium received from the written option is greater than the premium paid for the long option, resulting in a premium credited into the trader or investor's account when the position is opened. When traders or investors use a credit spread strategy, the maximum profit they receive is the net premium. The credit spread results in a profit when the options' spreads narrow.

Right, now when we have some basic understanding, let's dive in:

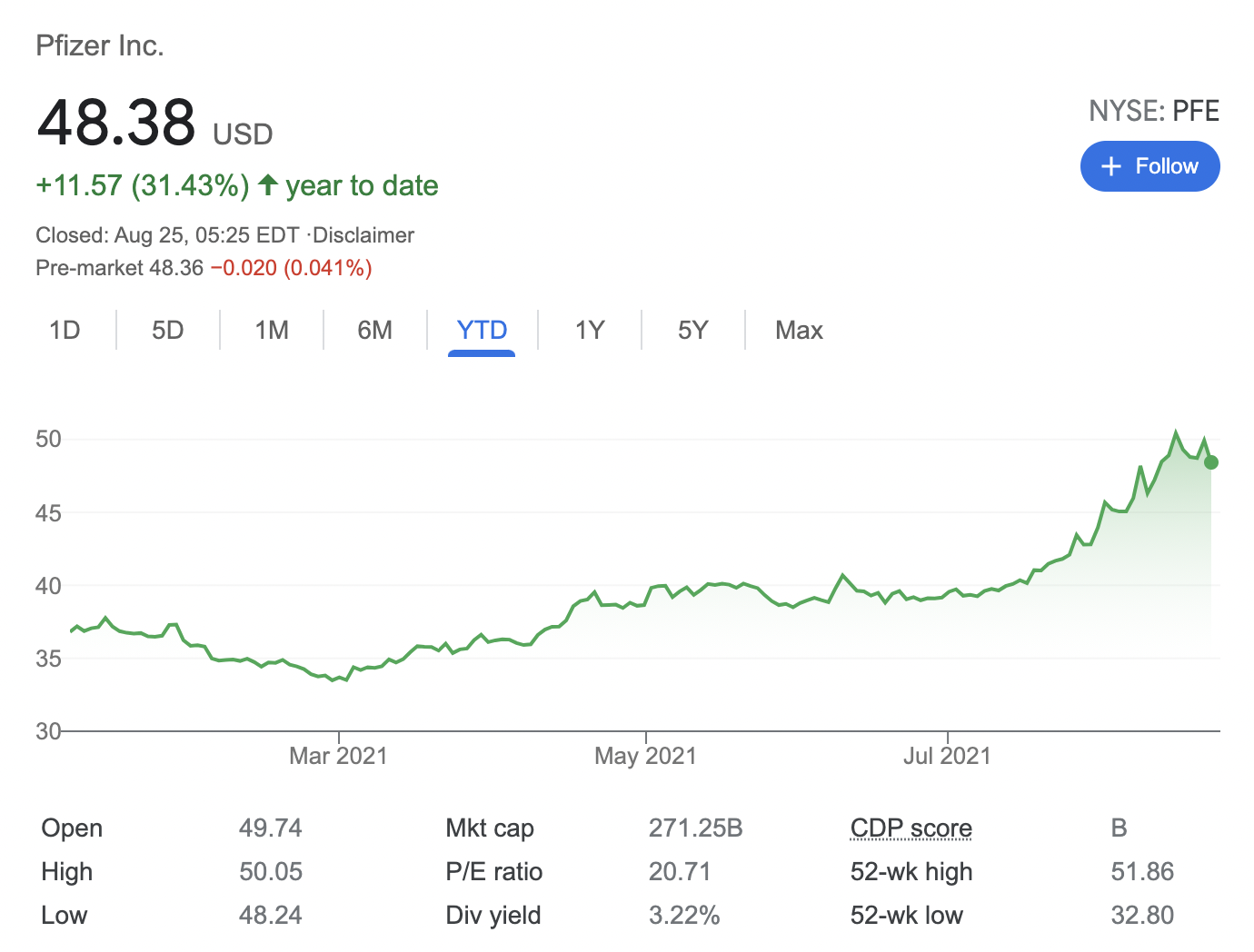

Selling put options on PFE stock

I must admit PFE is my biggest surprise, and the company seems but overvalued right now, but as I still think this is a great company with a dividend yield above 3%, I wouldn't mind having a few hundred shares more in my portfolio.

I have been selling puts on Pfizer stock since January 2020. Pfizer stock also contributes some bits to our dividend income in the following months: March, June, September, and December

On August 25, 2021, you could sell a put on Pfizer stock with a September 23 expiry and strike price of $46 for about $0.82. That gets you $82 and makes about 1.78% return in less than 30 days. Or about 21.36% annualized. Break-even: $45.18

If PFE stock closes above $46 on September 24 you keep the premium and start over. If the stock closes under $46 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of PFE stock, make sure you have $4,600 cash or buying power (margin) to buy 100 shares if assigned.

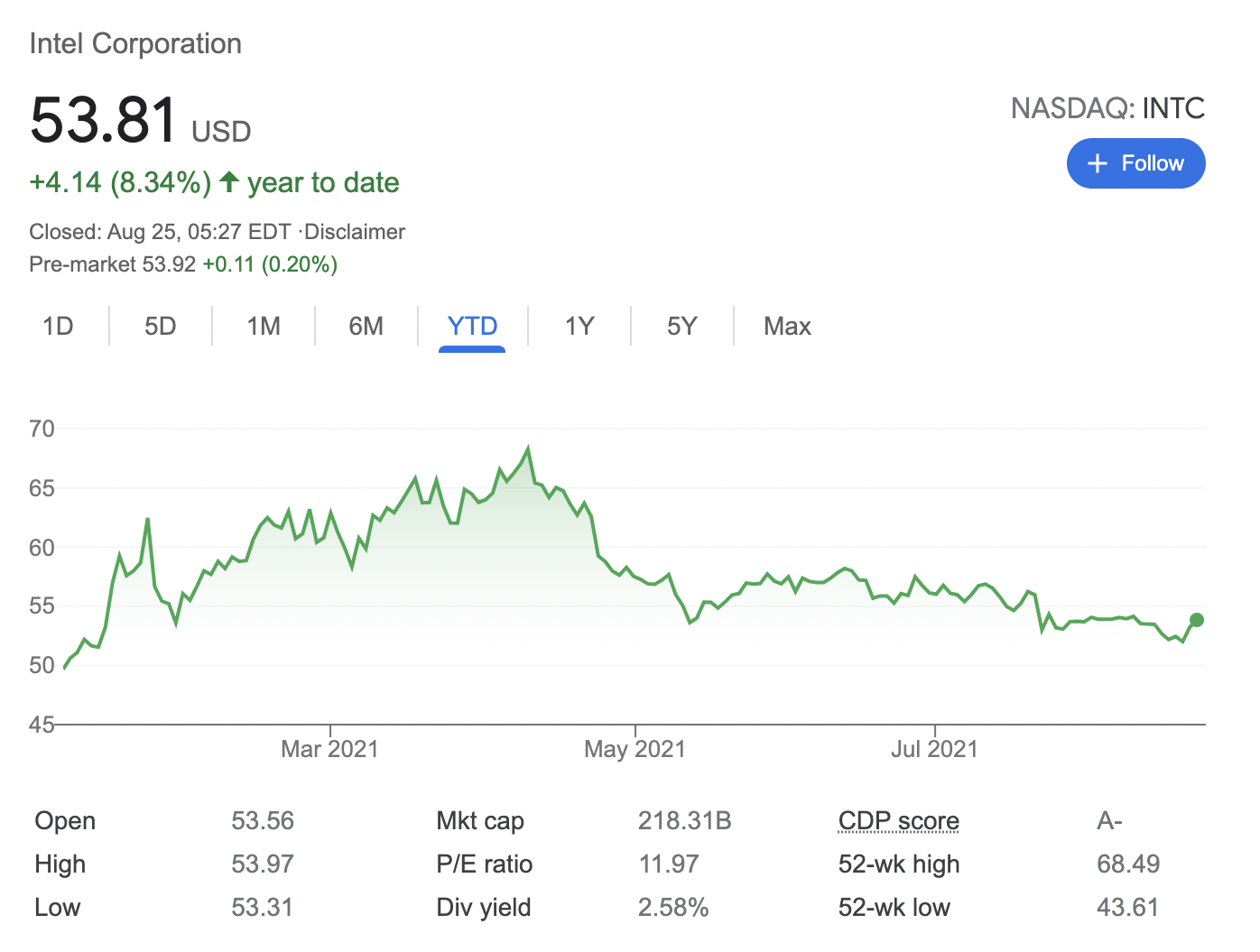

Selling put options on INTC stock

Intel stock has been in my portfolio since May 2020.. I like this stock a lot, the only thing that worries me - Apples move away from the Intel chips. I would more alerted buying a few hunderd shares know, but a decent 2.5% dividend and juicy options premium seems is worth the risk.

On August 25, 2021, you could sell a put on INTC stock with a September 23 expiry and strike price of $53 for about $1.08. That gets you $108 and makes about 2.02% potential income return in less than 30 days. Break-even: $51.92

If INTC stock closes above $53 on September 24 you keep the premium and start over. If the stock closes under $53 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of INTC stock, make sure you have $5,300 cash or buying power (margin) to buy 100 shares if assigned.

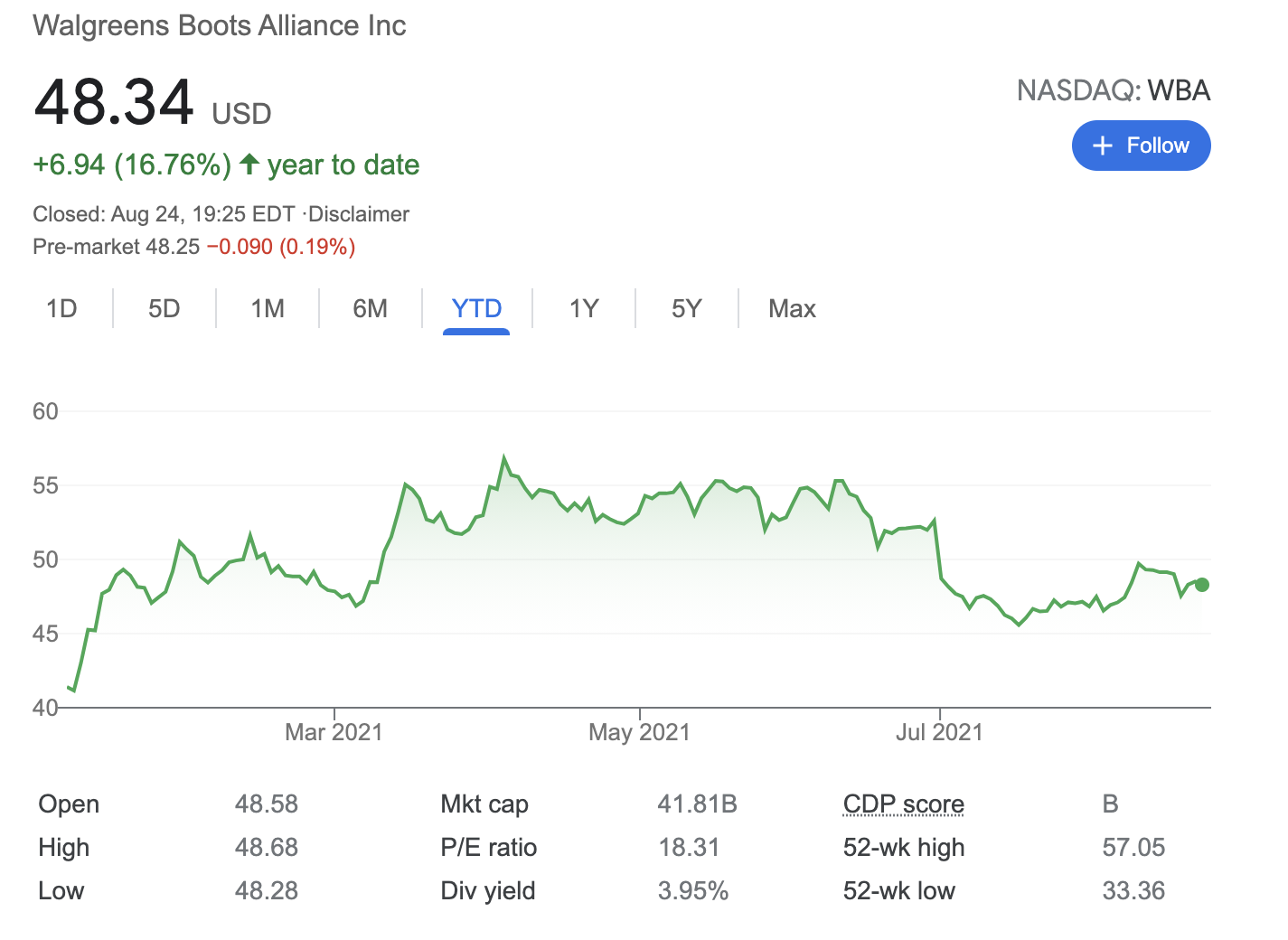

Selling Put options on WBA stock

Just like in the case with PFE stock, WBA stock seems bit overvalued to me, but a nice dividend of almost 4% and juicy premiums leaves me to love this stock. WBA has been in my stock portfoio since the start of 2021.

On August 25, 2021, you could sell a put on WBA stock with a September 24 expiry and strike price of $47 for about $0.7. That gets you $70 and makes about 1.48% potential income return in less than 30 days. Break-even: $46.30

If WBA stock closes above $47 on September 24 you keep the premium and start over. If the stock closes under $47 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of WBA stock, make sure you have $4,700 cash or buying power (margin) to buy 100 shares if assigned.

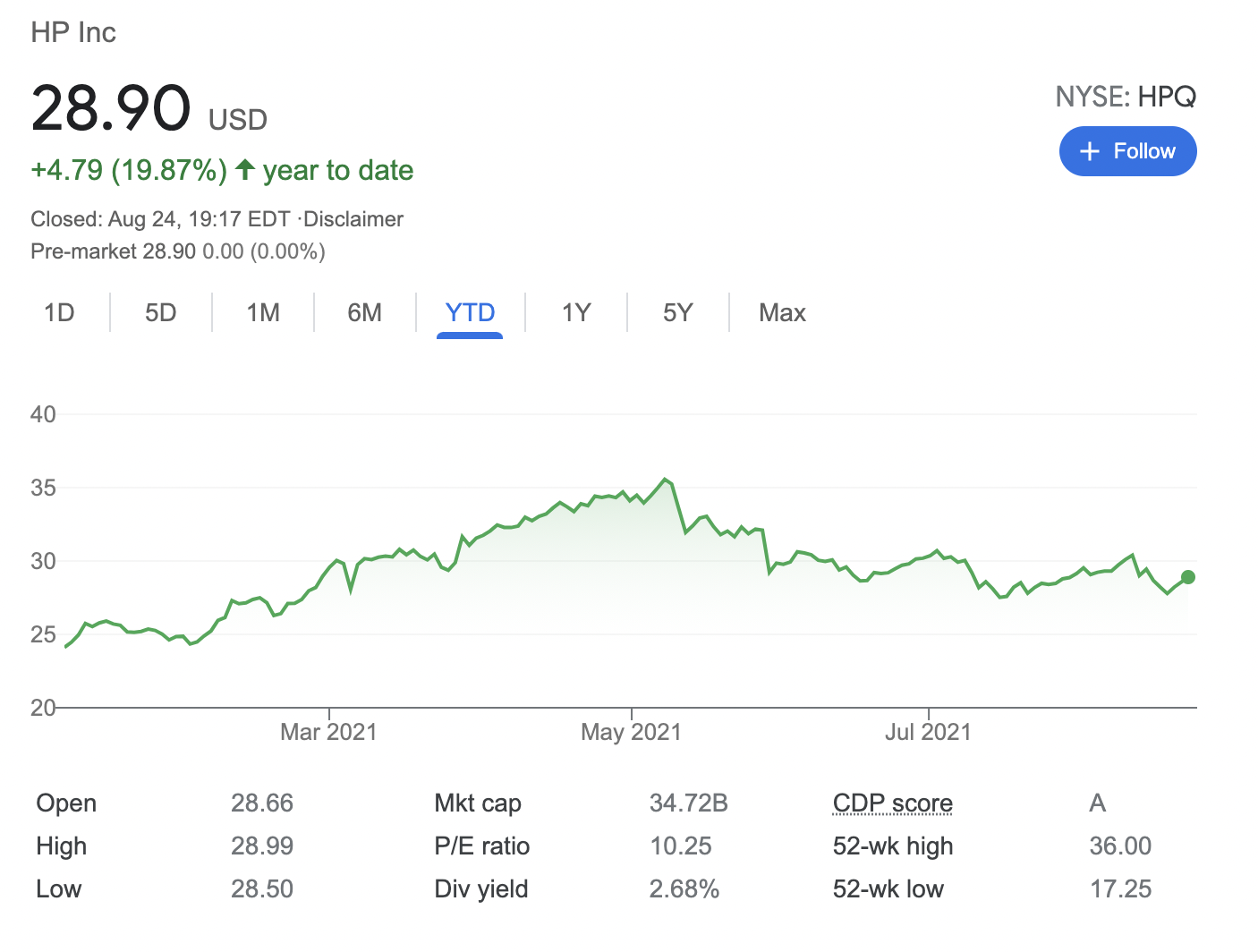

Selling put options on HPQ stock

HPQ stock is one of the latest additions to my stock portfolio

On August 25, 2021, you could sell a put option on HPQ stock with a September 24 expiry and strike price of $26 for about $0.51. That gets you $51 and makes about 1.96% potential income return in less than 30 days. Break-even: $25.49

If HPQ stock closes above $26 on September 24 you keep the premium and start over. If the stock closes under $26 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of HPQ stock, make sure you have $2,600 cash or buying power (margin) to buy 100 shares if assigned.

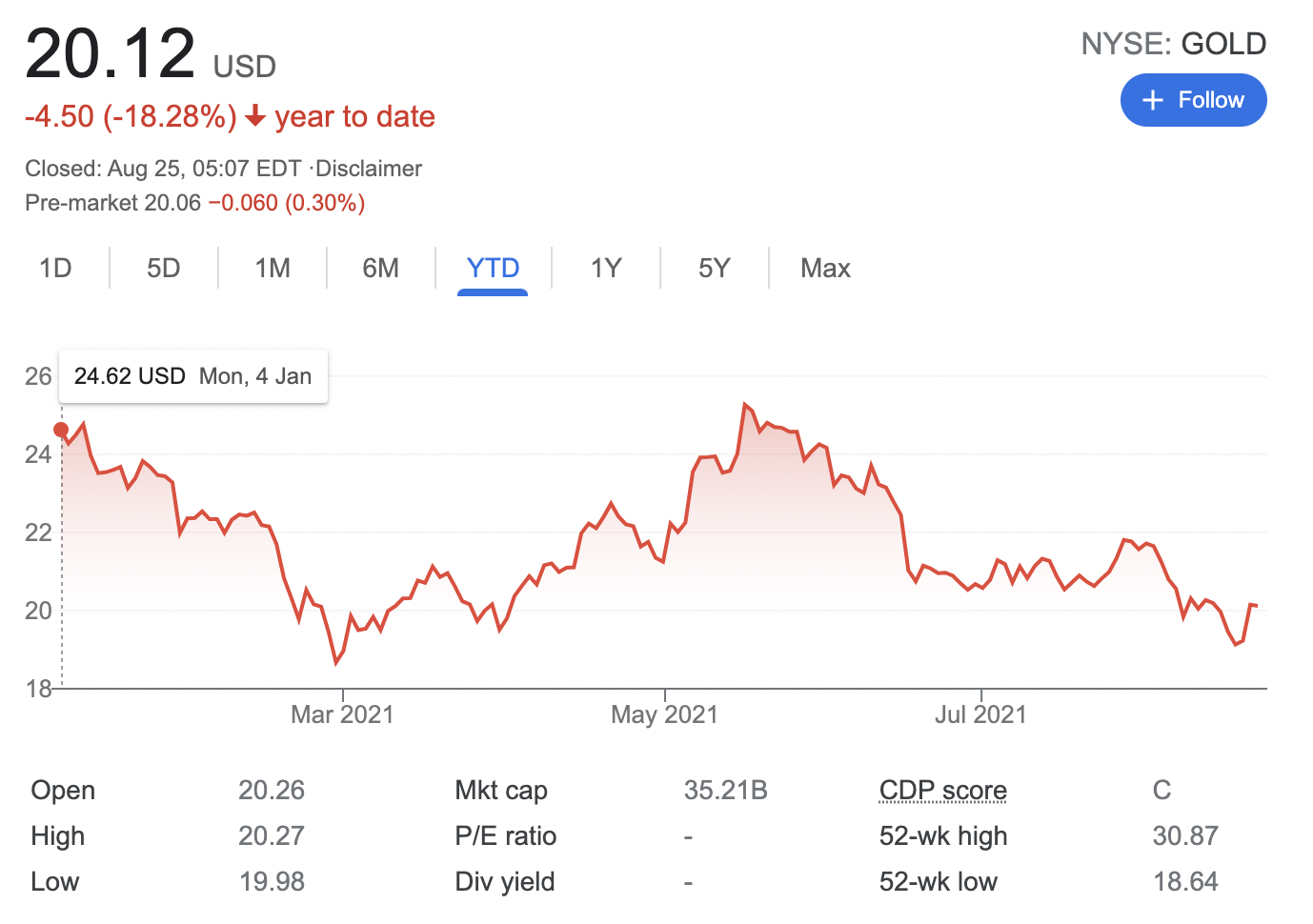

Selling put options on Gold

I like exposure to gold, and Barrick Gold actually is a stock compnay owning gold mines. This stock has been in my portfolio since the early April 2021

On August 25, 2021, you could sell a put option on GOLD stock with a September 24 expiry and strike price of $19 for about $0.33 That gets you $51 and makes about 1.73% potential income return in less than 30 days. Break-even: $18.67

If GOLD stock closes above $19 on September 24 you keep the premium and start over. If the stock closes under $19 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of GOLD stock, make sure you have $1,900 cash or buying power (margin) to buy 100 shares if assigned.

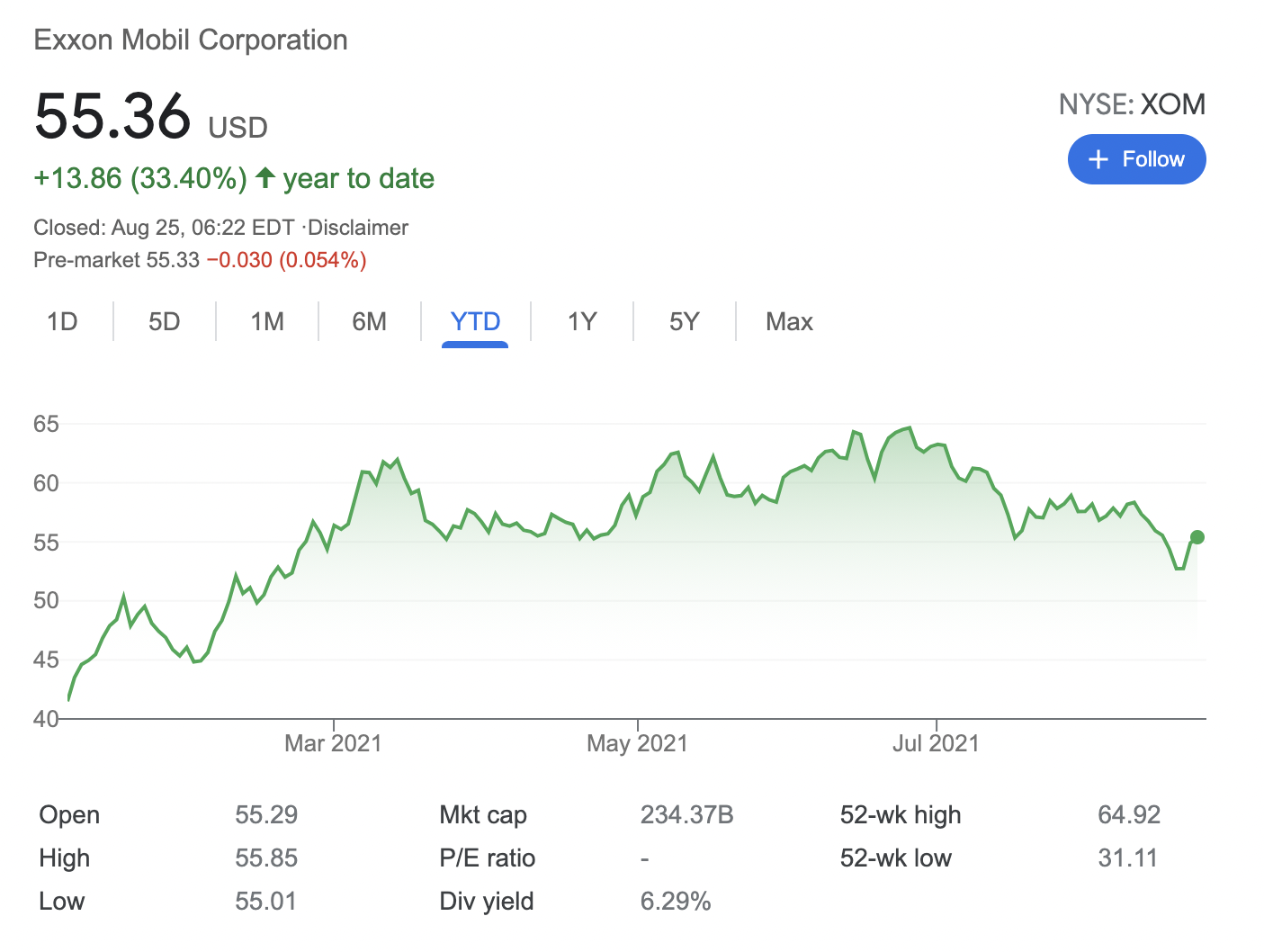

Selling put options on XOM

XOM stock is one of the latest additions to my stock portfolio

On August 25, 2021, you could sell a put option on XOM stock with a September 24 expiry and strike price of $53 for about $0.83 That gets you $83 and makes about 1.56% potential income return in less than 30 days. Break-even: $52.17

If XOM stock closes above $53 on September 24 you keep the premium and start over. If the stock closes under $53 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of XOM stock, make sure you have $5,300 cash or buying power (margin) to buy 100 shares if assigned.

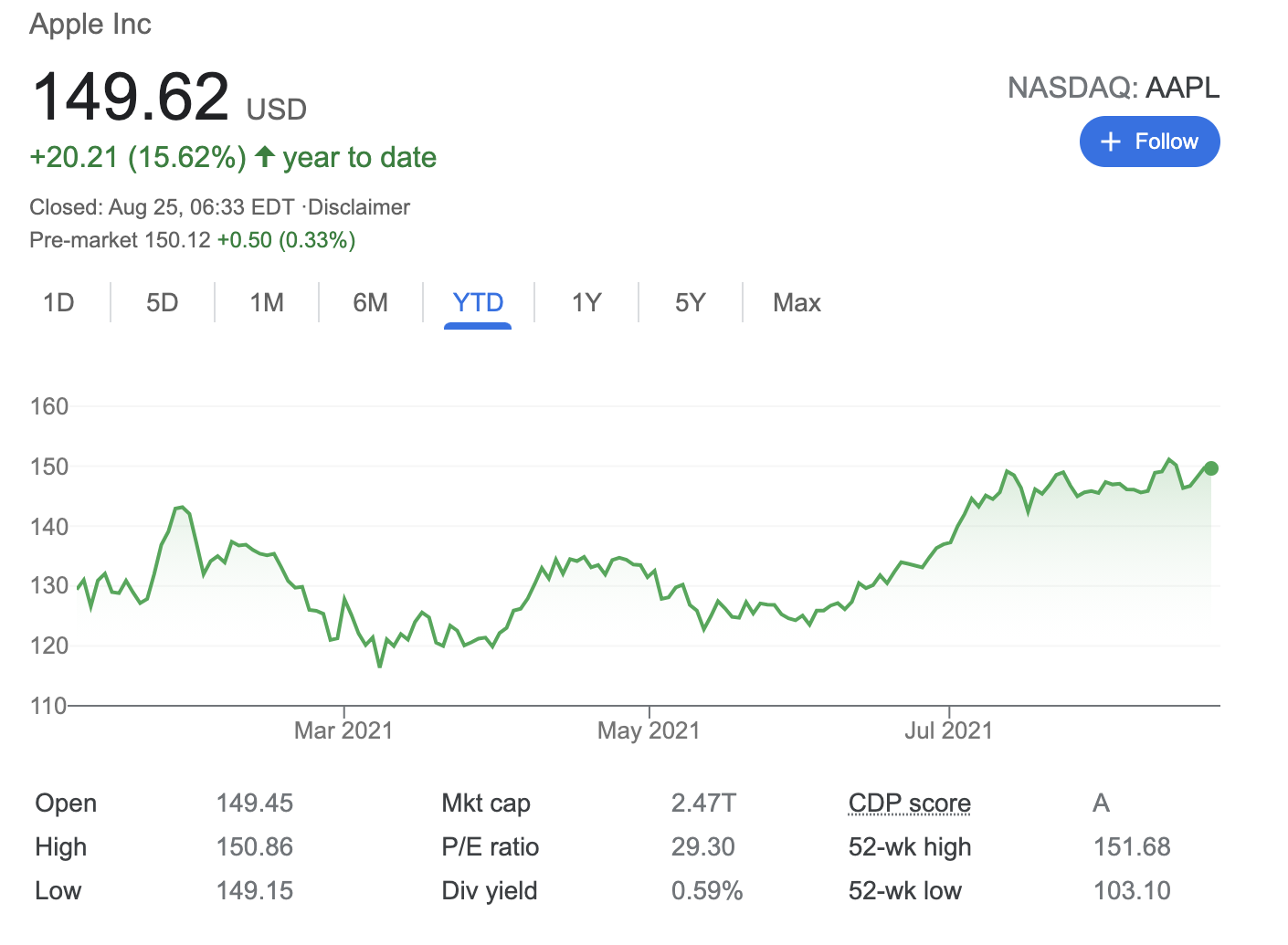

Selling put options on APPLE

Actually, Apple is one of my favorite tech stocks, the current price might seem a bit high, and when entering a trade with AAPL stock I would think of using a credit spread.

On August 25, 2021, you could sell a put option on AAPL stock with a September 24 expiry and strike price of $140 for about $1.10 That gets you $110 and makes about 0.78% potential income return in less than 30 days. Break-even: $138.90

If AAPL stock closes above $140 on September 24 you keep the premium and start over. If the stock closes under $140 you get assigned but check your break-even points. There are several options you could use not to get assigned, like a roll down or roll forward. Or you could take stock, collect dividends and sell covered calls. Win, win, win

Remember, you are selling one contract, 100 shares of AAPL stock, make sure you have $14,000 cash or buying power (margin) to buy 100 shares if assigned.

The Bottom Line

Selling put options on these seven dividend stocks will generate $537 in income against $38,400 in possible stock purchases. That's a 1.39% return in less than 30 days