On August 29, 2024, I bought 1 long ETH perpetual futures contract at $2,553.85 and simultaneously sold 1 in the money covered call on it with a strike price of $2,500 and expiry next Friday (September 6). Credit received $115.2 (before commissions)

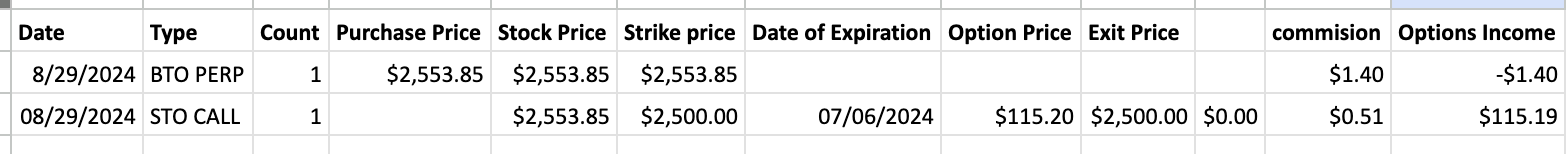

Here is the trade setup:

- BOT 1 ETH-PERM 2,553.85 USD

- SLD 1 CALL SEP 06 '24 2,500 Call Option 115.2 USD

What happens next?

On the expiry date, September 06, 2024, ETH is trading under $2,500 per share - options expire worthlessly and I keep premium - if ETH trades above $2,500 on the expiry date, my 1 ETH contract will get called away and I will realize a profit of $61.35 or potential 2.45% income yield in 8 days.

Break-even price: $2,553.85-$115.2= $2,438.65

As long as Ethereum stays above $2,438 by the option's expiration, the trade will be profitable.

In case ETH price falls under $2,438 on expiry, we risk losing money, but to limit the downside I have created additional trigger based short ETH future at $2,430.

In theory max we can lose from this trade is $8.65. But thats just a theory.

This covered call strategy with Ethereum futures provides a balanced approach to income generation and risk management. The $115 premium offers some cushion against a price drop, while the trigger-based short futures trade acts as a safety net if the market turns against me. It’s a trade that aligns well with my broader investment strategy, combining income generation with prudent risk management.

This trade is another step in my ongoing journey with TerraMatris Crypto Hedge Fund, where calculated risks and strategic planning are essential to navigating the volatile crypto markets.

- In total: 2 trades since August 29, 2024

- Options premium: $113.79

- Break Even: $2,440.06

My plan is to close the trade with max profit, but in case ETH trades under strike price of $2,500, will keep rolling it forward